ADX/DMS

Definition

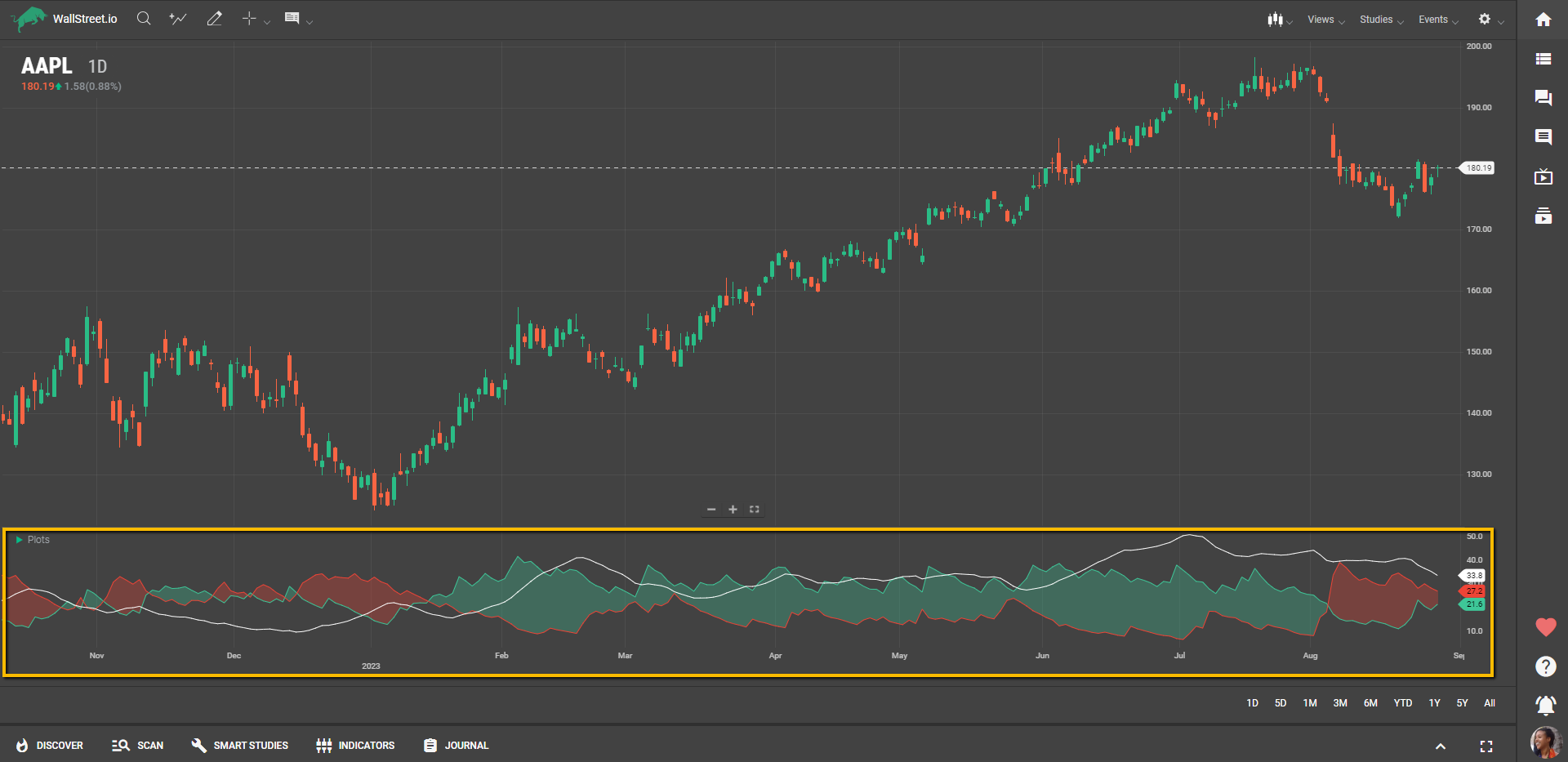

The ADX/DMS (sometimes called DMI instead of DMS) is a set of indicators within technical analysis that helps traders identify the strength and direction of a trend. The ADX measures the strength of a trend but not its direction, while the DMS includes two lines, the +DI (Positive Directional Indicator) and -DI (Negative Directional Indicator), which help indicate the trend's direction.

Suggested Trading Use

Traders can utilize the ADX/DMS Study to gauge the robustness of a trend and make informed decisions on entry and exit points. A strong trend (ADX above 25) combined with +DI crossing above -DI may suggest a strong upward trend, suitable for a buying position. Conversely, a strong trend with -DI crossing above +DI may signal a strong downward trend, suitable for selling or shorting.

Discover Tab Reference Guide

Discover Tab Reference Guide Discover Tab How-To Guide

Discover Tab How-To Guide Smart Studies How-To Guide

Smart Studies How-To Guide Smart Studies Reference Guide

Smart Studies Reference Guide Scan Tab Reference Guide

Scan Tab Reference Guide Scan Tab How-To Guide

Scan Tab How-To Guide Watchlists How-To guide

Watchlists How-To guide Watchlists Reference Guide

Watchlists Reference Guide Chatrooms Reference Guide

Chatrooms Reference Guide Community Wall How-To Guide

Community Wall How-To Guide Community Wall Reference Guide

Community Wall Reference Guide Streams Reference Guide

Streams Reference Guide Streams How-To Guide

Streams How-To Guide