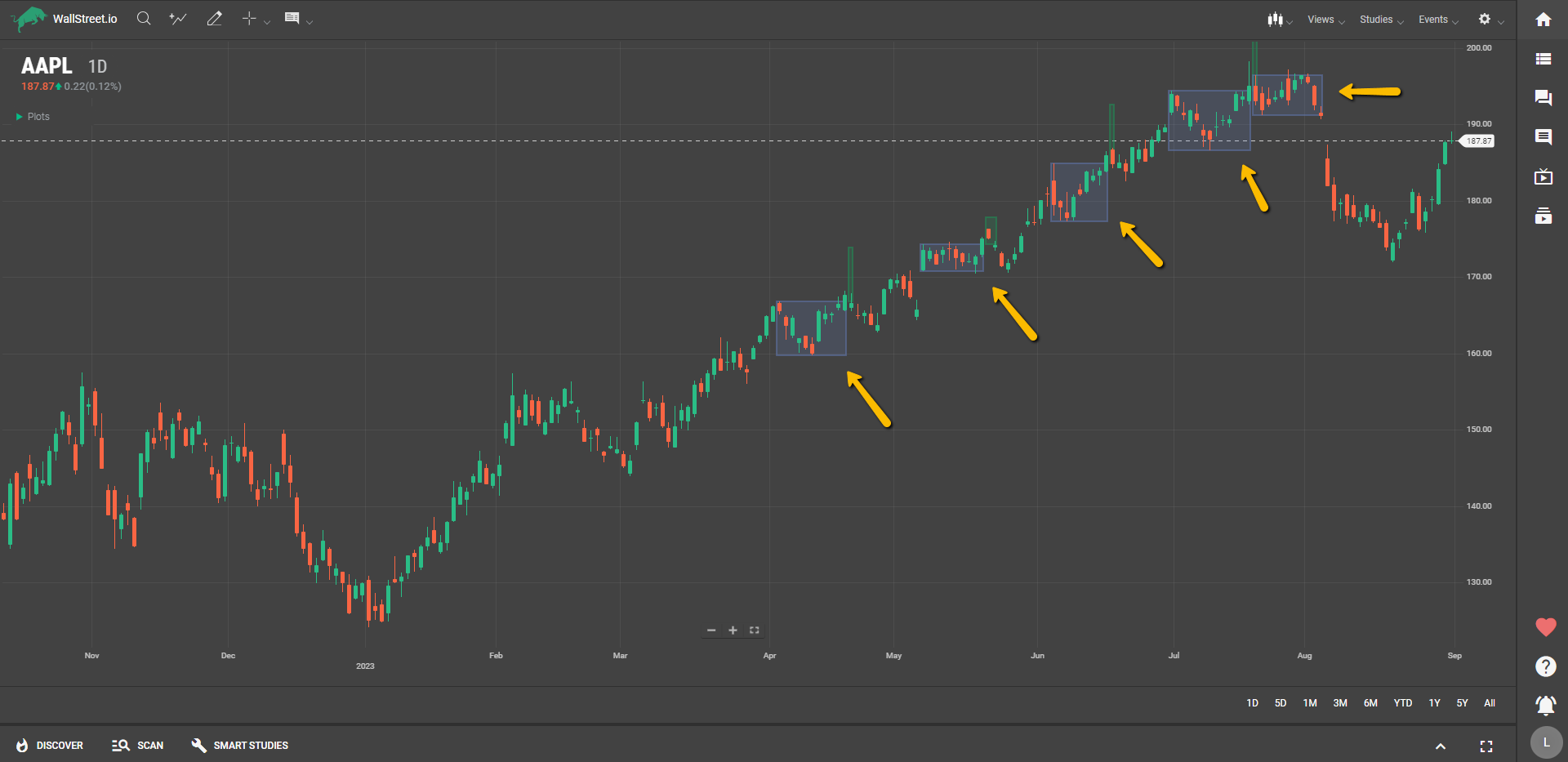

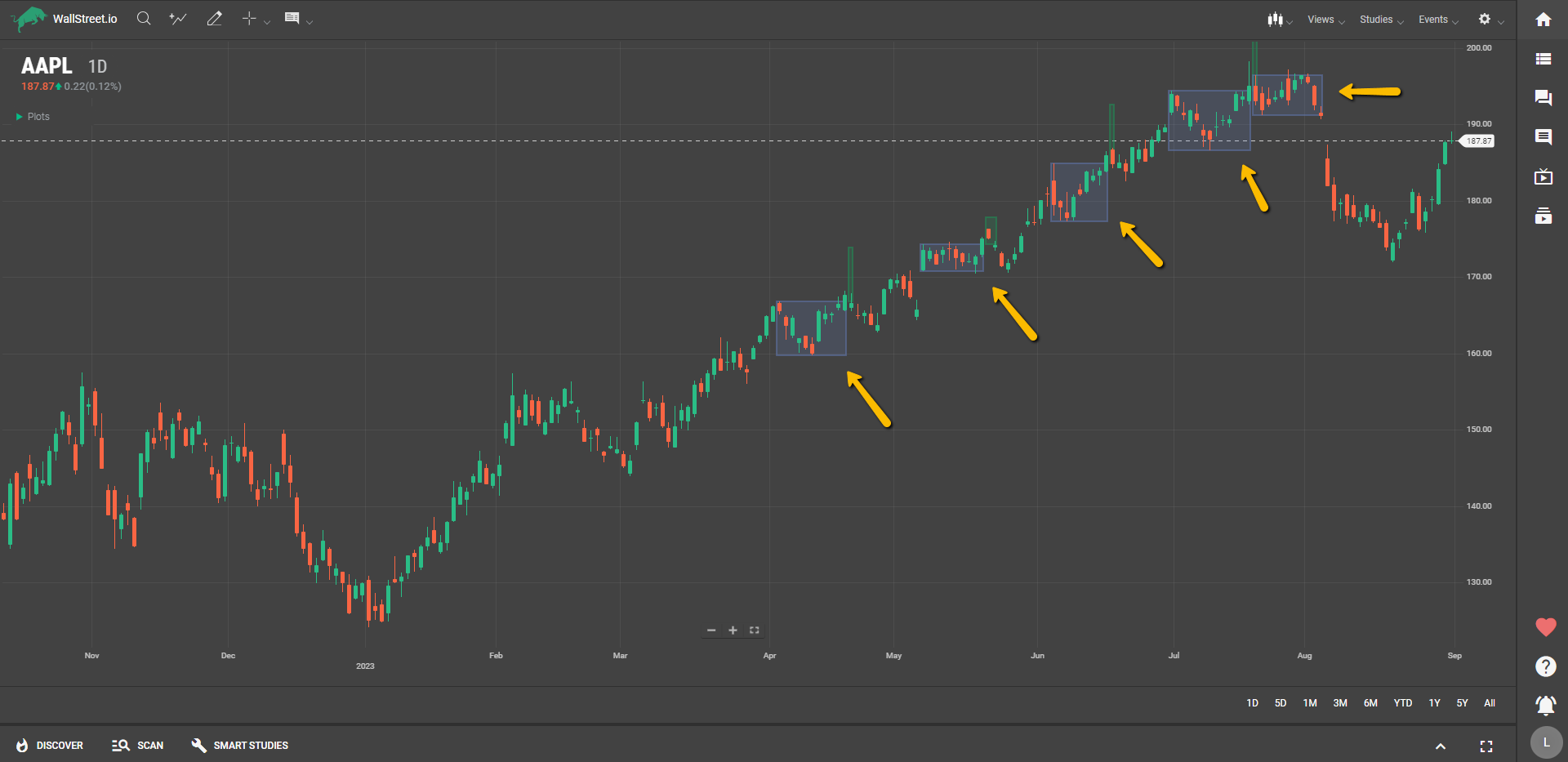

Definition

The Darvas Box is a trend-following indicator that identifies key support and resistance levels based on price ranges. It draws boxes around price bars to highlight stocks hitting new highs or lows, making it easier to identify entry and exit points. The box remains in place until the price breaks out to a new high or falls below a specified low, making it a straightforward but powerful tool for understanding price behavior.

Suggested Trading Use

So, how can you make the Darvas Box work for you? Let's find out:

Identify Breakouts: Use the Darvas Box to spot when a stock is moving out of its comfort zone on higher volume. This is often a sign that the stock is gaining or losing momentum, which could be a good time to enter or exit a position.Risk Management: The boxes can also serve as natural places to set stop-loss orders. For instance, if a stock falls below the lower boundary of the box on higher volume, it might be a sign to sell.Add to Existing Positions: New boxes forming while you're already invested in a stock can be opportunities to add to your existing position. These new boxes can also help you adjust your stop-loss levels.Volume Spikes: You can customize the Darvas Box to point out volume spikes. A sudden surge in volume when a stock breaks out of its box can be a strong indicator of the stock's future direction.Customize for Your Strategy: The Darvas Box allows for quite a bit of customization, like setting specific period intervals for highs or defining a minimum price for boxes to form. Tailor these settings to suit your trading style and time frame.With the Darvas Box, you'll have a clearer visual guide to a stock's volatility and trend patterns, giving you the insights to spot potential opportunities or risks.

Discover Tab Reference Guide

Discover Tab Reference Guide Discover Tab How-To Guide

Discover Tab How-To Guide Smart Studies How-To Guide

Smart Studies How-To Guide Smart Studies Reference Guide

Smart Studies Reference Guide Scan Tab Reference Guide

Scan Tab Reference Guide Scan Tab How-To Guide

Scan Tab How-To Guide Watchlists How-To guide

Watchlists How-To guide Watchlists Reference Guide

Watchlists Reference Guide Chatrooms Reference Guide

Chatrooms Reference Guide Community Wall How-To Guide

Community Wall How-To Guide Community Wall Reference Guide

Community Wall Reference Guide Streams Reference Guide

Streams Reference Guide Streams How-To Guide

Streams How-To Guide