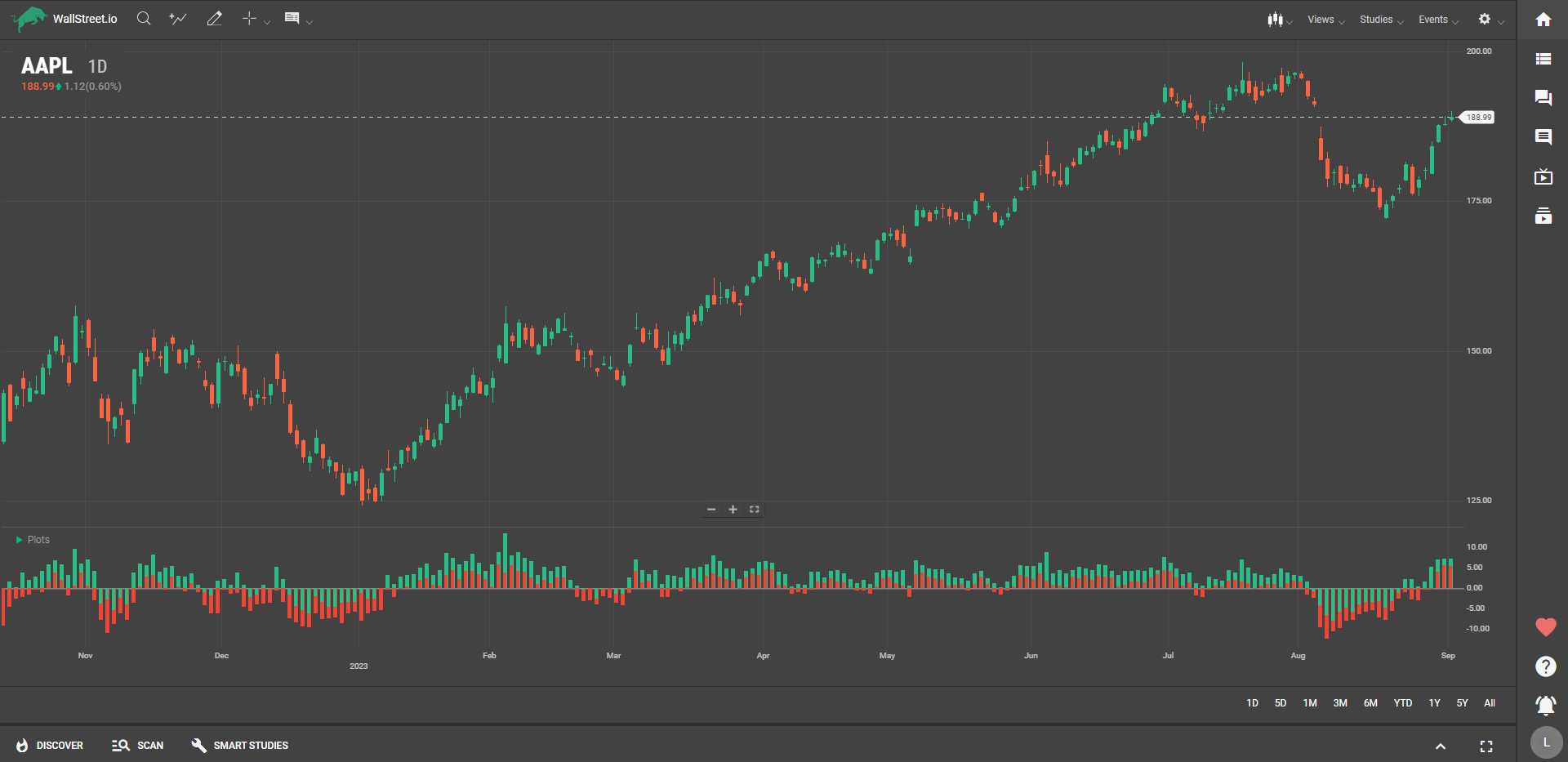

Elder Ray Index

Definition

The Elder Ray Index is a technical indicator that presents two histograms. These histograms measure how far the day's high and low prices are from an exponential moving average (EMA) of the asset's price. Because it's an unbounded oscillator, it doesn't have specific upper or lower limits, allowing for flexibility in interpretation.

Suggested Trading Use

When the histogram values for the high prices are increasing and are above the EMA, it usually indicates bullish strength. You might consider this a favorable moment for entering or maintaining a long position.

Conversely, when the histogram values for the low prices are decreasing and are below the EMA, it suggests bearish conditions. You could interpret this as a potential time to consider short positions or exercise caution with existing long positions.

The Elder Ray Index helps you understand the bullish or bearish pressure in relation to an EMA, offering a nuanced view of market sentiment. By keeping an eye on these histogram values in relation to the EMA, you can gain additional insights into market conditions.

Discover Tab Reference Guide

Discover Tab Reference Guide Discover Tab How-To Guide

Discover Tab How-To Guide Smart Studies How-To Guide

Smart Studies How-To Guide Smart Studies Reference Guide

Smart Studies Reference Guide Scan Tab Reference Guide

Scan Tab Reference Guide Scan Tab How-To Guide

Scan Tab How-To Guide Watchlists How-To guide

Watchlists How-To guide Watchlists Reference Guide

Watchlists Reference Guide Chatrooms Reference Guide

Chatrooms Reference Guide Community Wall How-To Guide

Community Wall How-To Guide Community Wall Reference Guide

Community Wall Reference Guide Streams Reference Guide

Streams Reference Guide Streams How-To Guide

Streams How-To Guide