Accumulative Swing Index

Definition

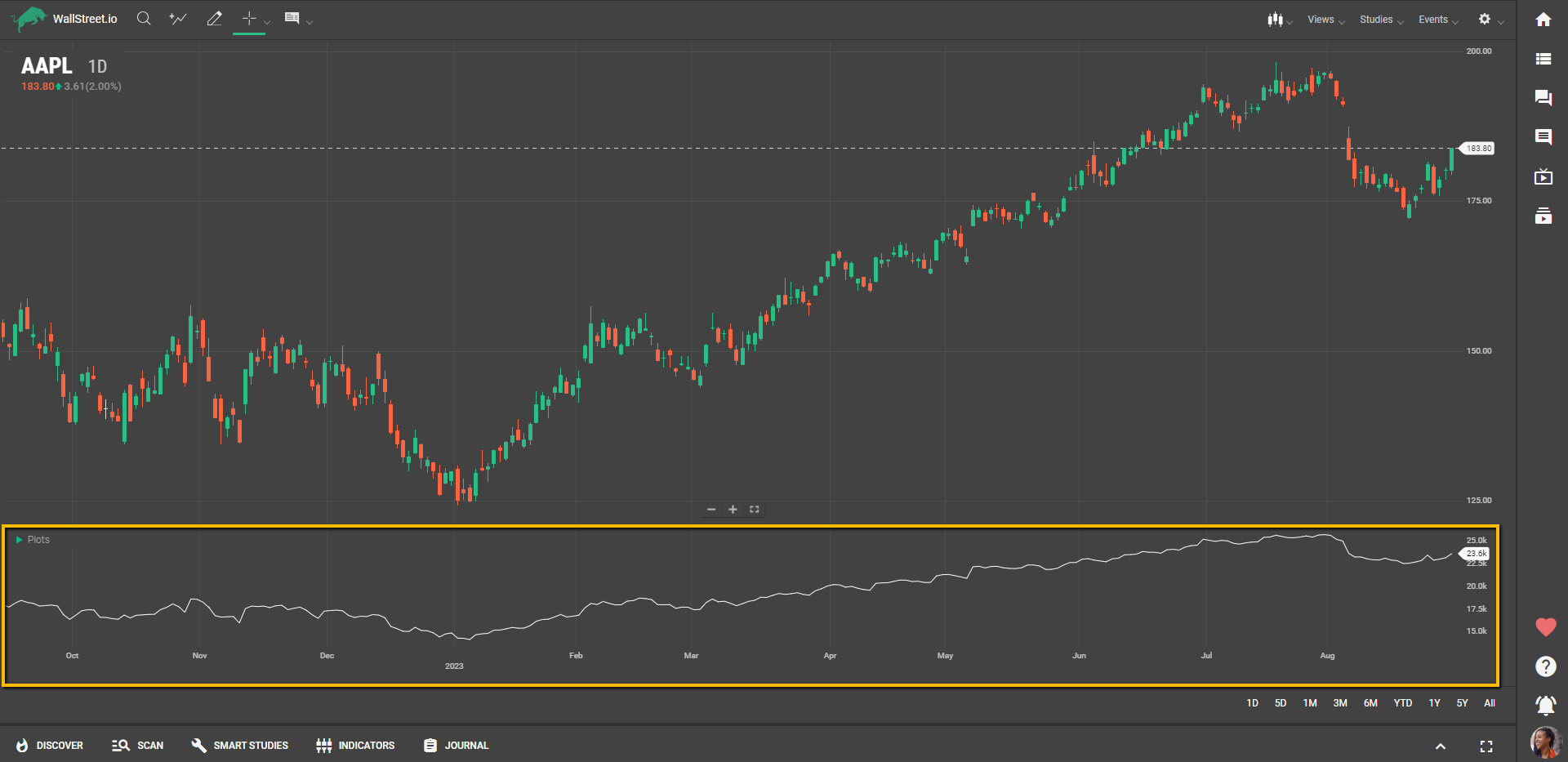

The Accumulative Swing Index is a technical indicator that provides a cumulative total of the Swing Index, which measures short-term price swings. Essentially, the ASI adds up these swings to create a line that can oscillate above and below zero, offering a broader view of market trends. The ASI is particularly useful for capturing the "real" trend of an asset by accounting for both its magnitude and characteristics over time.

Suggested Trading Use

Traders can use the Accumulative Swing Index to identify general trends and potential reversal points. When the ASI line moves above zero, it often signifies an overall bullish trend, making it a potential time to consider entering a long position. Conversely, when the ASI line moves below zero, it may indicate a bearish trend, suggesting it could be a time to consider a short position or exiting a long one.

The ASI is also effective in spotting divergence with the underlying asset's price. For example, if the asset is making new highs but the ASI fails to do so, it could signal that the trend is losing strength and a reversal might be forthcoming.

The Accumulative Swing Index is a versatile tool that goes beyond simple price action to give traders a more comprehensive understanding of market behavior. It can be particularly useful for those who want to capture the nuanced ebb and flow of market trends.

Discover Tab Reference Guide

Discover Tab Reference Guide Discover Tab How-To Guide

Discover Tab How-To Guide Smart Studies How-To Guide

Smart Studies How-To Guide Smart Studies Reference Guide

Smart Studies Reference Guide Scan Tab Reference Guide

Scan Tab Reference Guide Scan Tab How-To Guide

Scan Tab How-To Guide Watchlists How-To guide

Watchlists How-To guide Watchlists Reference Guide

Watchlists Reference Guide Chatrooms Reference Guide

Chatrooms Reference Guide Community Wall How-To Guide

Community Wall How-To Guide Community Wall Reference Guide

Community Wall Reference Guide Streams Reference Guide

Streams Reference Guide Streams How-To Guide

Streams How-To Guide