Moving Average Deviation

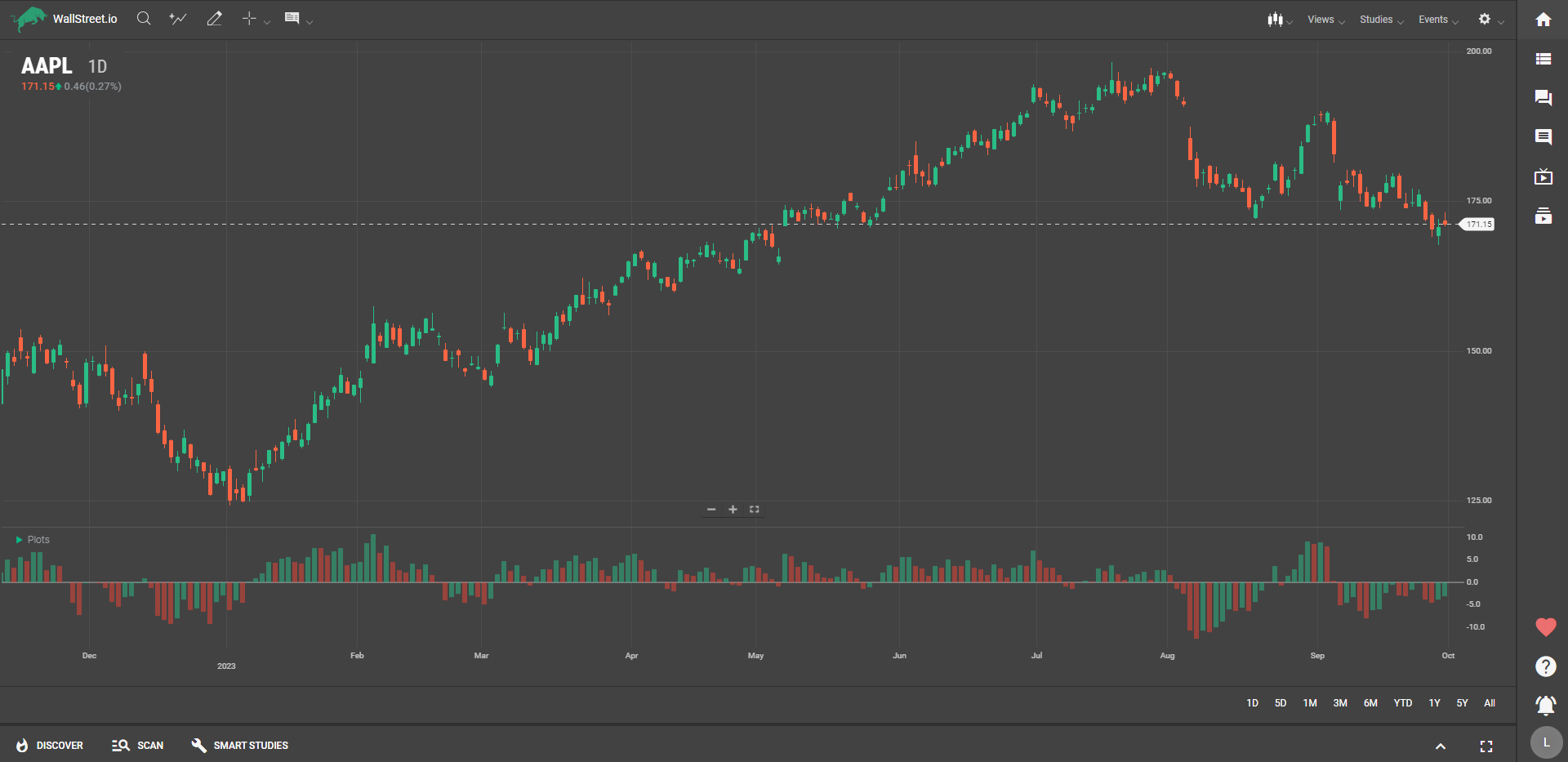

Definition

The Moving Average Deviation study calculates the gap between the current market price and a selected moving average. This gap is expressed either in points or percentages. The study essentially quantifies how far the price has strayed from its moving average.

Suggested Trading Use

Keep an eye on this indicator to gauge market sentiment. If the deviation is increasing, it suggests that the current price movement is becoming stronger compared to the average, which might indicate a potential continuation or reversal depending on the broader trend.

Conversely, a shrinking deviation could imply that the market is reverting to its mean, signaling less volatility or the possibility of a trend change. Use this study to better understand price behavior in relation to its average, aiding you in entry or exit strategy formulation.

Discover Tab Reference Guide

Discover Tab Reference Guide Discover Tab How-To Guide

Discover Tab How-To Guide Smart Studies How-To Guide

Smart Studies How-To Guide Smart Studies Reference Guide

Smart Studies Reference Guide Scan Tab Reference Guide

Scan Tab Reference Guide Scan Tab How-To Guide

Scan Tab How-To Guide Watchlists How-To guide

Watchlists How-To guide Watchlists Reference Guide

Watchlists Reference Guide Chatrooms Reference Guide

Chatrooms Reference Guide Community Wall How-To Guide

Community Wall How-To Guide Community Wall Reference Guide

Community Wall Reference Guide Streams Reference Guide

Streams Reference Guide Streams How-To Guide

Streams How-To Guide