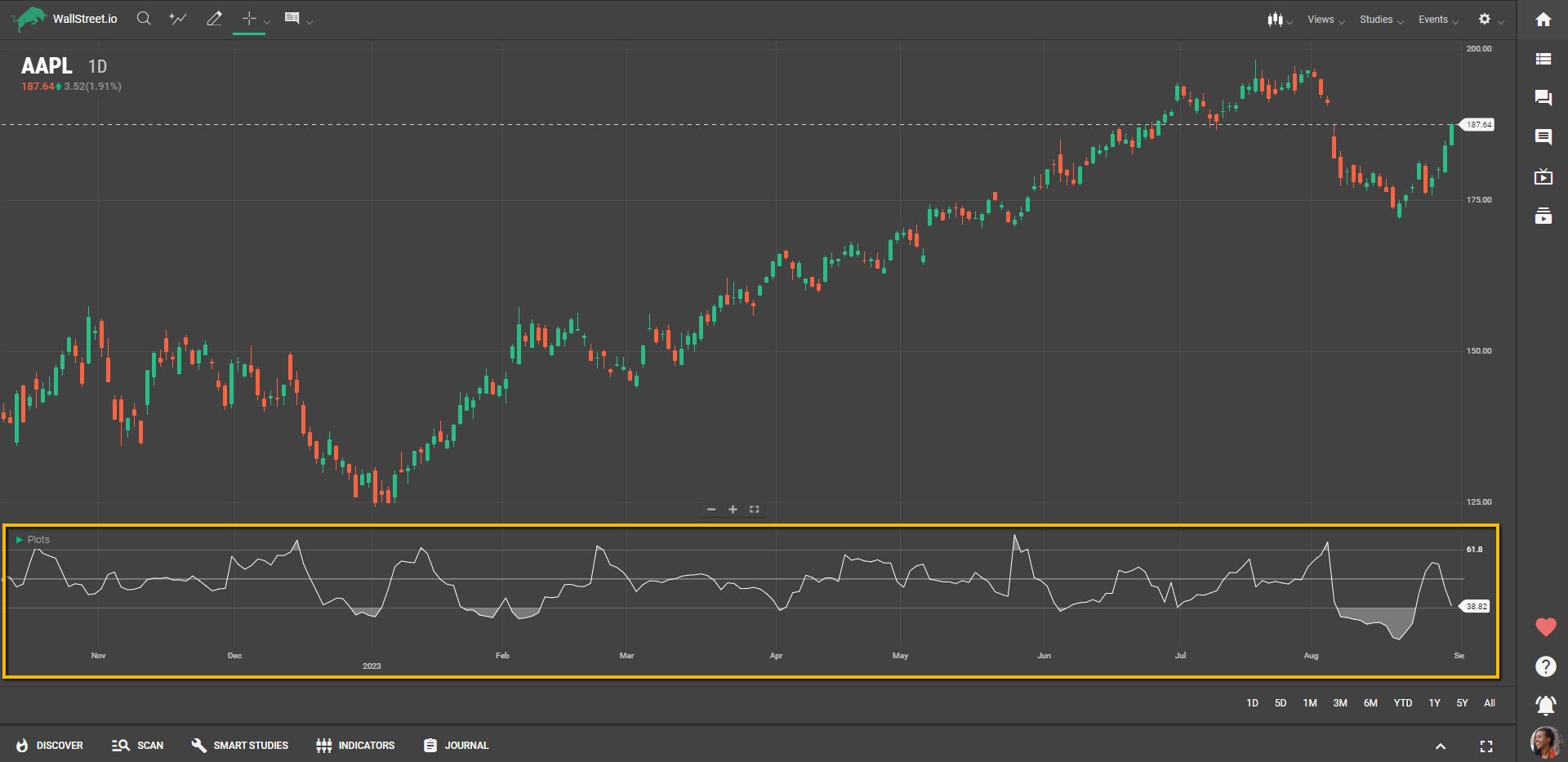

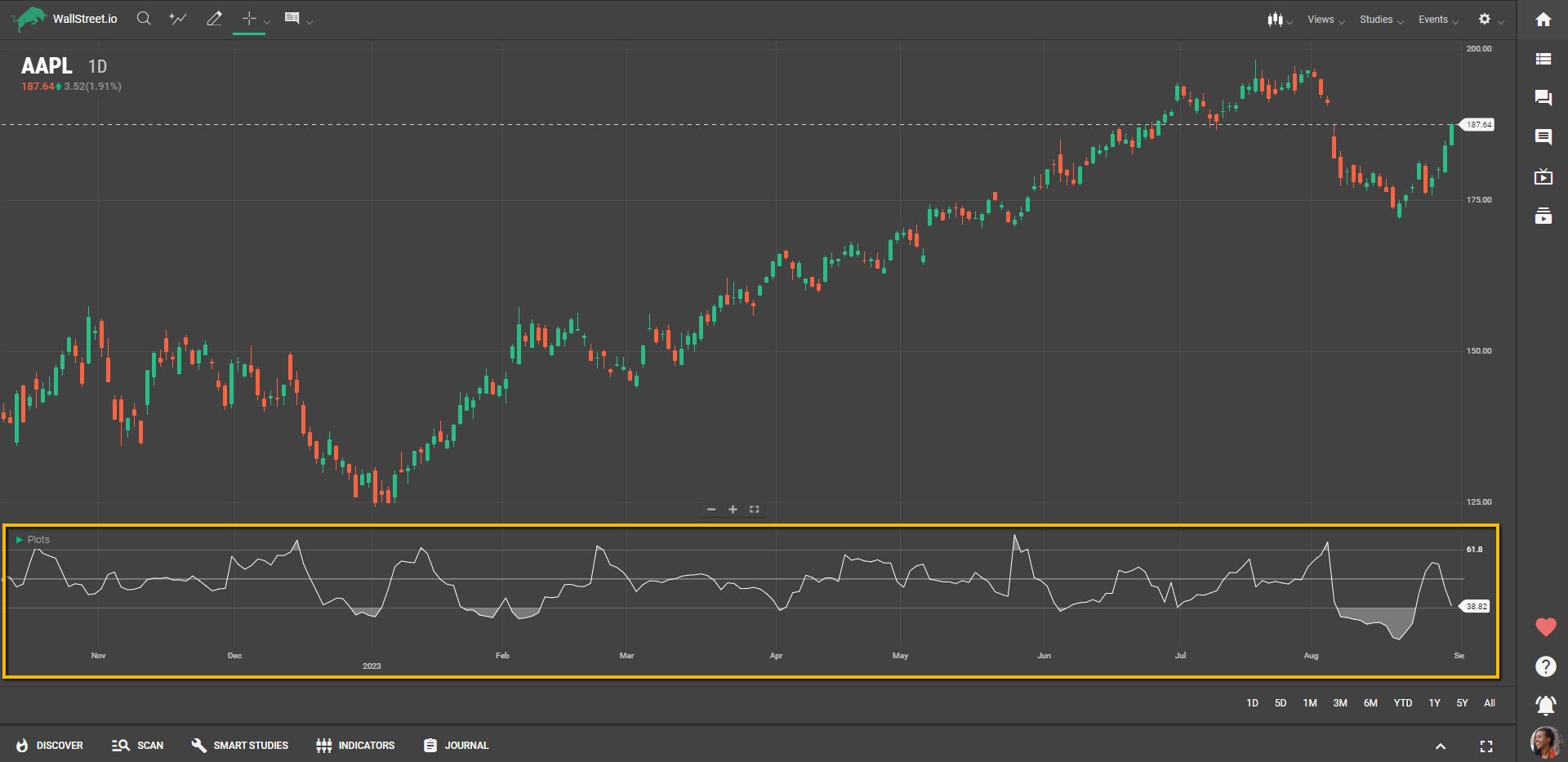

Definition

The Choppiness Index (CI) is a specialized indicator that measures the degree of market volatility without focusing on direction (up or down). The CI ranges between 0 and 100; a higher value indicates that the market is more consolidated and less likely to trend, while a lower value suggests the opposite.

Suggested Trading Use

The Choppiness Index is particularly useful for identifying market conditions, which can guide trading strategies:

Identifying Market Phases: High readings (e.g., above 60) usually indicate a range-bound or "choppy" market, which may be suited for short-term or range-trading strategies. Low readings (e.g., below 40) suggest a trending market, where trend-following strategies might be more effective.Anticipating Breakouts: An extended period of high CI values could indicate that the market is coiling up, making it ripe for a potential breakout. Traders might use this information to prepare for a significant price movement.Risk Management: Knowing the market's phase can help traders adjust their risk levels. For instance, in a choppy market with high CI values, traders might choose to decrease position sizes to mitigate risk.Supplementing Other Indicators: The CI can be used in conjunction with directional indicators to fine-tune trading decisions. For example, in a trending market signaled by a low CI, a directional indicator's buy or sell signal could carry more weight.The Choppiness Index is a tool for gauging market conditions, providing traders with valuable insights for crafting tailored strategies based on current volatility levels.

Discover Tab Reference Guide

Discover Tab Reference Guide Discover Tab How-To Guide

Discover Tab How-To Guide Smart Studies How-To Guide

Smart Studies How-To Guide Smart Studies Reference Guide

Smart Studies Reference Guide Scan Tab Reference Guide

Scan Tab Reference Guide Scan Tab How-To Guide

Scan Tab How-To Guide Watchlists How-To guide

Watchlists How-To guide Watchlists Reference Guide

Watchlists Reference Guide Chatrooms Reference Guide

Chatrooms Reference Guide Community Wall How-To Guide

Community Wall How-To Guide Community Wall Reference Guide

Community Wall Reference Guide Streams Reference Guide

Streams Reference Guide Streams How-To Guide

Streams How-To Guide