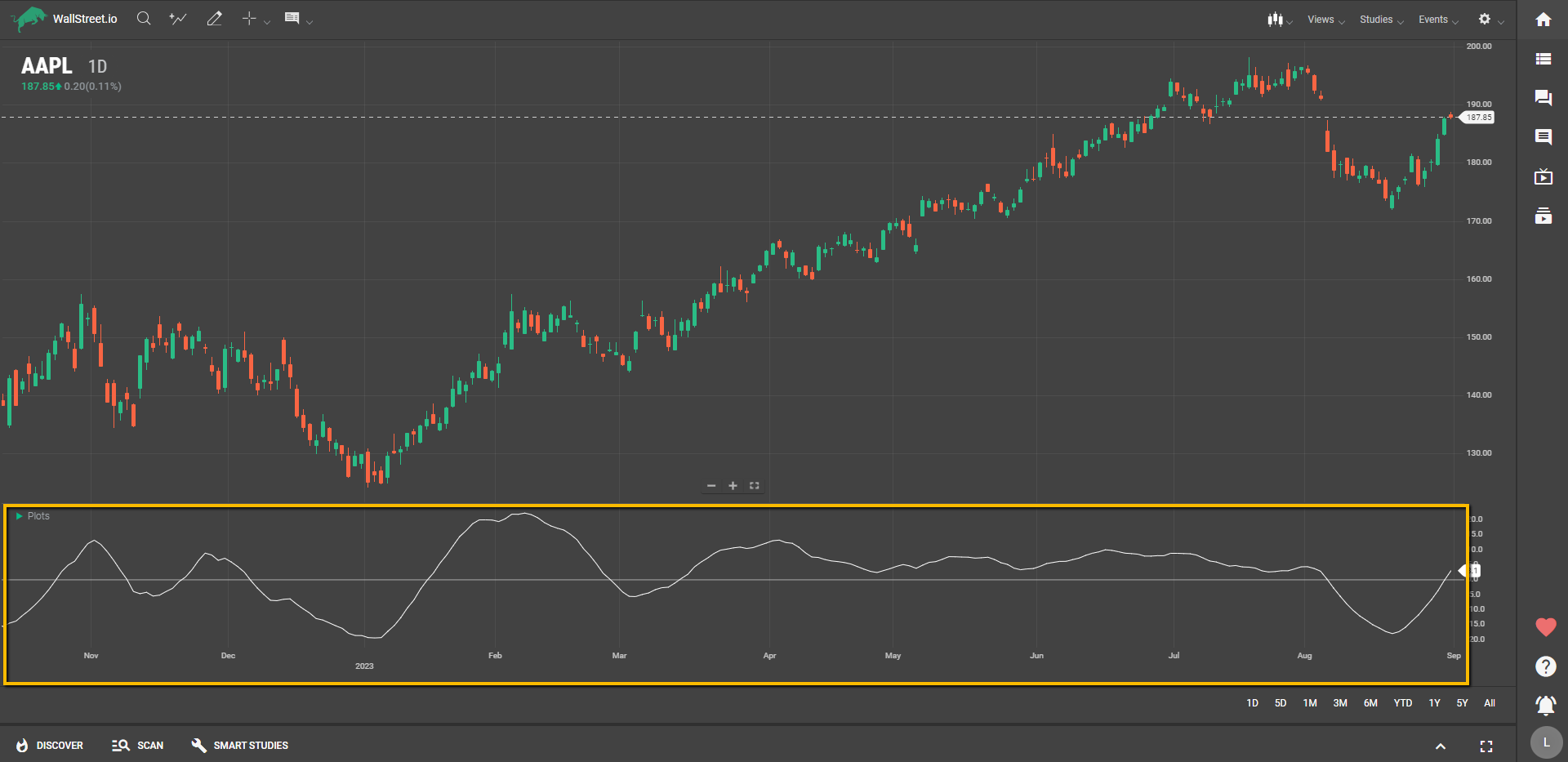

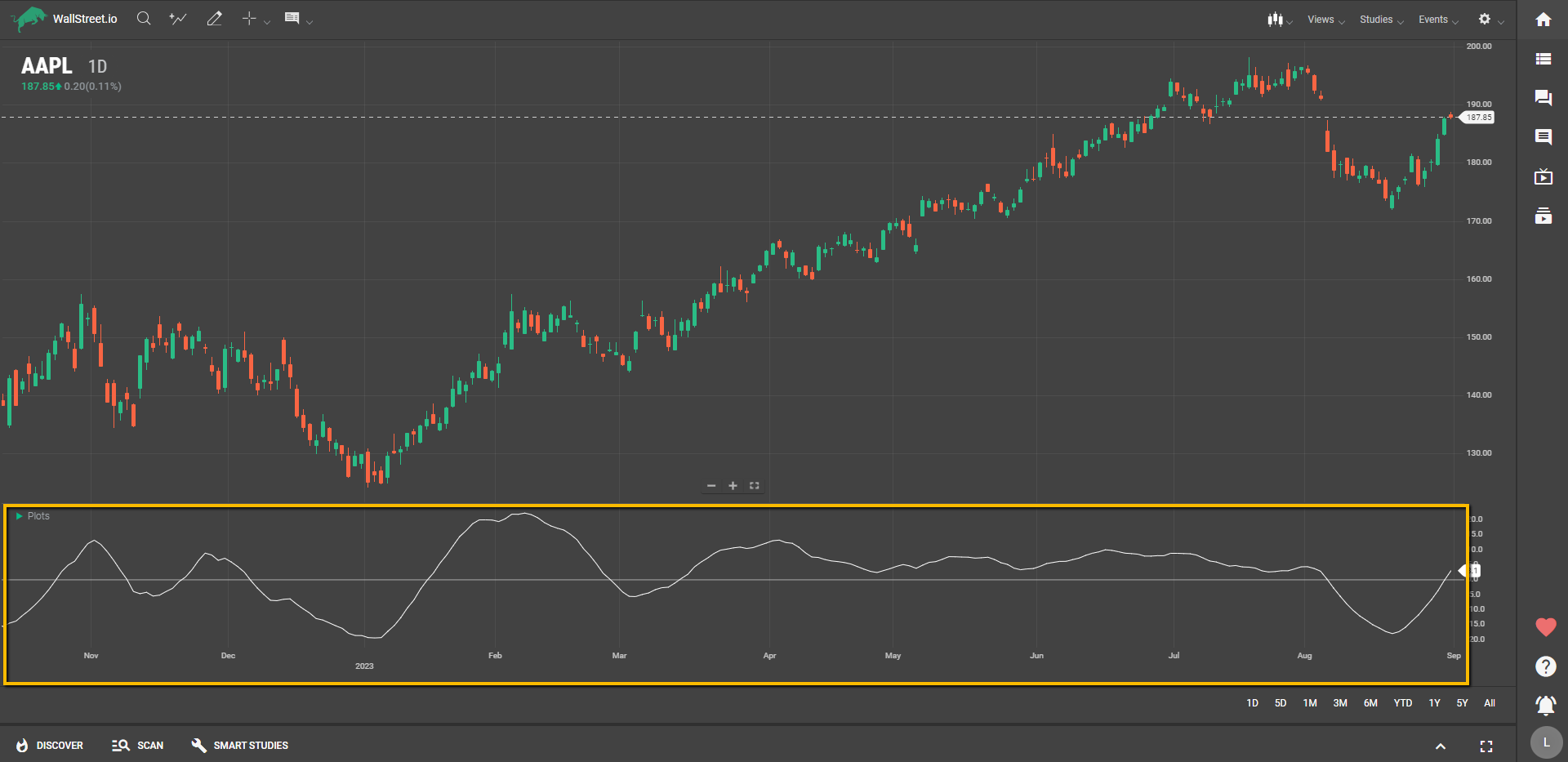

Definition

The Coppock Curve helps you gauge the long-term momentum of an asset by combining two different rates of change—one long-term and one short-term—and then applying a weighted moving average to this sum. The curve oscillates around a zero line, providing you with clues about market sentiment.

Suggested Trading Use

Here are some practical ways you can use the Coppock Curve in your trading strategy:

Identify Bullish Entry Points: When the Coppock Curve crosses above the zero line, it's often considered a bullish signal. This could be an opportune moment for you to consider entering a long position.Spot Market Bottoms: The Coppock Curve is particularly useful for identifying the end of a bear market or a substantial downward move. When you see the curve turning upwards from a low point, it could indicate that the market is recovering and a new upward trend might be forming.Combine with Other Studies: The Coppock Curve can be used in conjunction with other indicators to confirm signals. For example, if you see a bullish signal on the Coppock Curve, you might look for confirming signals on other long-term momentum or trend-following indicators.Avoid Whipsaws: Be cautious about overly rapid fluctuations in the Coppock Curve. These could be false signals and may not necessarily indicate a sustainable change in trend.Be Mindful of Trend Lengths: Since the Coppock Curve incorporates both long-term and short-term rates of change, it can offer a more comprehensive view of an asset's momentum. Make sure to factor in the lengths of these trends when interpreting the curve.The Coppock Curve can be a versatile tool, especially for those focused on long-term trading, helping you to spot potential trend reversals and entry points based on market momentum.

Discover Tab Reference Guide

Discover Tab Reference Guide Discover Tab How-To Guide

Discover Tab How-To Guide Smart Studies How-To Guide

Smart Studies How-To Guide Smart Studies Reference Guide

Smart Studies Reference Guide Scan Tab Reference Guide

Scan Tab Reference Guide Scan Tab How-To Guide

Scan Tab How-To Guide Watchlists How-To guide

Watchlists How-To guide Watchlists Reference Guide

Watchlists Reference Guide Chatrooms Reference Guide

Chatrooms Reference Guide Community Wall How-To Guide

Community Wall How-To Guide Community Wall Reference Guide

Community Wall Reference Guide Streams Reference Guide

Streams Reference Guide Streams How-To Guide

Streams How-To Guide