Definition

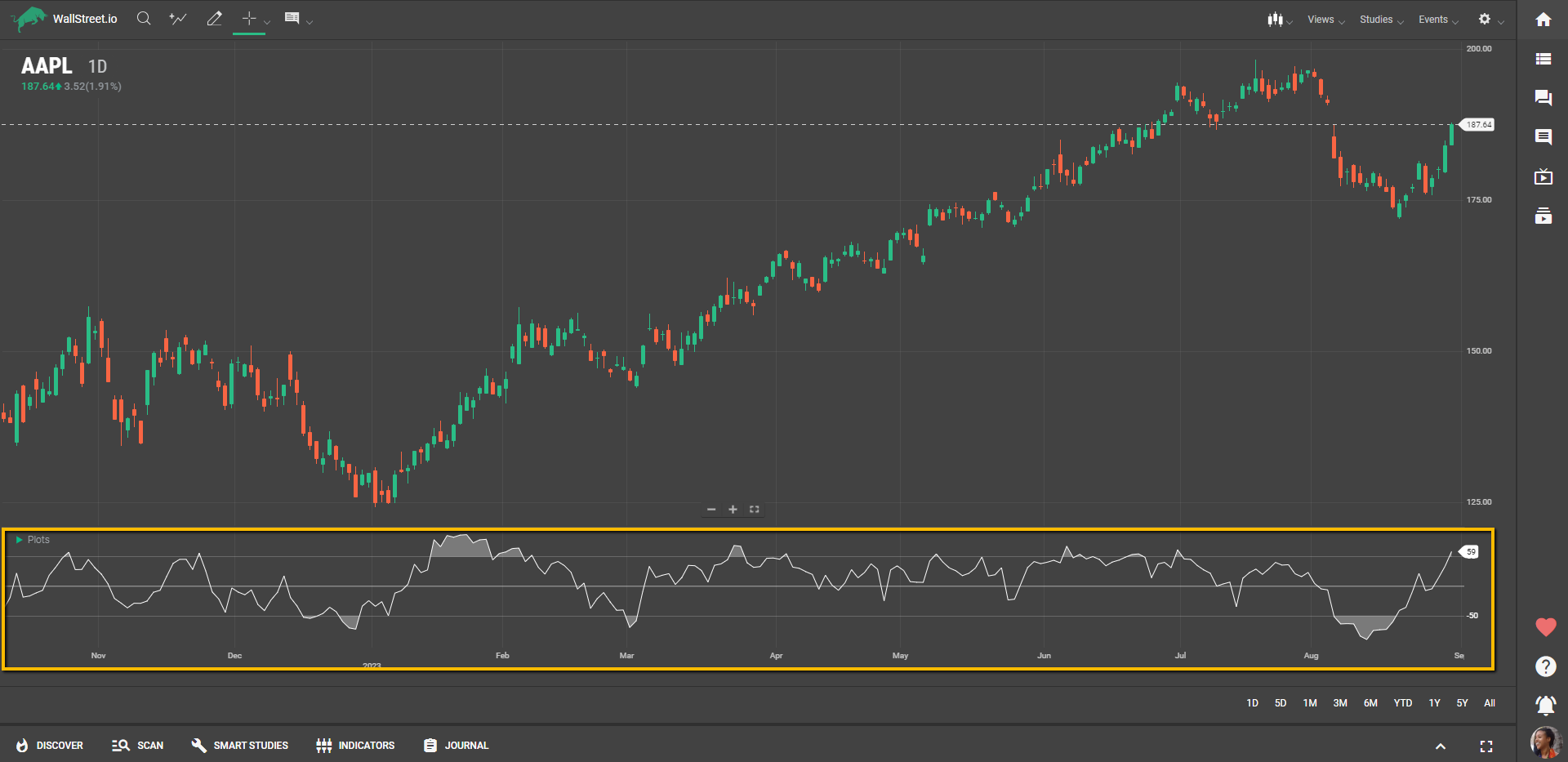

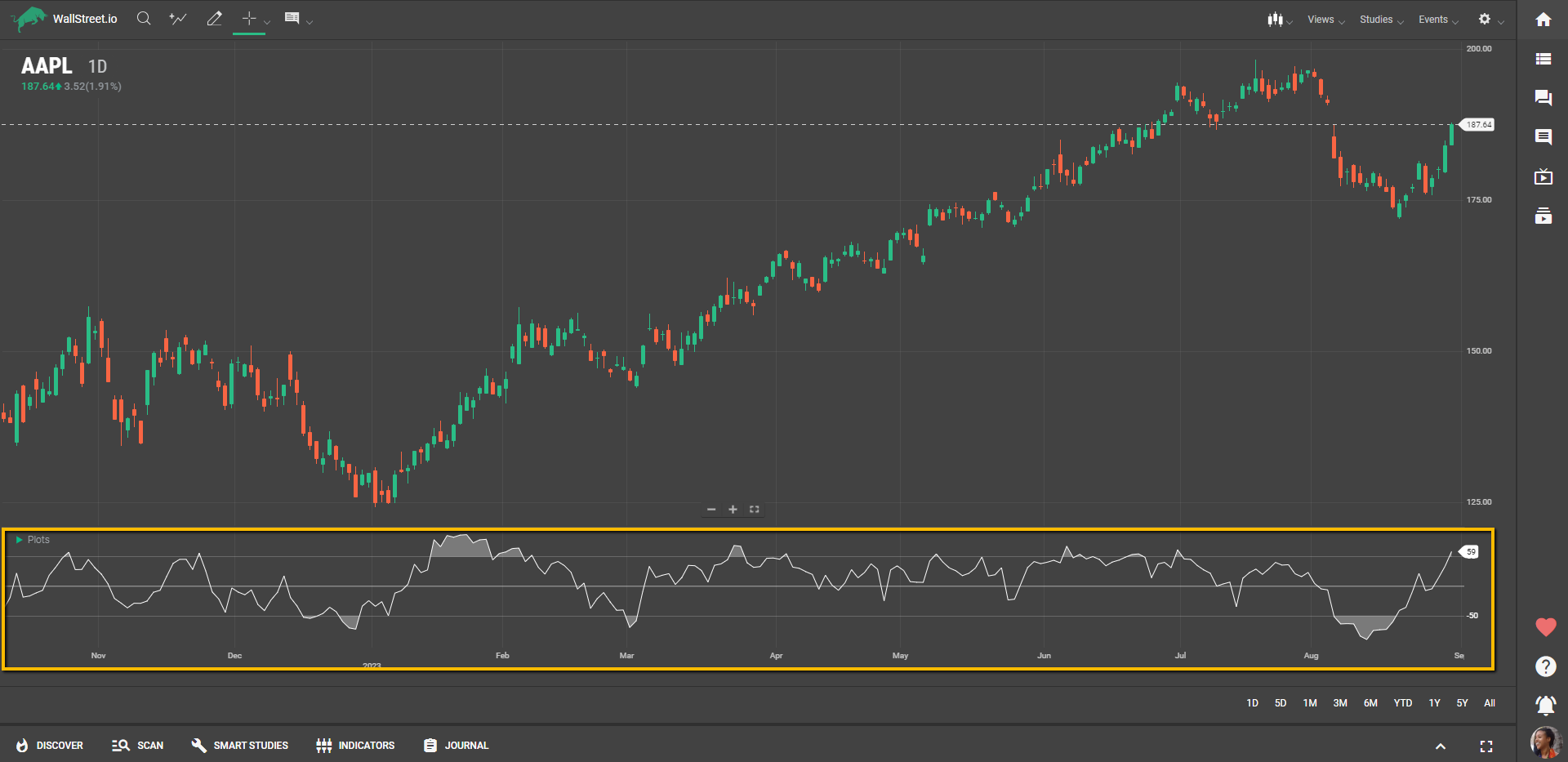

The Chande Momentum Oscillator (CMO) is a technical analysis tool that measures the momentum of an asset's price changes in percentage terms. Specifically, it calculates the sum of all recent one-period price changes and divides it by the sum of the absolute values of those changes. The CMO oscillates between -100 and +100, offering traders a quick gauge of an asset's momentum relative to its recent past.

Suggested Trading Use

The Chande Momentum Oscillator is versatile and can be used in various ways to assist traders:

Momentum Identification: A positive CMO value suggests upward price momentum, while a negative value indicates downward momentum. This can help traders decide whether to take a long or short position.Overbought and Oversold Levels: Generally, readings above +50 are considered overbought, signaling that the asset may be primed for a downturn. Conversely, readings below -50 suggest oversold conditions, potentially indicating an upcoming upward move.Signal Confirmation: The CMO can validate signals from other technical indicators. For instance, a bullish signal from another indicator paired with a positive CMO value can reinforce a buy signal.Trend Change Alerts: When the CMO crosses above or below zero, it may signify a trend change. This can be valuable for traders looking to enter or exit positions at pivotal moments.The Chande Momentum Oscillator offers traders insights into both trend direction and strength, making it a handy addition to any trader’s technical toolkit.

Discover Tab Reference Guide

Discover Tab Reference Guide Discover Tab How-To Guide

Discover Tab How-To Guide Smart Studies How-To Guide

Smart Studies How-To Guide Smart Studies Reference Guide

Smart Studies Reference Guide Scan Tab Reference Guide

Scan Tab Reference Guide Scan Tab How-To Guide

Scan Tab How-To Guide Watchlists How-To guide

Watchlists How-To guide Watchlists Reference Guide

Watchlists Reference Guide Chatrooms Reference Guide

Chatrooms Reference Guide Community Wall How-To Guide

Community Wall How-To Guide Community Wall Reference Guide

Community Wall Reference Guide Streams Reference Guide

Streams Reference Guide Streams How-To Guide

Streams How-To Guide