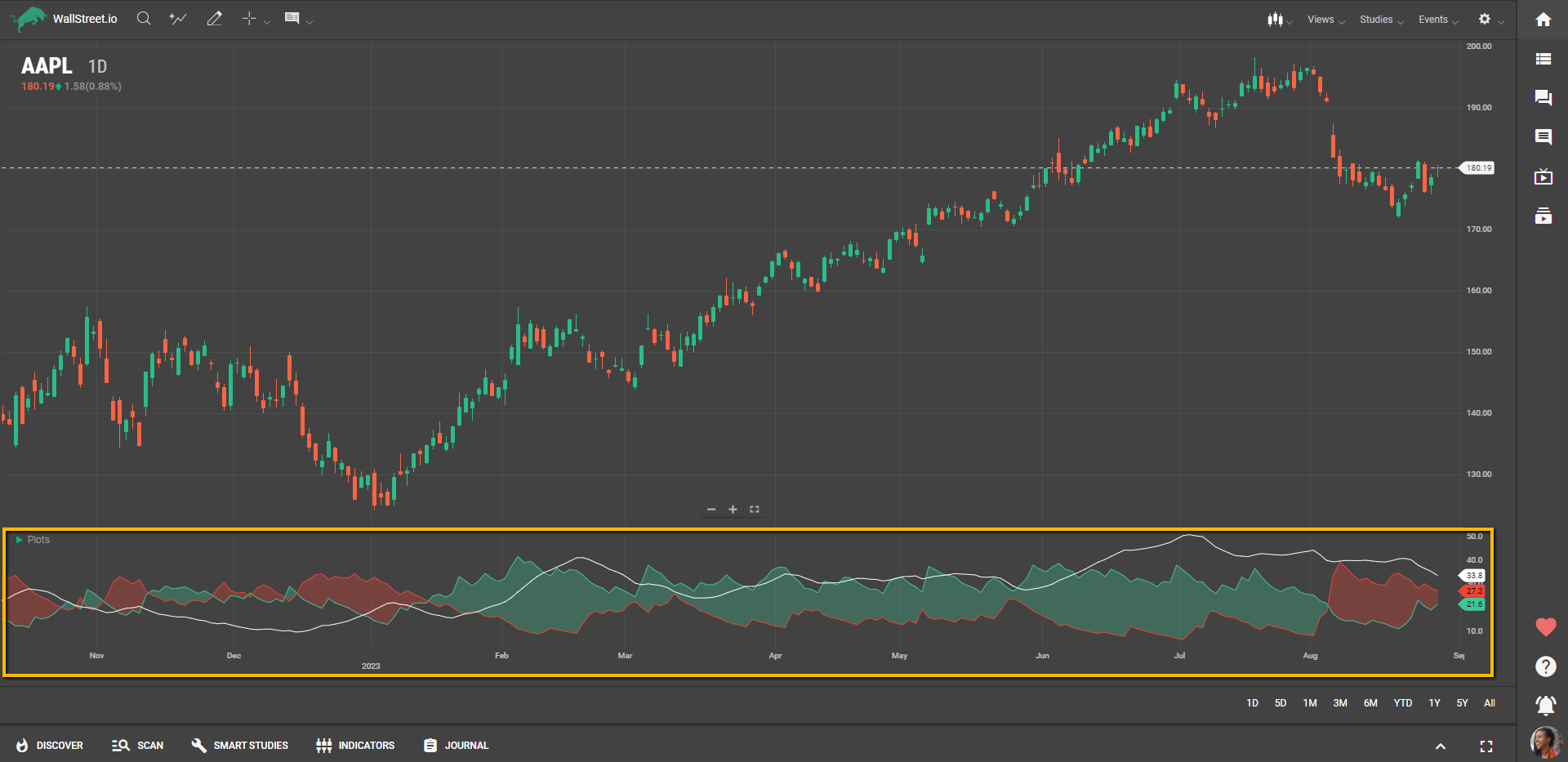

ADX as Smart Studies

The Average Directional Index (ADX) is used to quantify the strength and intensity of a market trend, regardless of its direction. Essentially, a higher ADX value indicates a strong trend, while a lower value suggests a weak or non-existent trend.

In short, it measures the extent to which a market is trending and provides insights into the potential for trend continuation or trend reversal.

Using the ADX

Click on the first dropdown menu under the "Buy When" or "Sell When" Signal sections, depending on if you want to create a Long (bullish) or Short (bearish) strategy.

From the dropdown list of studies, select "ADX." Upon making this selection, a smaller dropdown menu will appear, allowing you to set the "Period.”

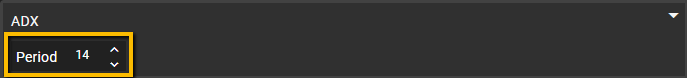

Customizing the ADX Period

The "Period" customization allows you to set the length of time the ADX considers for its calculation. By default, this value is set at 14, but the period can be adjusted based on your preference.

For example, if a period of 14 is chosen, the ADX will be calculated based on the past 14 periods of price data.

A shorter period, such as 10, may provide more sensitive and responsive ADX readings, capturing shorter-term trends. On the other hand, a longer period, like 20 or 30, may smooth out the ADX readings and provide a broader view of the overall trend.

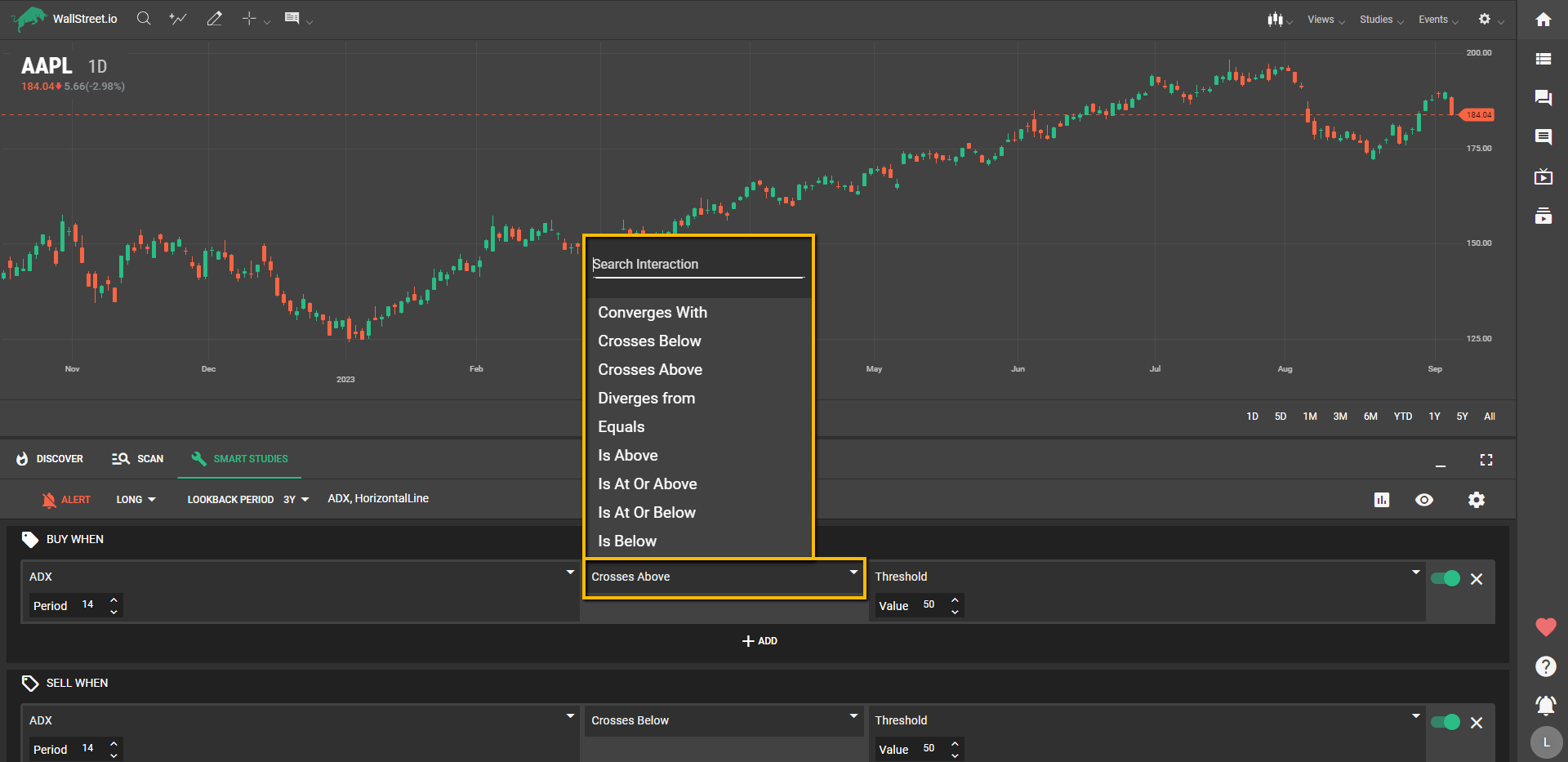

Setting Interactions

After setting your ADX period, the next step is to select an interaction from the second dropdown menu. Interactions like "Is above," "Crosses below," and so on will determine the exact condition that must be met for your Signal to trigger.

Once you've picked an interaction, it's time to choose a complementary study or a threshold value from the third dropdown menu. You can opt to pair the ADX with:

Using ADX with Another ADX

You could choose to combine the ADX with another instance of itself but with a different period setting. This allows you, for example, to compare short-term and long-term trend strengths, offering a multi-dimensional view of market conditions.

Using a Threshold Value

The "Threshold" option lets you specify a numeric value that the ADX must reach to trigger your Entry or Exit Signal. For example, if you set a threshold value of 40, your "Buy When" Signal could be triggered when the ADX crosses above 40, indicating a strong uptrend.

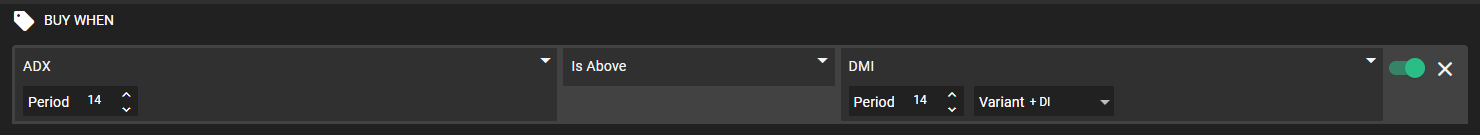

Combining ADX with DMI

When paired with DMI, the ADX can provide a more holistic view of market direction. For example, in a straightforward, single-signal strategy, you could use the ADX and DMI in the following way:

This is,

Buy When:

In this example, the Entry Signal triggers when the ADX value (with a period of 14) is above the +DI value of the DMI (also with a period of 14). This setup targets situations where the overall trend strength (ADX) is stronger than the current directional movement (+DI of DMI).

Here, you're not specifying a numerical threshold; rather, you're directly comparing two different studies. This can offer a dynamic way to enter trades based on the relationship between general trend strength and specific directional movement.

The ADX is an invaluable tool for identifying trend strength, so don't hesitate to get creative! You can also construct complex strategies by adding multiple Signals within the same group or by creating different groups of Signals.

Discover Tab Reference Guide

Discover Tab Reference Guide Discover Tab How-To Guide

Discover Tab How-To Guide Smart Studies How-To Guide

Smart Studies How-To Guide Smart Studies Reference Guide

Smart Studies Reference Guide Scan Tab Reference Guide

Scan Tab Reference Guide Scan Tab How-To Guide

Scan Tab How-To Guide Watchlists How-To guide

Watchlists How-To guide Watchlists Reference Guide

Watchlists Reference Guide Chatrooms Reference Guide

Chatrooms Reference Guide Community Wall How-To Guide

Community Wall How-To Guide Community Wall Reference Guide

Community Wall Reference Guide Streams Reference Guide

Streams Reference Guide Streams How-To Guide

Streams How-To Guide