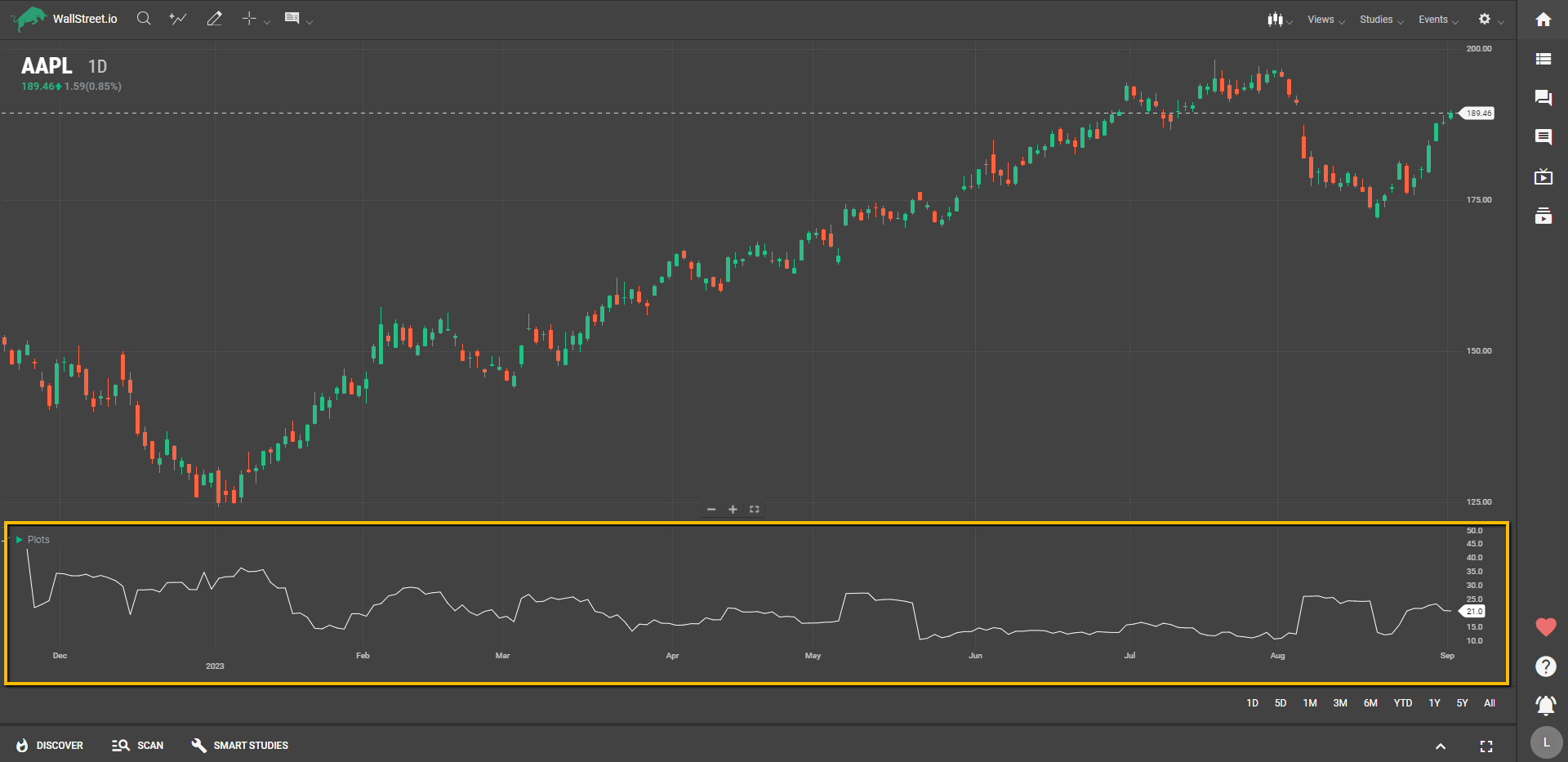

Historical Volatility

Definition

Historical Volatility calculates the market's past behavior by using the standard deviation of percentage returns over a designated number of periods. The outcome is then converted to an annual rate, giving you a longer-term view of the asset's price fluctuations.

Suggested Trading Use

Use Historical Volatility to get a sense of how wildly or calmly an asset has moved in the past. A higher value suggests more unpredictability, which may mean higher risk but also potentially higher reward. Conversely, a lower value suggests the asset has been more stable.

If you're considering entering or exiting a position, understanding the asset's past volatility can help you anticipate the size of price swings. This can be particularly useful for setting your stop-loss or take-profit levels, as well as for timing your trades. Keep in mind, however, that past volatility is not a guarantee of future behavior. Always be cautious and make sure this study aligns with your overall trading strategy.

Discover Tab Reference Guide

Discover Tab Reference Guide Discover Tab How-To Guide

Discover Tab How-To Guide Smart Studies How-To Guide

Smart Studies How-To Guide Smart Studies Reference Guide

Smart Studies Reference Guide Scan Tab Reference Guide

Scan Tab Reference Guide Scan Tab How-To Guide

Scan Tab How-To Guide Watchlists How-To guide

Watchlists How-To guide Watchlists Reference Guide

Watchlists Reference Guide Chatrooms Reference Guide

Chatrooms Reference Guide Community Wall How-To Guide

Community Wall How-To Guide Community Wall Reference Guide

Community Wall Reference Guide Streams Reference Guide

Streams Reference Guide Streams How-To Guide

Streams How-To Guide