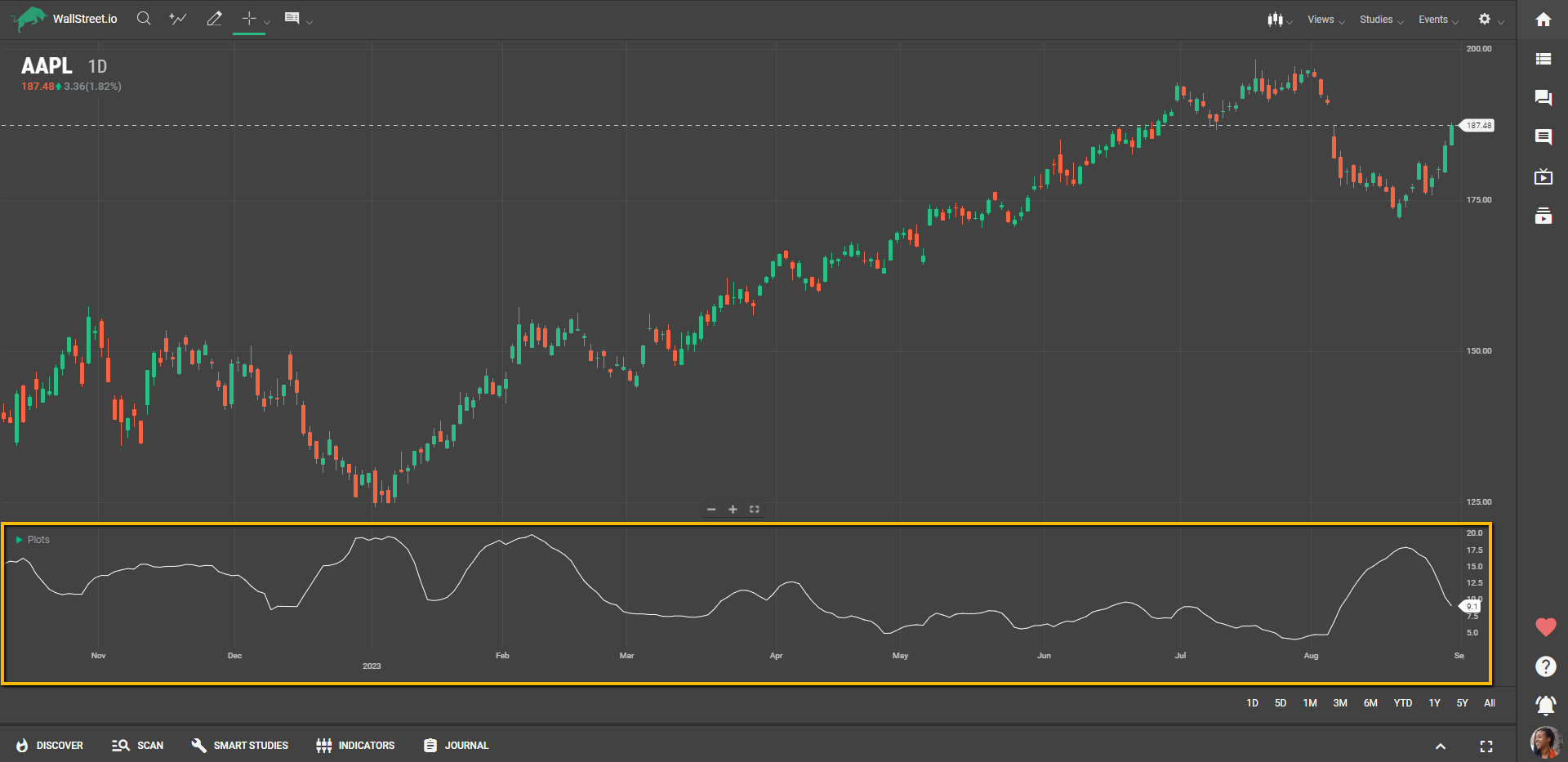

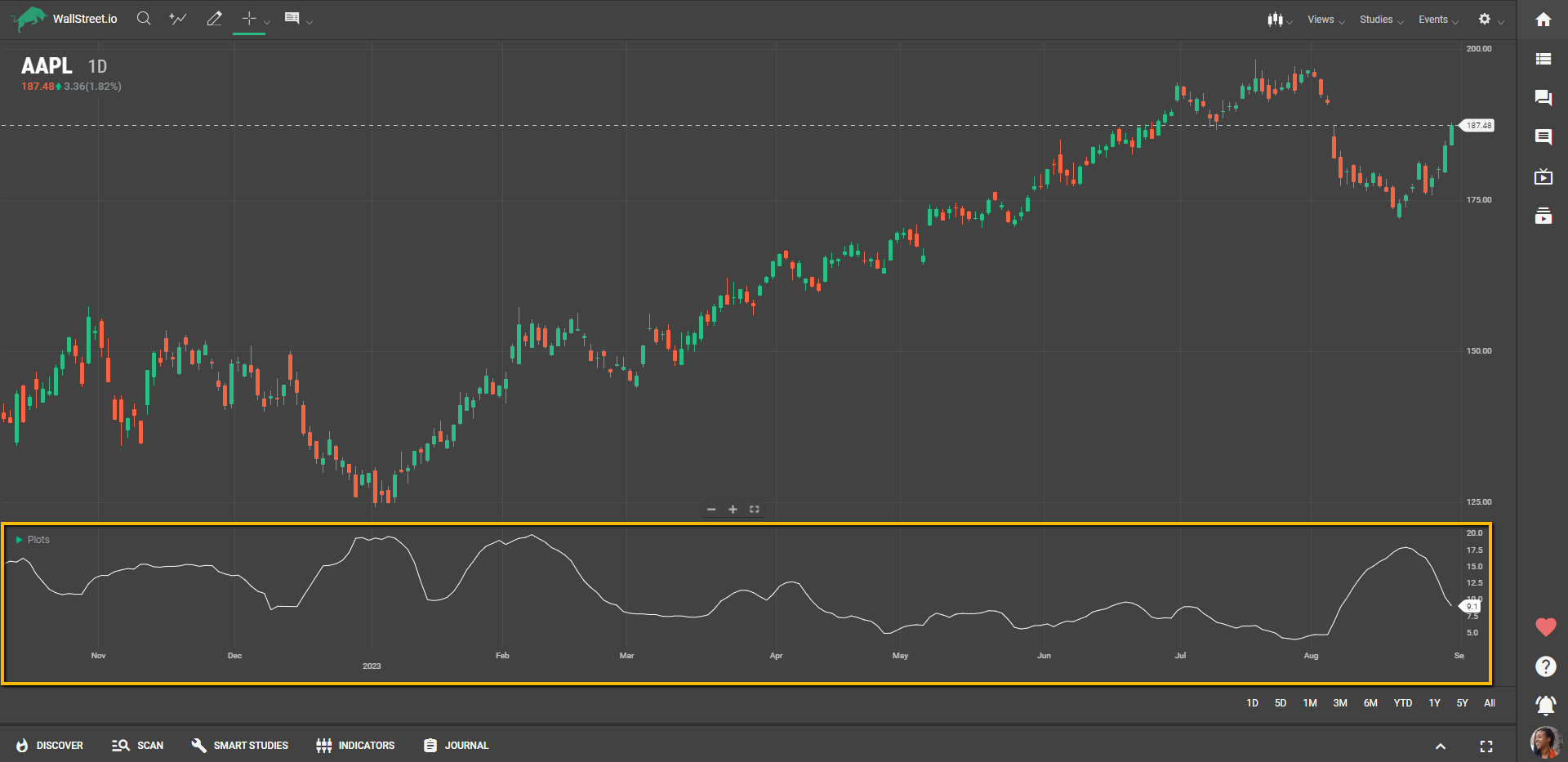

Definition

The Bollinger Bandwidth indicator quantifies the width between the upper and lower Bollinger Bands. It serves as a measure of volatility in the market. A wider bandwidth indicates higher volatility, while a narrower bandwidth suggests lower volatility. The Bollinger Bandwidth is particularly useful in identifying periods of market consolidation and impending trends.

Suggested Trading Use

Bollinger Bandwidth can be used in various ways:

Identifying Market Volatility: A rising Bandwidth value typically indicates increasing market volatility, while a falling Bandwidth suggests declining volatility.Anticipating Breakouts: A narrow Bandwidth often signifies market consolidation and can be a precursor to a big price move or trend. Traders often consider a narrow Bandwidth as a setup for an impending breakout.Confirming Trends: A widening Bandwidth during an uptrend may confirm the strength of the trend, while a narrowing Bandwidth during a downtrend could signify a weakening in the trend.Comparing Peaks and Troughs: By examining previous peaks and troughs in the Bandwidth, traders can potentially anticipate future volatility levels and market conditions.

Discover Tab Reference Guide

Discover Tab Reference Guide Discover Tab How-To Guide

Discover Tab How-To Guide Smart Studies How-To Guide

Smart Studies How-To Guide Smart Studies Reference Guide

Smart Studies Reference Guide Scan Tab Reference Guide

Scan Tab Reference Guide Scan Tab How-To Guide

Scan Tab How-To Guide Watchlists How-To guide

Watchlists How-To guide Watchlists Reference Guide

Watchlists Reference Guide Chatrooms Reference Guide

Chatrooms Reference Guide Community Wall How-To Guide

Community Wall How-To Guide Community Wall Reference Guide

Community Wall Reference Guide Streams Reference Guide

Streams Reference Guide Streams How-To Guide

Streams How-To Guide