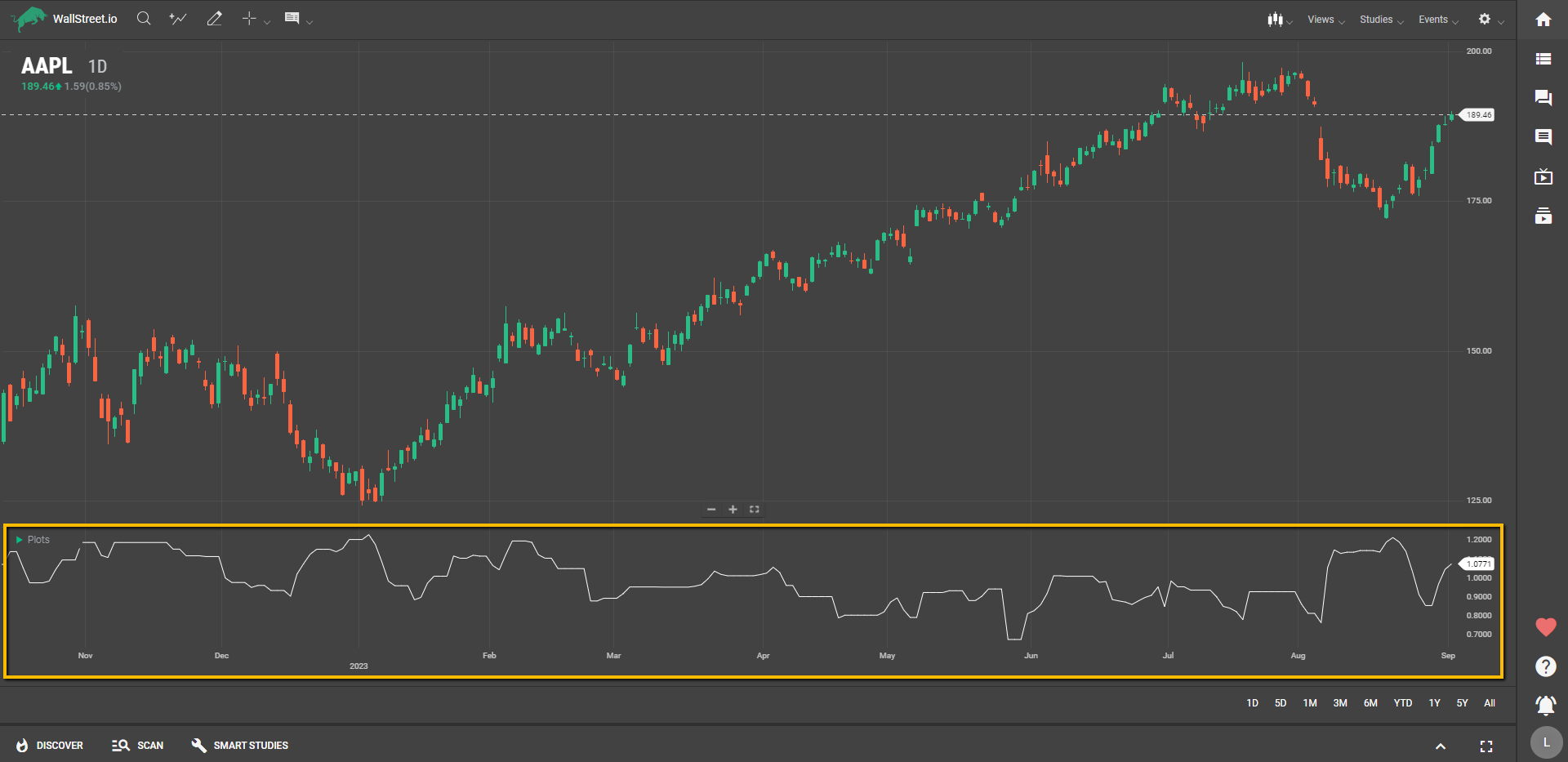

Gopalakrishnan Range Index (GaP)

Definition

The Gopalakrishnan Range Index, commonly known as GAPO, quantifies market volatility by using the natural log of the range between the highest and lowest prices over a specified period. When the GAPO value rises, it means the market is hitting new highs or lows compared to the lookback period.

Suggested Trading Use

When you observe the GAPO increasing, it indicates heightened market volatility, often because the market is making new highs or lows relative to the lookback period. This might be the time to consider trading strategies that benefit from increased volatility, such as options straddles or trend-following techniques. An increase in GAPO might suggest that directional movements are strong, allowing you to potentially capture larger gains in shorter time frames.

Conversely, if the GAPO is decreasing or remaining stable, the market may be in a consolidation phase or moving sideways. During these periods, you might want to be cautious with breakout strategies or other methods that rely on significant price movements. Instead, consider strategies better suited for a stable or sideways market, such as selling options for premium collection or using mean-reversion strategies.

By keeping an eye on the GAPO, you can better tailor your strategies to the prevailing market conditions, maximizing your opportunities while minimizing unnecessary risks.

Discover Tab Reference Guide

Discover Tab Reference Guide Discover Tab How-To Guide

Discover Tab How-To Guide Smart Studies How-To Guide

Smart Studies How-To Guide Smart Studies Reference Guide

Smart Studies Reference Guide Scan Tab Reference Guide

Scan Tab Reference Guide Scan Tab How-To Guide

Scan Tab How-To Guide Watchlists How-To guide

Watchlists How-To guide Watchlists Reference Guide

Watchlists Reference Guide Chatrooms Reference Guide

Chatrooms Reference Guide Community Wall How-To Guide

Community Wall How-To Guide Community Wall Reference Guide

Community Wall Reference Guide Streams Reference Guide

Streams Reference Guide Streams How-To Guide

Streams How-To Guide