Linear Reg R2

Definition

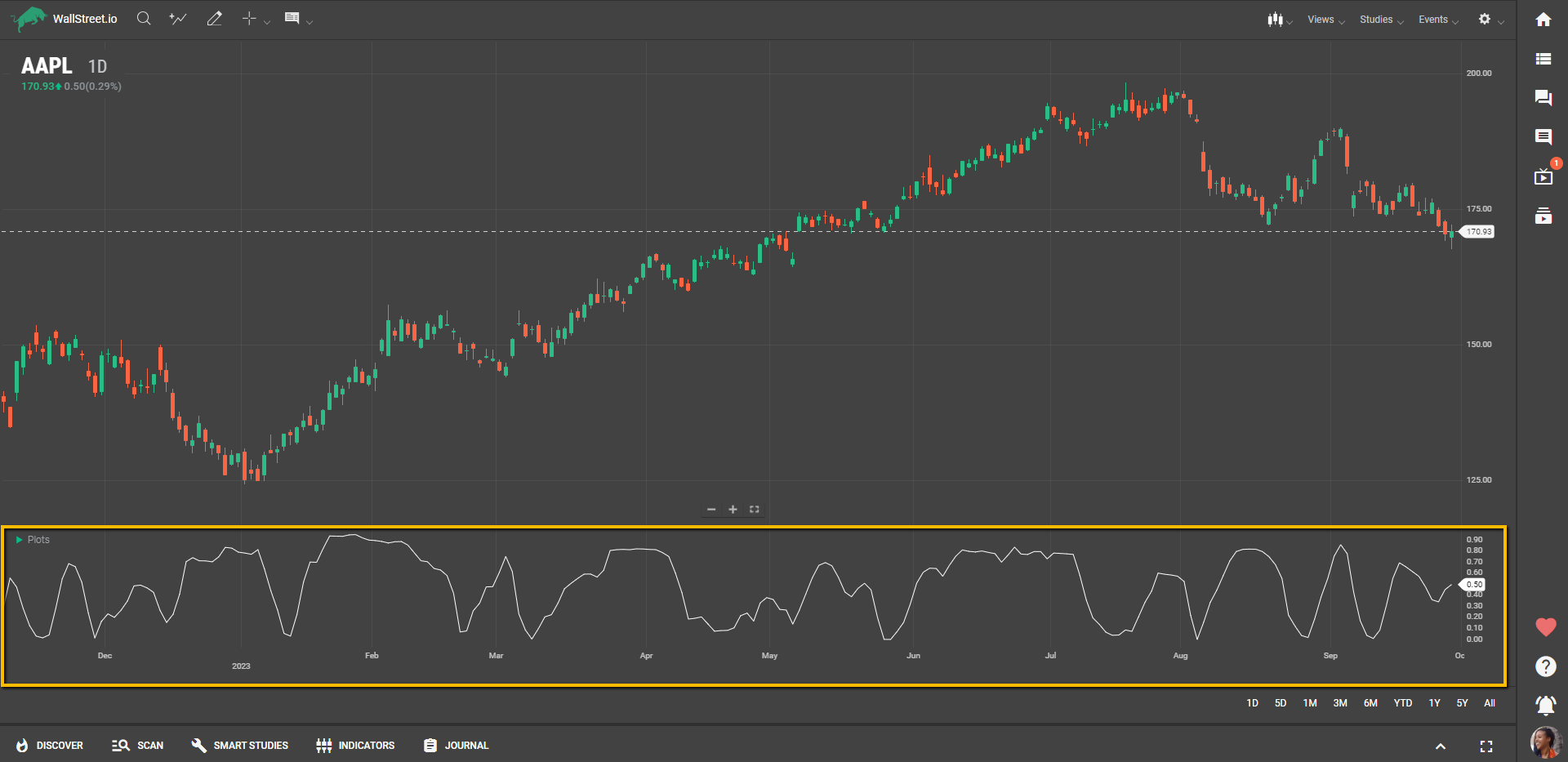

The Linear Regression R2 (LR-R2) is a specialized trading study that tells you how well the trendline fits the actual price data. It uses the same ordinary least squares method as other linear regression studies to create the trendline.

The "ordinary least squares method" is a statistical way to find the most accurate straight line that represents a trend by minimizing the distance from each data point to this line.

The LR-R2 generates an R-Squared value for each period, which acts as a gauge for the quality of the fit. In essence, it tells you how reliable the derived trendline is for forecasting future prices.

Suggested Trading Use

When you're trying to assess the reliability of a trend, turn your attention to the Linear Reg R2. The R-Squared value it provides is a good indicator of how accurately the trendline reflects the actual market data. Higher R2 values signify a better-quality fit, and thus, increased confidence in your use of trend-based strategies.

This study is also versatile; you can apply it to other studies by adjusting the Field parameter. If you're already using the Linear Regression Forecast (LR-Forecast) in your analysis, consider pairing it with the LR-R2. The R-Squared values can offer additional confidence in the forecasted trends, helping you to navigate the market with greater clarity.

Discover Tab Reference Guide

Discover Tab Reference Guide Discover Tab How-To Guide

Discover Tab How-To Guide Smart Studies How-To Guide

Smart Studies How-To Guide Smart Studies Reference Guide

Smart Studies Reference Guide Scan Tab Reference Guide

Scan Tab Reference Guide Scan Tab How-To Guide

Scan Tab How-To Guide Watchlists How-To guide

Watchlists How-To guide Watchlists Reference Guide

Watchlists Reference Guide Chatrooms Reference Guide

Chatrooms Reference Guide Community Wall How-To Guide

Community Wall How-To Guide Community Wall Reference Guide

Community Wall Reference Guide Streams Reference Guide

Streams Reference Guide Streams How-To Guide

Streams How-To Guide