Guppy Multiple Moving Average

Definition

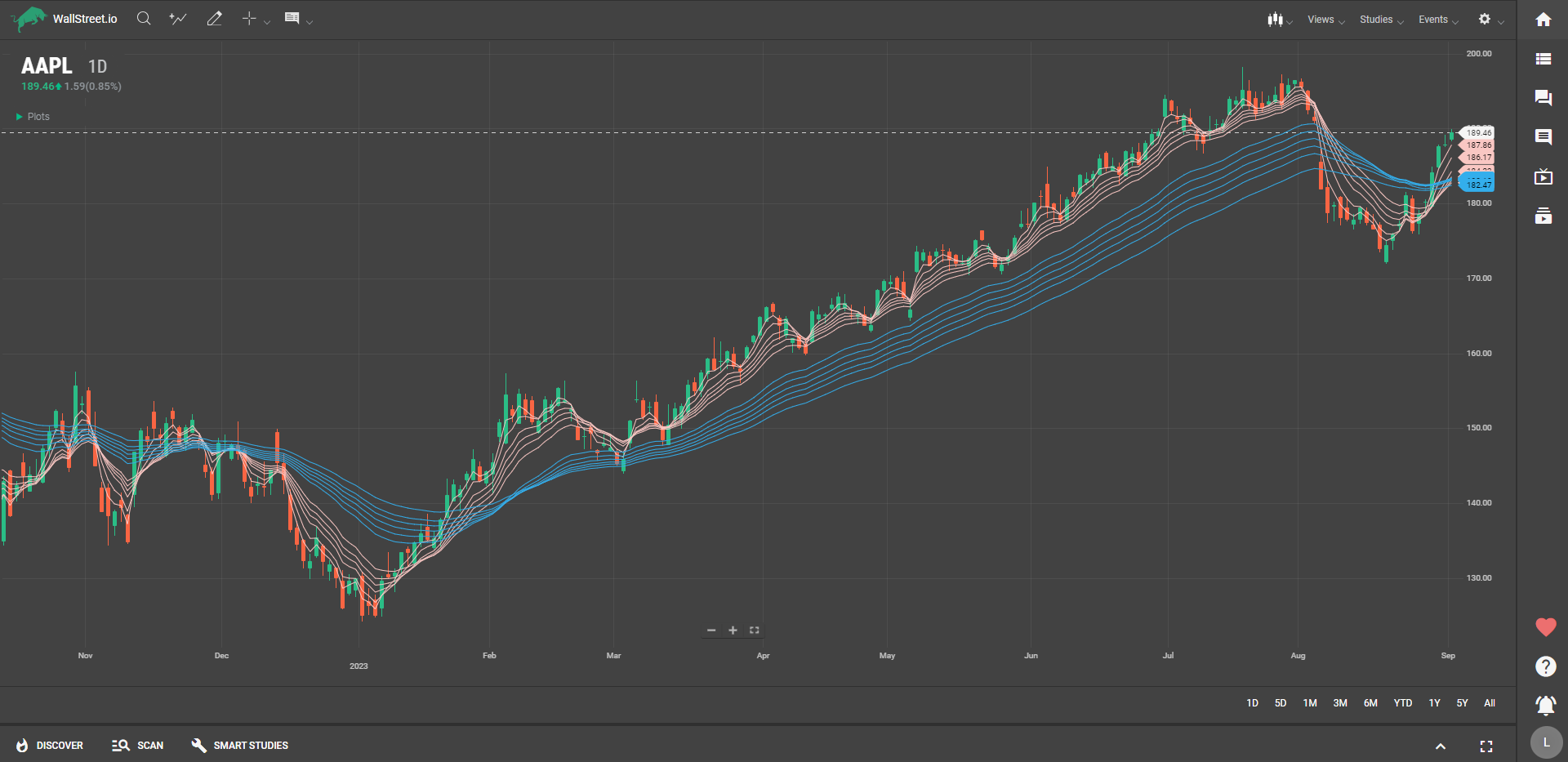

The Guppy Multiple Moving Average (GMMA) employs two sets of exponential moving averages (EMAs)—one with six short-term EMAs and another with six long-term EMAs. This configuration gives you a multi-faceted view of market trends and potential trading opportunities by offering more points of reference than a single moving average.

Suggested Trading Use

When using GMMA, pay attention to the interaction between the short-term and long-term EMAs. If the short-term EMAs cross above the long-term EMAs and both groups are trending upward, you're likely observing the beginning or continuation of a bullish trend. This may be a good time to consider going long on the asset.

Conversely, if the short-term EMAs cross below the long-term EMAs and both are trending downward, a bearish trend could be forming or continuing. In this scenario, you might think about shorting the asset or exiting long positions.

The space between the two sets of EMAs—often called the "Guppy zone"—can also be revealing. A widening gap indicates increasing trend strength, while a narrowing gap can signal a weakening trend or possible reversal.

Utilize GMMA as a tool to help gauge the strength and direction of trends, thereby aiding you in the selection of appropriate trading strategies for the current market environment.

Discover Tab Reference Guide

Discover Tab Reference Guide Discover Tab How-To Guide

Discover Tab How-To Guide Smart Studies How-To Guide

Smart Studies How-To Guide Smart Studies Reference Guide

Smart Studies Reference Guide Scan Tab Reference Guide

Scan Tab Reference Guide Scan Tab How-To Guide

Scan Tab How-To Guide Watchlists How-To guide

Watchlists How-To guide Watchlists Reference Guide

Watchlists Reference Guide Chatrooms Reference Guide

Chatrooms Reference Guide Community Wall How-To Guide

Community Wall How-To Guide Community Wall Reference Guide

Community Wall Reference Guide Streams Reference Guide

Streams Reference Guide Streams How-To Guide

Streams How-To Guide