Strategy Notification Alerts How-To Guide

How to receive and use Strategy Notification Alerts

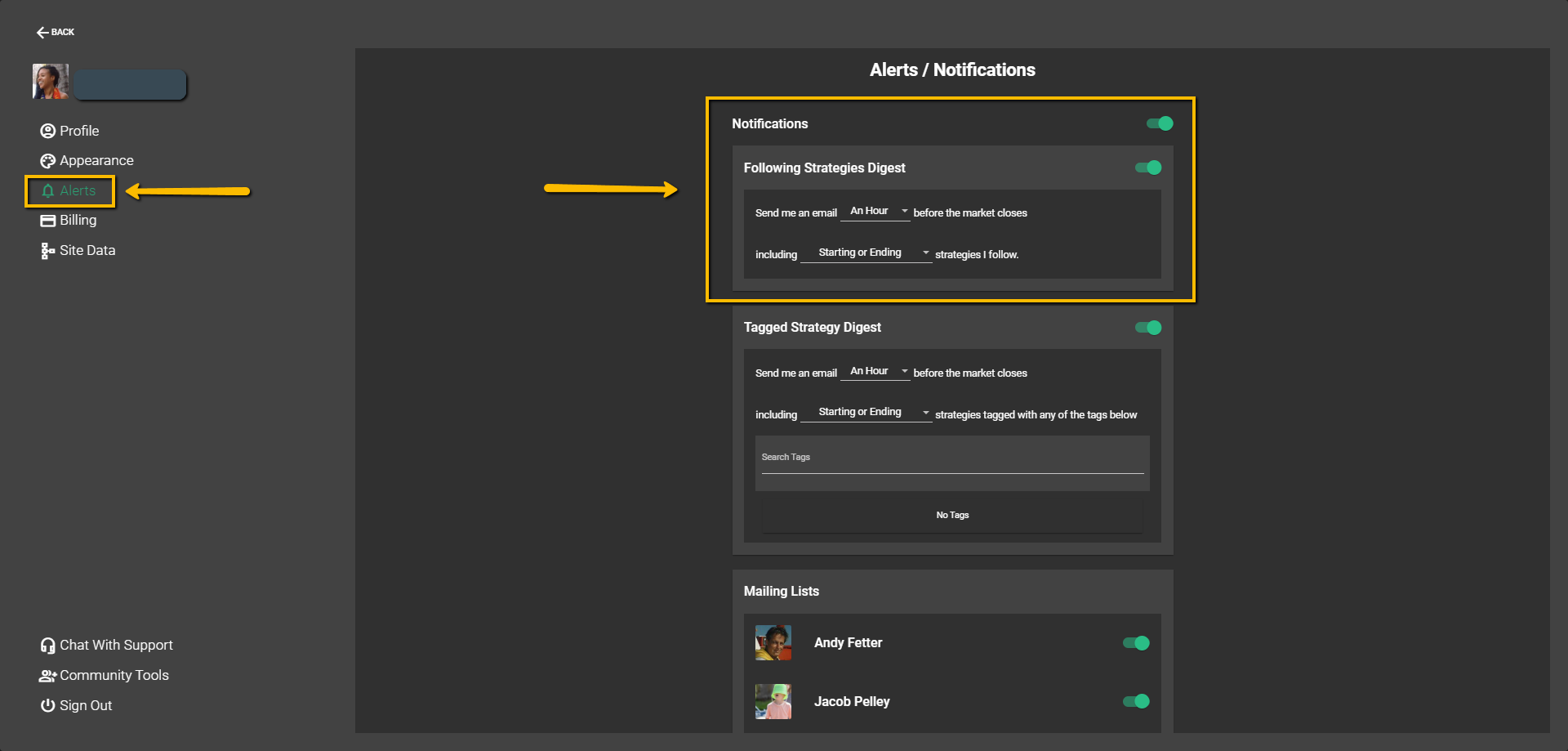

To receive email alerts from any given strategy on our platform (whether you found it on our platform or created it yourself), please make sure the Following Strategies Digest option is turned on in your account.

You can find this option on your My Account page > Alerts > Notifications:

Also, we kindly ask you to add support@wallstreet.io to your whitelist, since this will help prevent our emails from being missed or landing in your spam folder.

Personalize your Strategy Alerts to Fit Your Goals

It's important to note that to receive alerts, you'll first need to choose which strategies you want to follow. In other words, Strategy Alerts aren't sent automatically just for having a premium membership. This is because each trader's preferences are unique, and Wallstreet.io lets you customize your alerts based on the strategies you're interested in.

To start receiving alerts, you must find and follow strategies matching your trading style or interests. Once you've followed a strategy, our system will monitor it for you and send alerts when the strategy's conditions are met, like when it starts or ends.

Don’t worry! We’ve made it easy for you with several ways to explore and find strategies, so you can choose the one that best fits your experience and style. Let’s take a look at these options:

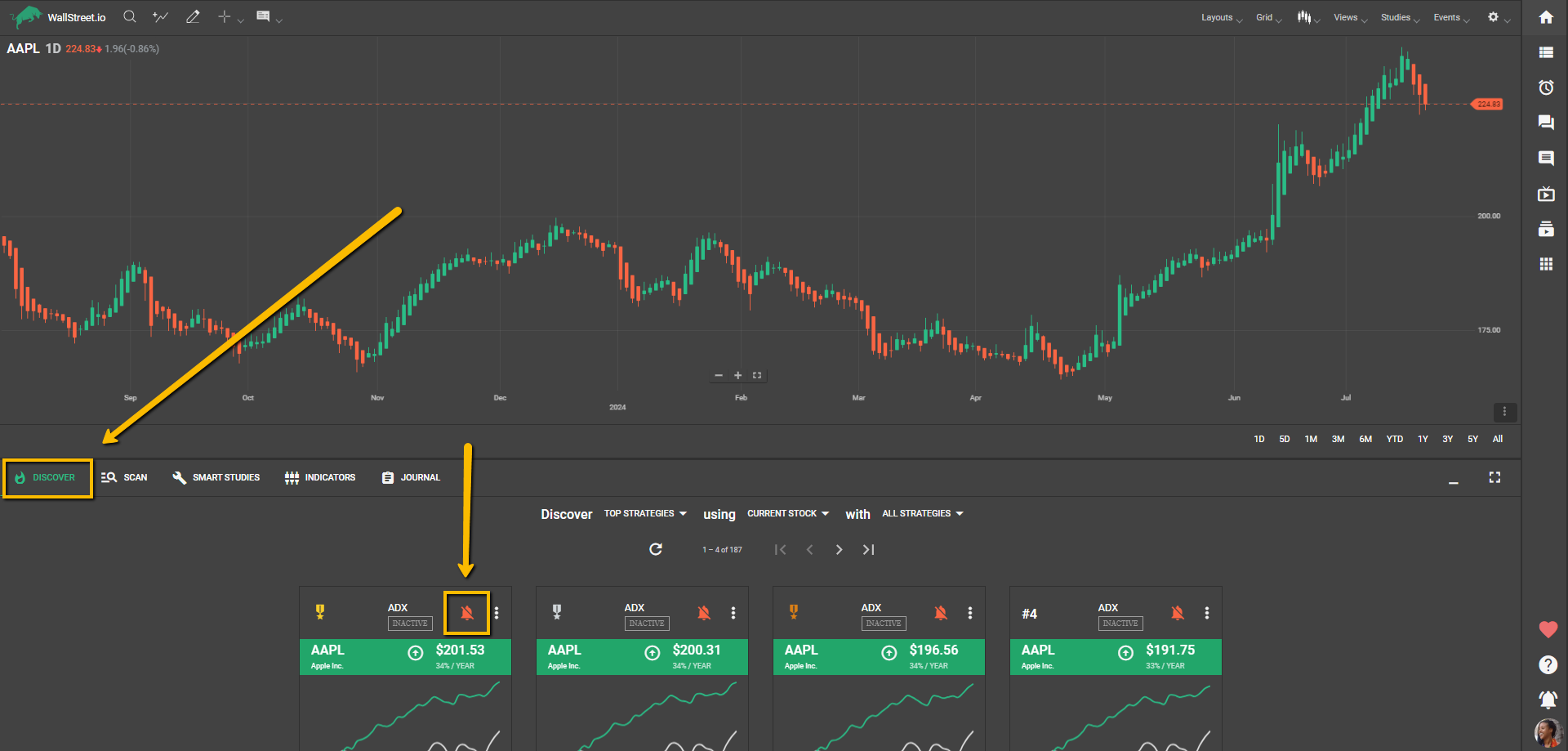

I. Discover tab method

After finding a Strategy Card with a strategy you’re interested in under the Discover tab, click on its red “Alert” bell icon at the top right of it.

Best for: Beginners and those looking for a quick start.

This method is straightforward and beginner-friendly, requiring minimal clicks. Simply adjust the three dropdown menus to your liking, and explore the top strategies, curated by an algorithm that ranks them based on performance.

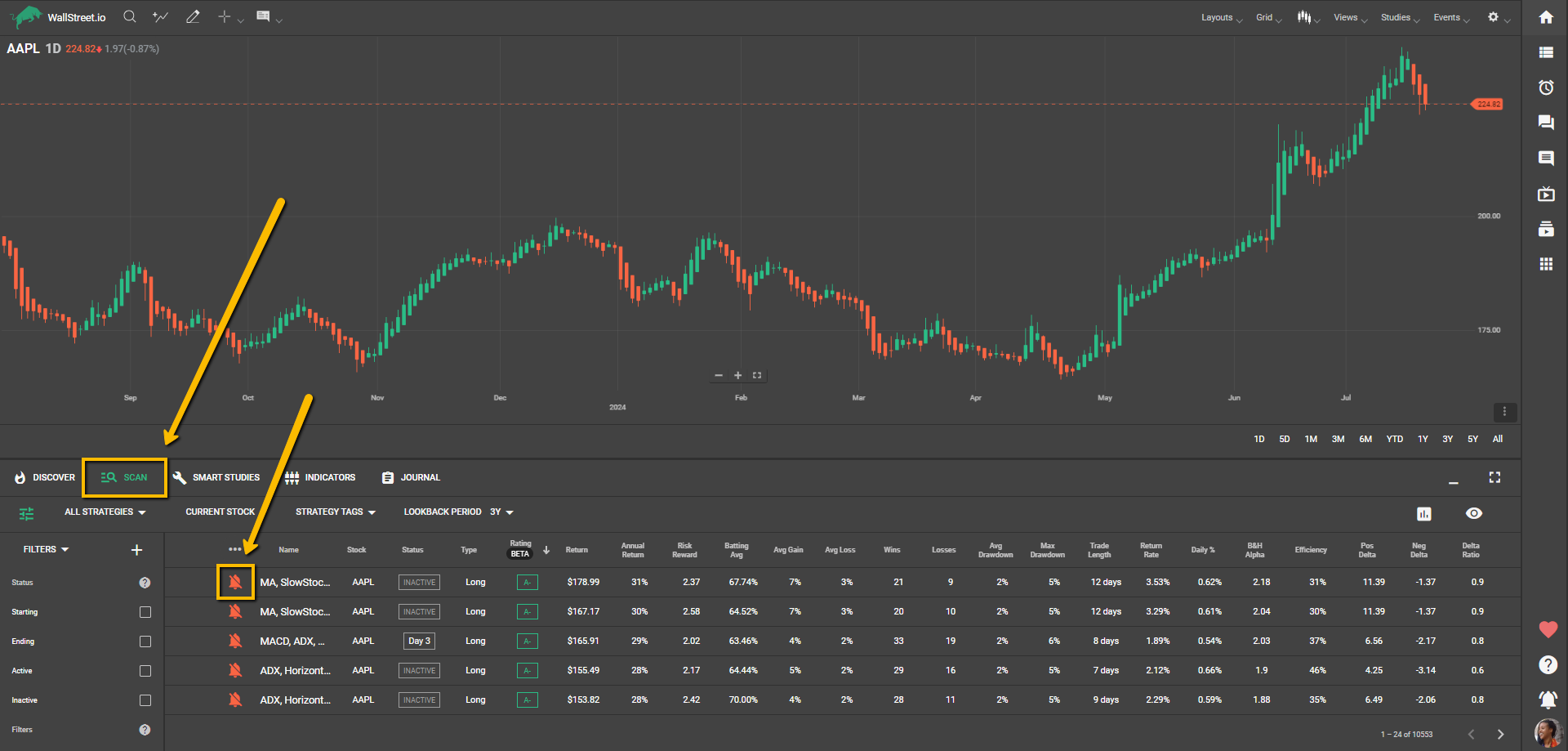

II. Scan tab method

After finding a strategy you’re interested in under the Scan tab (by using our Filter Tool), click on the red “Alert” bell icon at the beginning of the strategy row:

Best for: Intermediate to advanced users who prefer a hands-on selection.

The Scan tab offers access to all available strategies (hundreds of thousands) with powerful filters for narrowing down specific criteria. This approach is ideal for those who know what they’re looking for and want to tailor their strategy selection.

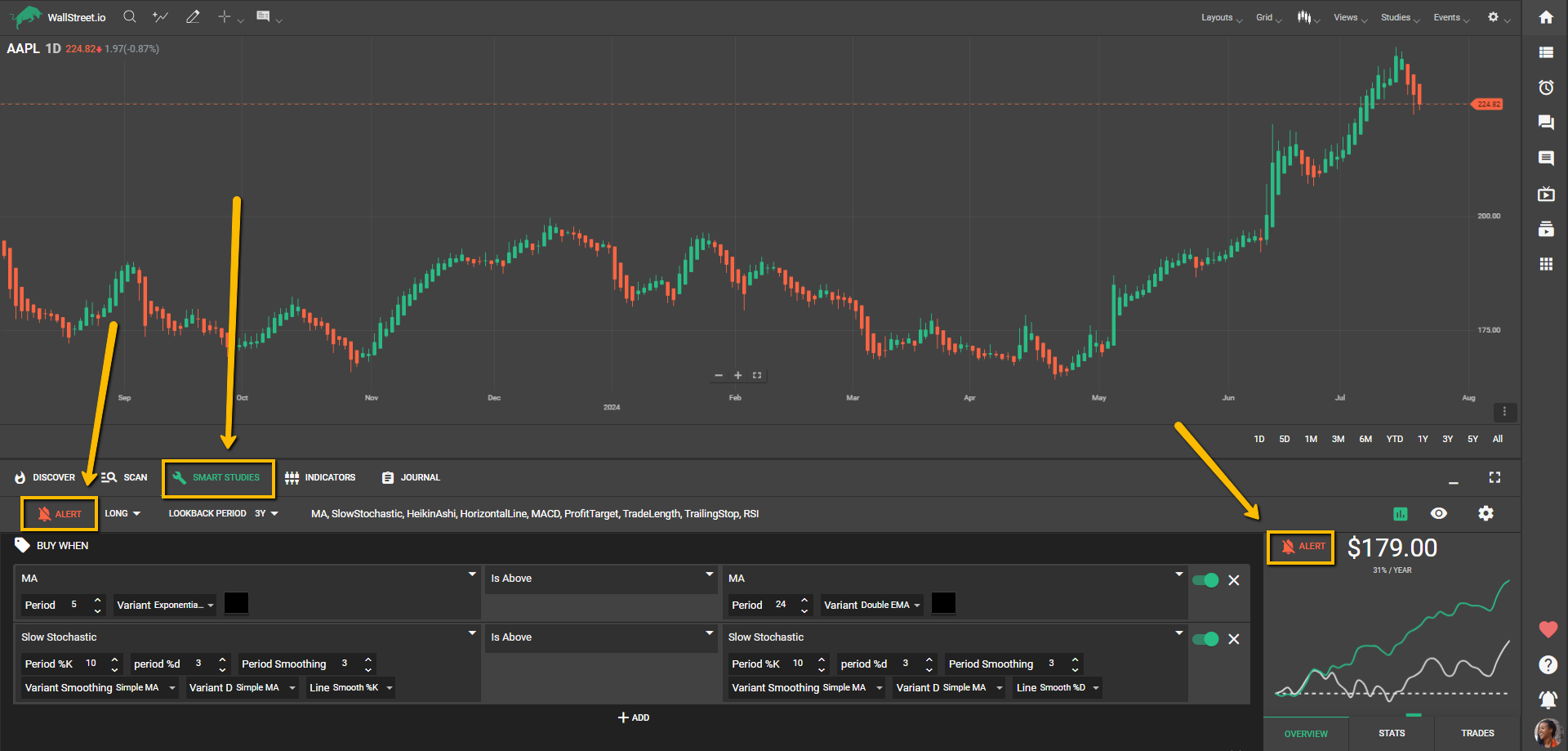

III. Smart Studies tab method

Under the Smart Studies tab, click on the red “Alert” bell icon found below:

Best for: Advanced users who want a sandbox for creating custom strategies.

The Smart Studies tab allows traders to mix and match indicators, experimenting with combinations to see how different strategies perform. While highly flexible, this approach may have a learning curve due to the multiple dropdown menus and settings.

Note: If there are no custom studies under the Smart Studies Tab when you click the Alert bell, it will activate alerts for a placeholder “BuyAndHold, NeverSell” strategy which will show you the same stats as if you bought the stock years ago and never sold, with no actionable entry or exit points to replicate.

This is not an alert you want to receive if you’re looking to trade:

You can unfollow this and any other unwanted strategies under the Scan Tab, selecting “My Strategies” and “All Stocks” from the dropdown menus, and clicking on the green alert bells next to the strategies you no longer want to follow.

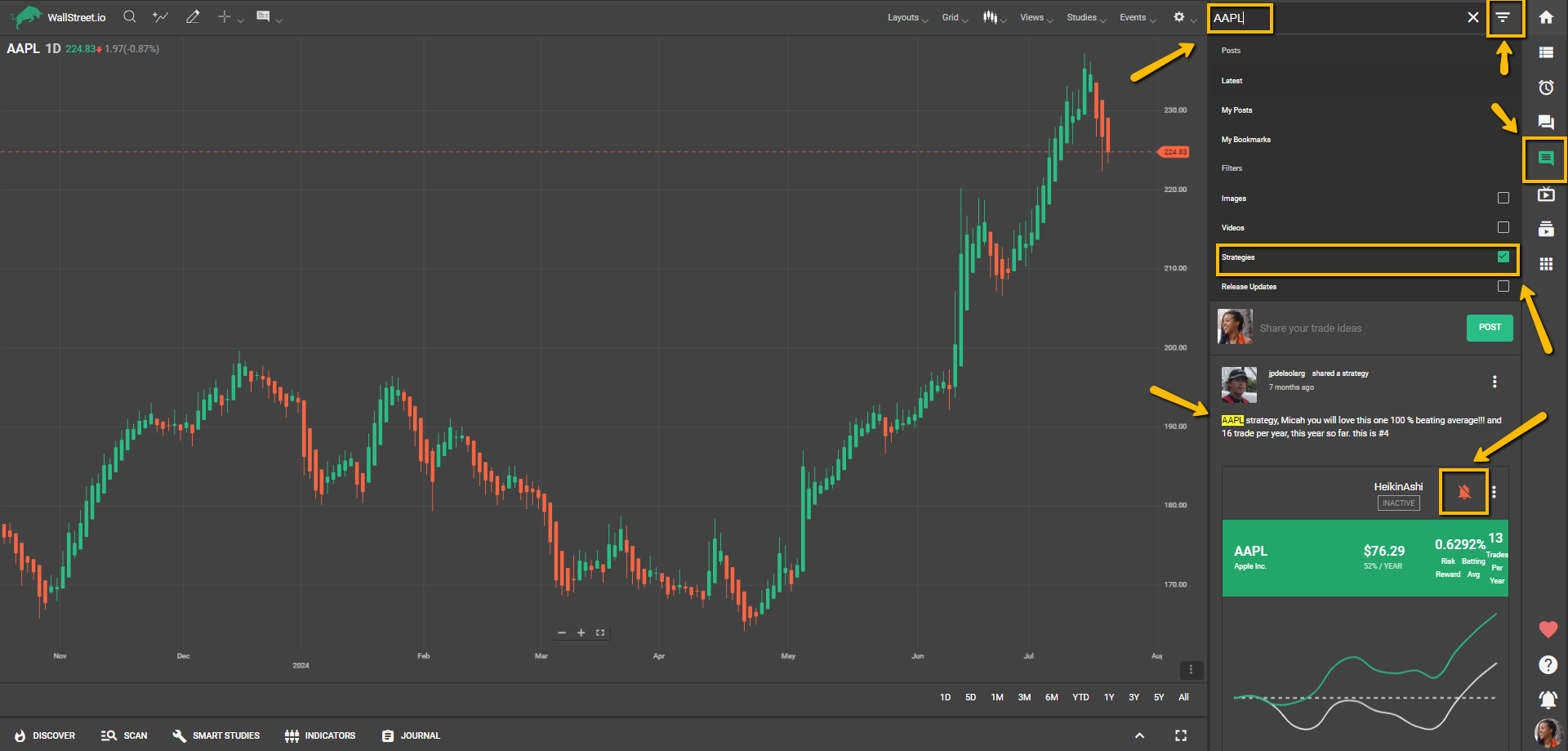

IV. Community widget method

Optional: If you can think of additional criteria to narrow your search, like strategies from a particular community member you already know or a particular symbol you’re looking for, click on the magnifying glass icon at the top right of the Community Widget and type the keyword on the search bar.

Best for: Socially engaged members looking for inspiration from the community.

This method is ideal for those who are active in the Community Wall and Chatrooms, interested in following strategies shared by other members. It’s perfect for anyone who values peer recommendations and wants to follow contributors whose approaches they admire.

V. Top Strategy Doc method

Micah regularly updates the Top Strategy Doc to share his favorite strategies through a curated selection. This document contains Strategy Cards with links that open the strategies in a new Wallstreet.io browser tab. To start receiving alerts for the strategy you just clicked on, click the red “Alert” bell icon under the Smart Studies tab (as shown earlier in method III)

Micah shares the link to the Top Strategy Doc in the Swing Trading Chatroom (available to premium members). If you don’t have the link, feel free to reach out to our Support team, and we'll be happy to share it with you.

Best for: Those who want expert-curated strategies with a personal touch.

Micah’s Top Strategy Doc provides a collection of handpicked strategies he considers top-performing at any given time. While based on his expertise, this list may differ from the Discover Tab’s algorithm-based suggestions. We encourage users to explore both to discover the full range of strategies available.

Do all Strategies follow the PayDay Cycle framework?

No, not all strategies on the platform are based on the PayDay Cycle framework. While the PayDay Cycle approach typically combines bullish Heikin-Ashi candles and a positive MACD crossover as key entry signals, strategies on Wallstreet.io can be built with endless combinations of indicators, including but not limited to Heikin-Ashi and MACD.

Advanced users can create and customize their strategies by choosing from a variety of studies and settings under the Smart Studies tab, and these backtests are the crowdsourced strategies that become discoverable by the rest of our community. As a result, strategies may "start" based on different conditions, such as specific moving average crossovers, RSI levels, or other criteria defined by the person who created the backtest.

When will I start seeing results?

Strategies on our platform are built on statistical data, meaning that consistency is key. To achieve the expected results, you’d need to follow each trade as outlined and trust the process.

In both the Scan Tab and Smart Studies tab, you can adjust the Lookback period to 1, 3, 5, and 10 years. These timeframes show how a strategy performed over different periods and help set realistic expectations.

For example, if a 1-year strategy has a certain batting average, you’d need to follow it for a full year to aim for similar results. Skipping trades or not following through may lead to different outcomes than the strategy performance stats suggest.

Strategy Notification Alert email overview

Once you turn on Alerts for a strategy:

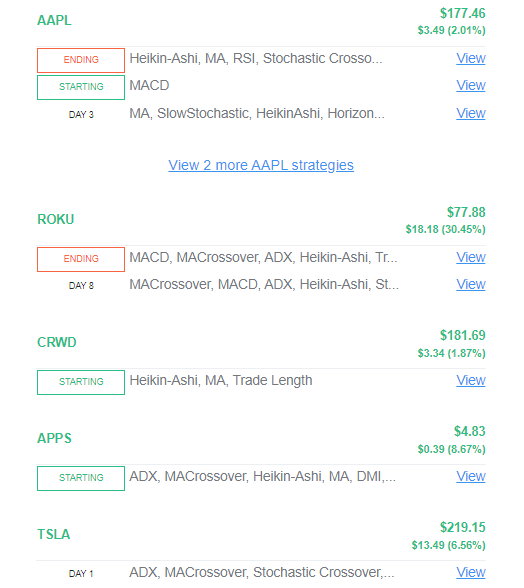

In the Strategy Notification emails, you’ll see the "Starting", "Ending" or “Day X” signs next to each strategy. This is how you know if the Buy or Sell conditions for the mentioned strategies are being met on the day you receive the email, or if you need to hold a previously opened trade.

The email will look similar to this:

In this example above, the email shows strategy alerts for three different strategies for three different tickers (AAPL, SPY, and QQQ), the actual price of each ticker, and the rolling 24h change, in dollar amounts and percentages.

To tell your followed strategies apart from one another, we strongly encourage giving them a particular name under the Smart Studies tab. In the previous example, I've named the AAPL strategy "Byron for Apple", the SPY strategy "Aaron's Spy Money Maker", and the QQQ strategy "Byron for QQQ".

Here’s a quick recording showing how you can rename your newly followed strategy:

This nickname is only visible to you, while the strategy keeps its generic name for the rest of the community. Remember that you can also follow Short or bearish strategies, so in this case, remember to rename them accordingly to avoid any confusion or mix-ups!

How do you use the emails?

The day I received the email above (with two “Starting” strategies and one “Ending” strategy), assuming they are all Long strategies, I’d open both a Long SPY trade and a Long QQQ trade, and also close a Long AAPL trade I might’ve had open until now (being the AAPL trade triggered by a previous “Starting” signal from my “Byron for Apple” strategy).

When you click "View" next to a strategy in your Strategy Notification email, it will open a new Wallstreet.io browser tab with the strategy already loaded. From there, you can review the strategy's entry and exit conditions under the Smart Studies tab, as well as its overall performance:

This extra step works as an added confirmation layer, allowing you to review the strategy and the current market scenario before deciding to place the corresponding trade with your broker, but this isn’t really necessary if you already did your research and decided to trust the strategy process :)

Important note:

Our platform gives you the flexibility to turn on alerts for as many strategies and tickers as you like. This means you might sometimes receive signals that seem to contradict each other for the same stock, since each strategy follows its own set of conditions. We encourage this flexibility to allow room for your unique experimentation and profit potential (hello, power users!).

However, keeping up with multiple strategies at once can feel overwhelming, so we recommend using your best judgment to decide which and how many strategies to follow. The email example below shows what can happen when too many strategies are followed at once—especially if they’re left with their default names. It can quickly become hard to read and interpret to the untrained eye!

If the emails you’re receiving look long and/or confusing like the one above, please unfollow any unwanted strategies under the Scan Tab.

A deep dive into strategy statuses

The 4 stages of a strategy:

• Starting

• Day X

• Ending

• Inactive

Starting: This means that the conditions that make up the strategy are true as of today. True means they are happening.

For example, if your strategy is set to trigger a “Buy When” signal when a stock closes above the 21-day Simple Moving Average, and today the stock is finally meeting this criterion, the status will be Starting.

In other words, in the example below, if you had planned to buy AAPL shares or call options guided by this followed Long AAPL strategy, then you'd be buying on this day before the market closed because this is your signal to open a trade for it:

Day X: This could also be described as Active or Hold, and "X" can be defined as the number of days after opening your trade. This is when the conditions for the strategy are true and have been true for more than one day. If you got into a trade on the Starting Day and today you see "Day X", then you'd hold the trade.

It is important to know how many days into a strategy you are. This is why we show "Day X" instead of just saying Active.

In the example below, the notification tells me that my “Aaron’s Spy Money Maker” strategy triggered a “Starting” signal 9 days ago.

In case you only want to receive Strategy Notifications when a given strategy starts or ends and are not interested in keeping up with active strategies, you can customize what email alerts you want to receive and when through your My Account page.

Ending: This means that the conditions that make up the strategy are no longer true as of today.

For example, if your strategy is set to trigger a “Sell When” signal when a stock closes below the 21-day Simple Moving Average, and today the stock is finally below the 21-day simple moving average, the status will be Ending.

In other words, in this example below, if you had planned to sell TSLA shares or call options guided by this followed Long TSLA strategy, then you'd be selling on this day before the market closed because this is your signal to close a trade for it:

Inactive: If you don't see a strategy you know you're following appearing in the Strategy Notification email, this means that the conditions that make up the strategy are untrue today. No buying, no holding, no selling, just sitting on your hands!

It's important to note that all our backtesting data is routed to the closing price each day. The closer you buy and sell to the close, the closer you'll follow the expected strategy results.

If you wait until the next day to buy or sell, you may experience slippage because of the risk the stock may gap up or down at the open.

Also, if you're receiving a little too many Strategy Notifications and would like to narrow down a bit or start with a clean slate altogether, you're free to easily disable alerts for any Strategies you're no longer interested in through the Scan Tab.

Discover Tab Reference Guide

Discover Tab Reference Guide Discover Tab How-To Guide

Discover Tab How-To Guide Smart Studies How-To Guide

Smart Studies How-To Guide Smart Studies Reference Guide

Smart Studies Reference Guide Scan Tab Reference Guide

Scan Tab Reference Guide Scan Tab How-To Guide

Scan Tab How-To Guide Watchlists How-To guide

Watchlists How-To guide Watchlists Reference Guide

Watchlists Reference Guide Chatrooms Reference Guide

Chatrooms Reference Guide Community Wall How-To Guide

Community Wall How-To Guide Community Wall Reference Guide

Community Wall Reference Guide Streams Reference Guide

Streams Reference Guide Streams How-To Guide

Streams How-To Guide