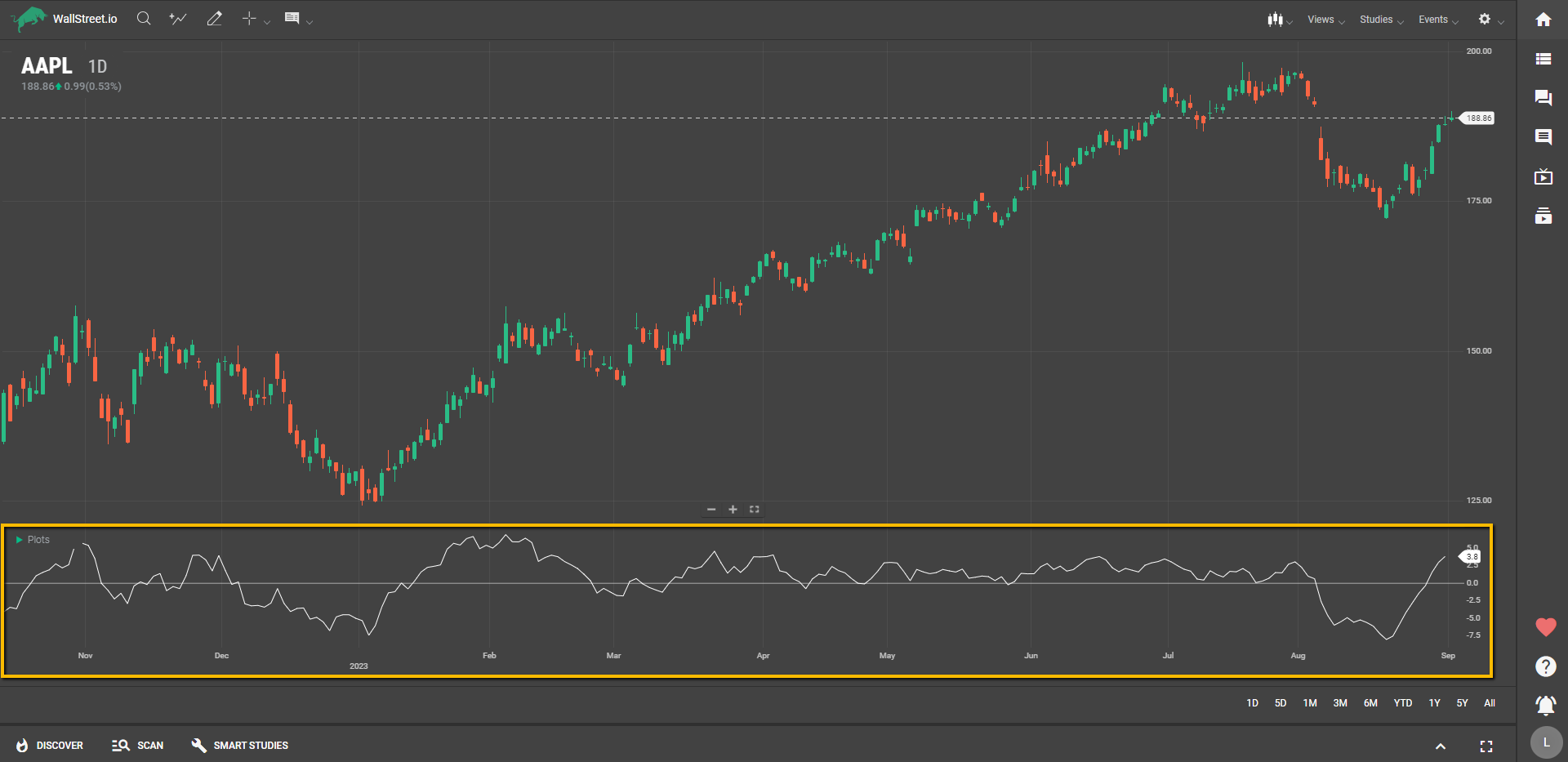

Ease of Movement (EoM)

Definition

The Ease of Movement (EOM) indicator is your go-to tool for understanding how much effort the market is exerting to move prices. Think of it as a "market effort gauge." It takes into account both the trading volume and the price range within a given period to give you an idea of how easily an asset is moving up or down.

Suggested Trading Use

When you see the EOM rising, the market is cruising upward with little resistance—kind of like a car smoothly accelerating down an open highway. This could be a good time to hop in for a bullish trade, as it suggests that buying pressure is effectively pushing prices up.

Conversely, if the EOM is dipping, the market is having a harder time gaining upward traction—imagine trying to walk through a mud pit. You might want to think twice about entering a long position or consider a short position, as the selling pressure is likely strong.

Because the EOM is an unbounded oscillator, it doesn't have an upper or lower limit, so it's crucial to compare current and past EOM values to get a sense of its relative strength or weakness.

Discover Tab Reference Guide

Discover Tab Reference Guide Discover Tab How-To Guide

Discover Tab How-To Guide Smart Studies How-To Guide

Smart Studies How-To Guide Smart Studies Reference Guide

Smart Studies Reference Guide Scan Tab Reference Guide

Scan Tab Reference Guide Scan Tab How-To Guide

Scan Tab How-To Guide Watchlists How-To guide

Watchlists How-To guide Watchlists Reference Guide

Watchlists Reference Guide Chatrooms Reference Guide

Chatrooms Reference Guide Community Wall How-To Guide

Community Wall How-To Guide Community Wall Reference Guide

Community Wall Reference Guide Streams Reference Guide

Streams Reference Guide Streams How-To Guide

Streams How-To Guide