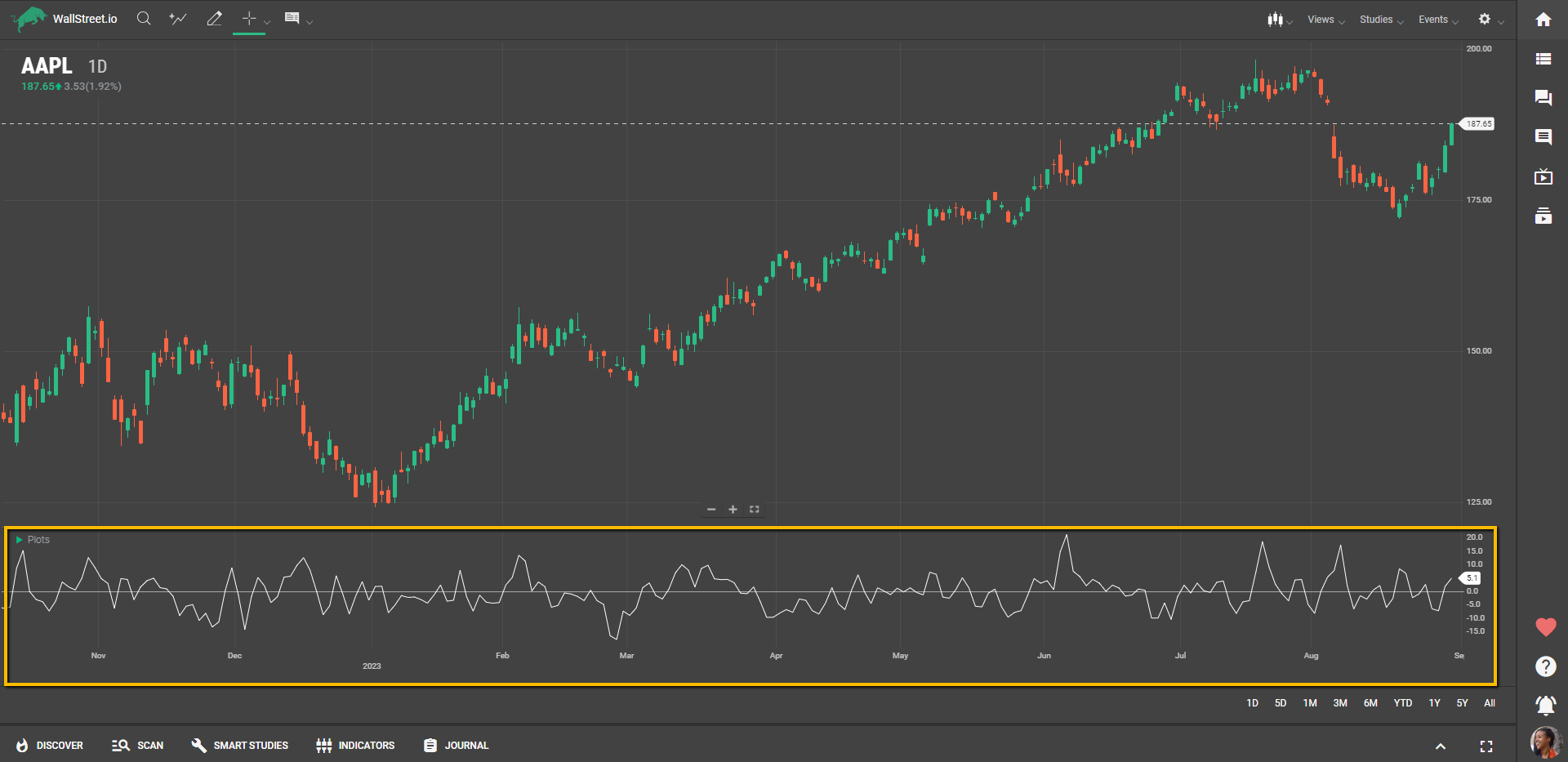

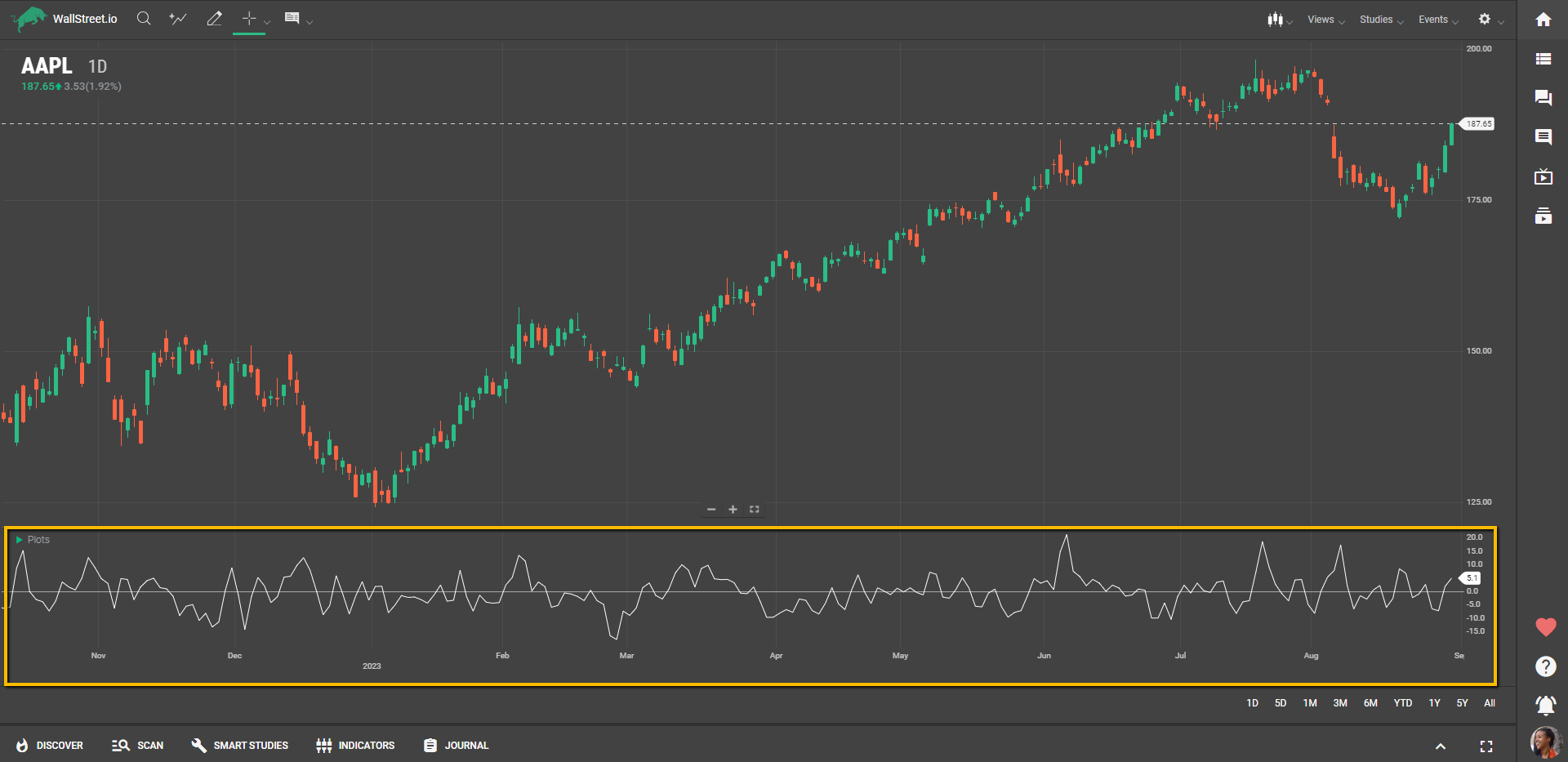

Definition

The Chaikin Volatility gauges the rate of change in the volatility of an asset by analyzing the fluctuation between the high and low prices. Specifically, it looks at how these highs and lows evolve over a set period, presenting the changes in percentage terms. The study produces unbounded values, with higher numbers suggesting increased volatility.

Suggested Trading Use

Chaikin Volatility can offer valuable insights for traders in several ways:

Spotting Volatility Trends: If the indicator is rising, it means that the price range (high-low) is expanding, possibly indicating a future trend. Conversely, if it's falling, it could suggest that the asset is settling into a more stable range.Timing Entry and Exit: Higher volatility often presents more trading opportunities. For example, during a rising market with increasing Chaikin Volatility, traders might find it advantageous to enter long positions, anticipating further upward movement. Similarly, in a falling market with increasing volatility, traders might look for opportunities to go short.Risk Management: Knowing when an asset is more volatile can help you manage your risk by adjusting your stop losses or position sizes accordingly.Divergence Identification: If the asset's price is rising but Chaikin Volatility is falling, or vice versa, this could indicate a potential change in the current trend.

Discover Tab Reference Guide

Discover Tab Reference Guide Discover Tab How-To Guide

Discover Tab How-To Guide Smart Studies How-To Guide

Smart Studies How-To Guide Smart Studies Reference Guide

Smart Studies Reference Guide Scan Tab Reference Guide

Scan Tab Reference Guide Scan Tab How-To Guide

Scan Tab How-To Guide Watchlists How-To guide

Watchlists How-To guide Watchlists Reference Guide

Watchlists Reference Guide Chatrooms Reference Guide

Chatrooms Reference Guide Community Wall How-To Guide

Community Wall How-To Guide Community Wall Reference Guide

Community Wall Reference Guide Streams Reference Guide

Streams Reference Guide Streams How-To Guide

Streams How-To Guide