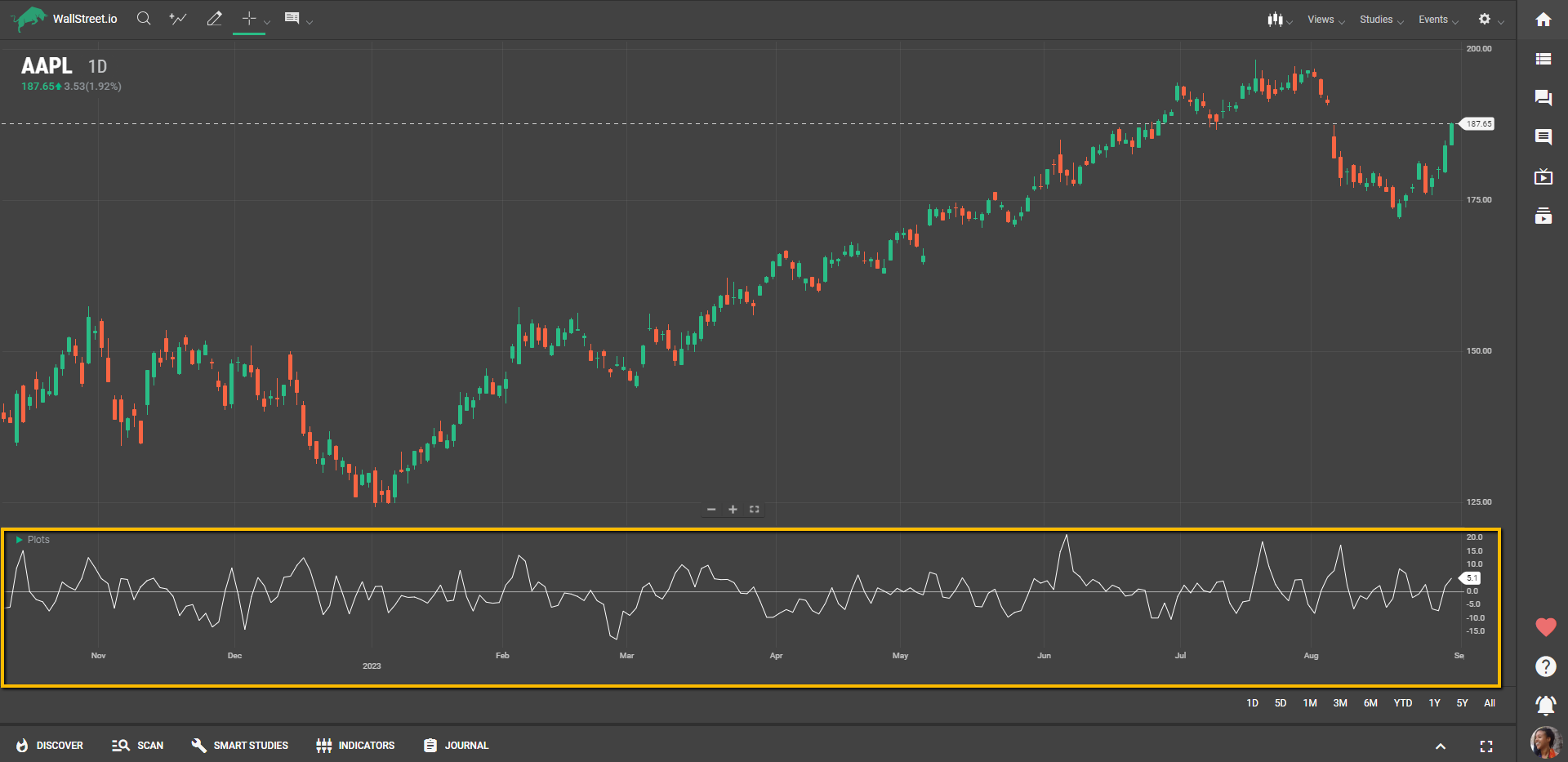

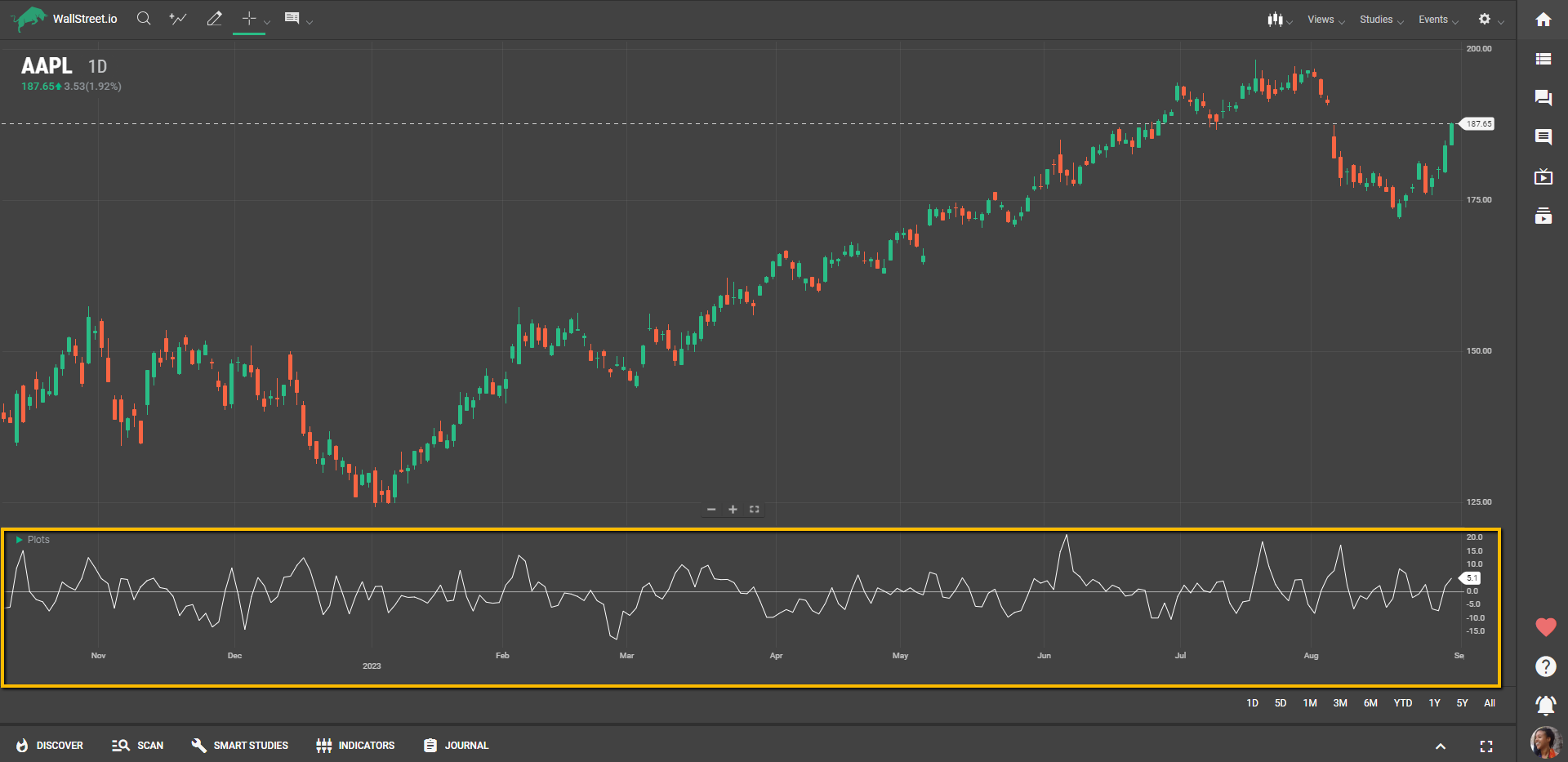

Definition

The Chande Forecast Oscillator (CFO) is a technical indicator that quantifies the difference between an asset's current market price and its Time Series Moving Average (TSMA). The TSMA is calculated through linear regression and follows the asset's price closely, making the CFO highly responsive to changes in trend. The oscillator is above zero when the asset's price is higher than the TSMA and below zero when it's lower.

Suggested Trading Use

The Chande Forecast Oscillator can serve as a useful tool in several trading contexts:

Identifying Trend Strength: When the oscillator is above zero, it generally suggests that the asset is in an uptrend, providing a possible entry point for long positions. Conversely, when the oscillator is below zero, it may indicate a downtrend, suggesting opportunities for short positions.Signal Confirmation: The CFO can be used to confirm other trading signals. For example, if another indicator suggests a bullish sentiment and the CFO is above zero, this could be seen as a stronger buy signal.Trend Reversal Alerts: A crossover from positive to negative or vice versa can indicate a possible trend reversal. This can provide traders with the timely information needed to adjust their strategies.Risk Management: When the oscillator is persistently staying near zero, it may indicate a lack of a clear trend. Traders may choose to be more cautious in such conditions by reducing position sizes or avoiding entries.

Discover Tab Reference Guide

Discover Tab Reference Guide Discover Tab How-To Guide

Discover Tab How-To Guide Smart Studies How-To Guide

Smart Studies How-To Guide Smart Studies Reference Guide

Smart Studies Reference Guide Scan Tab Reference Guide

Scan Tab Reference Guide Scan Tab How-To Guide

Scan Tab How-To Guide Watchlists How-To guide

Watchlists How-To guide Watchlists Reference Guide

Watchlists Reference Guide Chatrooms Reference Guide

Chatrooms Reference Guide Community Wall How-To Guide

Community Wall How-To Guide Community Wall Reference Guide

Community Wall Reference Guide Streams Reference Guide

Streams Reference Guide Streams How-To Guide

Streams How-To Guide