Ichimoku Clouds, also known as Ichimoku Kinko Hyo, is a powerful technical indicator that provides a comprehensive view of price action, support and resistance levels, and potential trend reversals.

1: Add the Ichimoku Clouds Indicator to Your Chart

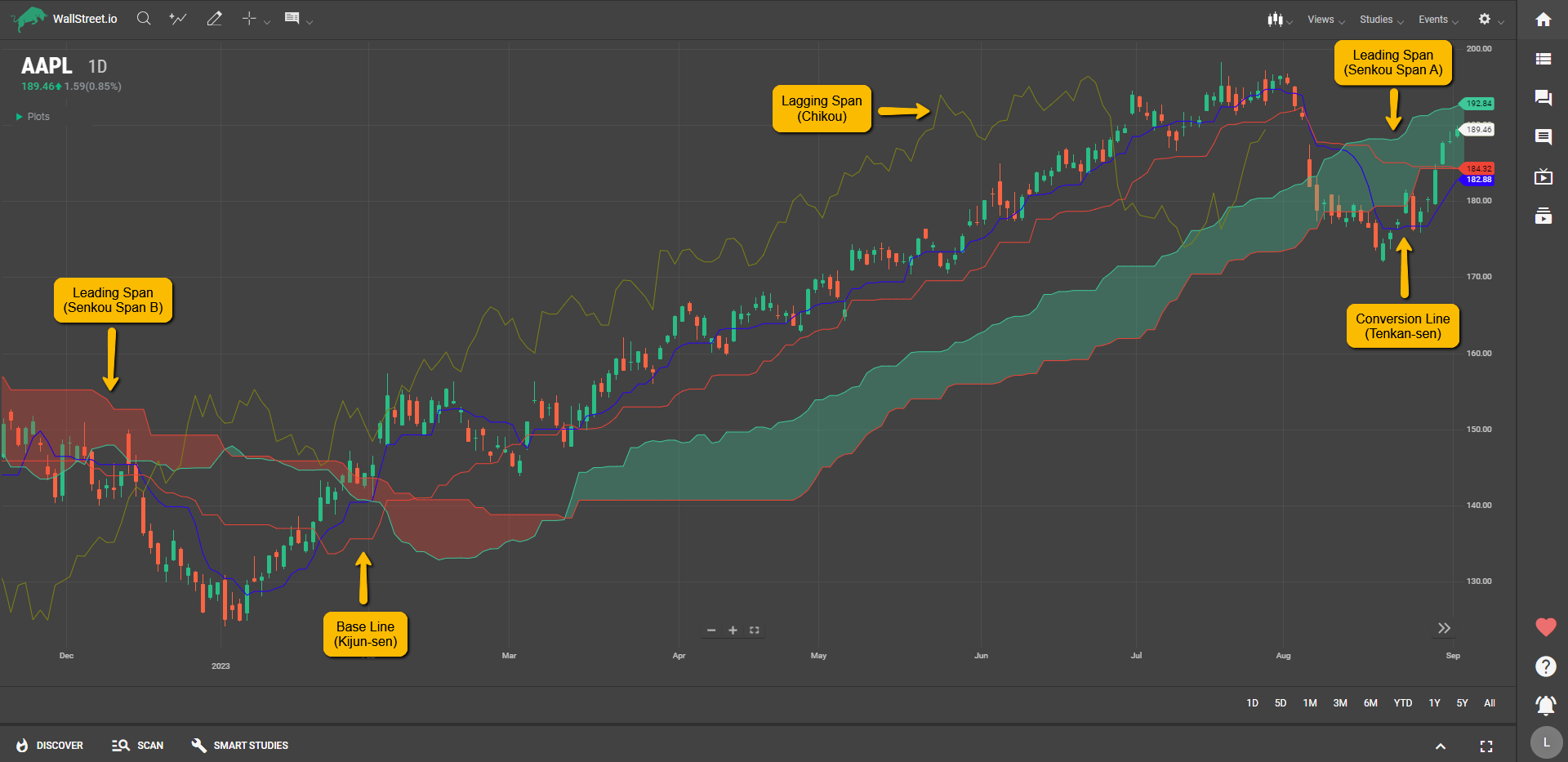

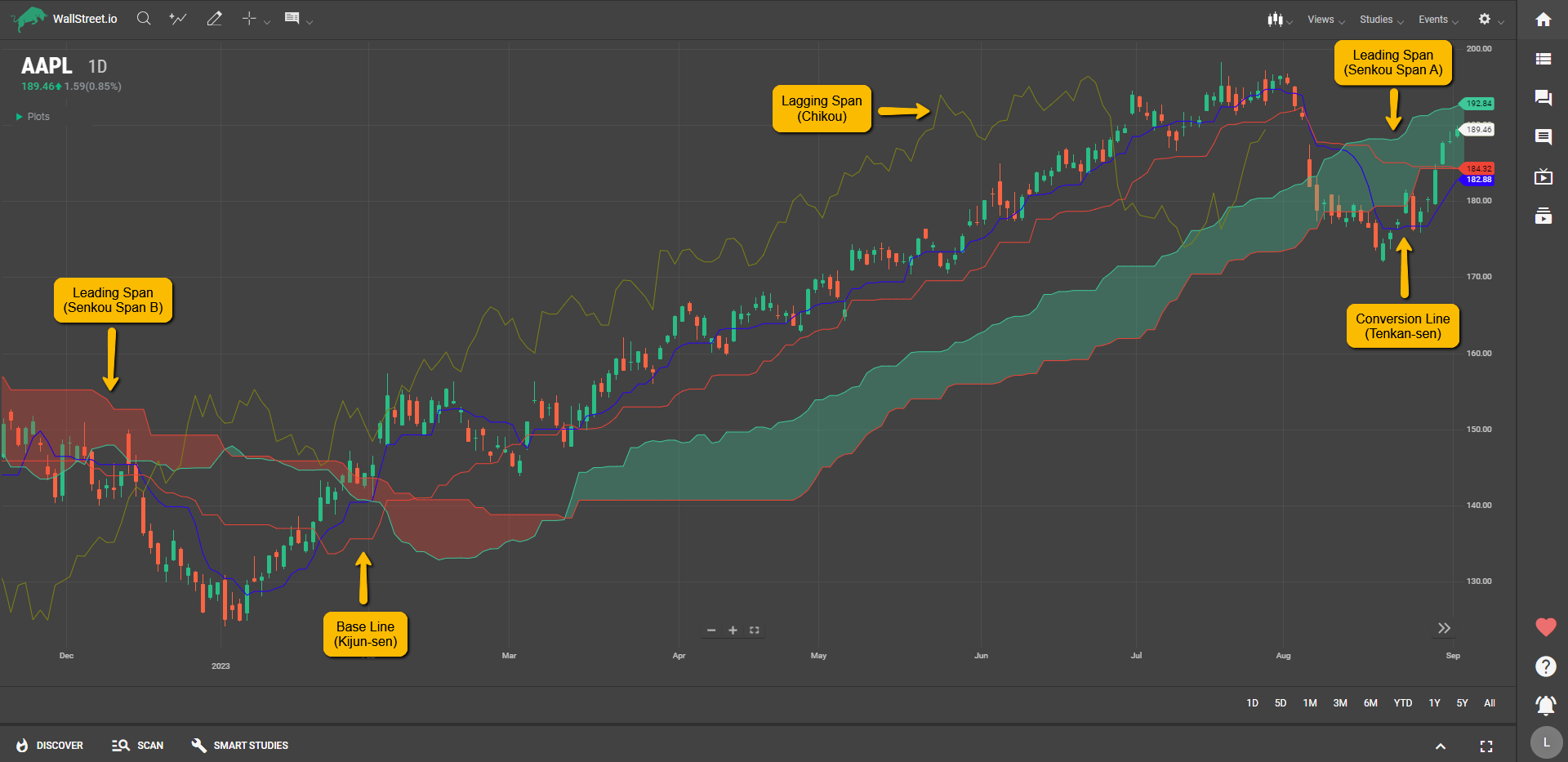

Select the Ichimoku Clouds from the list of our available Studies. The Ichimoku Clouds consist of five lines: Tenkan-sen (Conversion Line), Kijun-sen (Base Line), Senkou Span A (Leading Span A), Senkou Span B (Leading Span B), and Chikou Span (Lagging Span). These lines work together to form the cloud.

2: Understand the Components of Ichimoku Clouds

The Tenkan-sen is a short-term moving average that measures the average of the highest high and lowest low over a specific period (usually 9 periods).The Kijun-sen is a longer-term moving average that measures the average of the highest high and lowest low over a specific period (usually 26 periods).The Senkou Span A is the average of the Tenkan-sen and Kijun-sen plotted 26 periods ahead.The Senkou Span B is the average of the highest high and lowest low over a specific period (usually 52 periods) plotted 26 periods ahead.The Chikou Span is the current closing price plotted 26 periods back.3: Interpret the Ichimoku Clouds

The area between Senkou Span A and Senkou Span B forms the cloud, which is often colored differently to represent bullish or bearish sentiment.When the price is above the cloud, it indicates a bullish trend, suggesting potential support levels within the cloud.When the price is below the cloud, it indicates a bearish trend, suggesting potential resistance levels within the cloud.The Tenkan-sen and Kijun-sen lines act as dynamic support and resistance levels.The Chikou Span can be used to confirm trend direction and identify potential trading signals when it crosses the price or other lines within the cloud.4: Use Ichimoku Clouds for Trading Signals

Look for price breakouts or bounces from the cloud as potential entry or exit points.Monitor the interactions between the Tenkan-sen and Kijun-sen lines for crossovers, which can indicate potential trend reversals.Consider the positioning of the Chikou Span relative to the cloud and price for confirmation of trend strength or weakness.Tips and Best Uses:

Ichimoku Clouds are most effective in trending markets, as they provide valuable support and resistance levels.

Discover Tab Reference Guide

Discover Tab Reference Guide Discover Tab How-To Guide

Discover Tab How-To Guide Smart Studies How-To Guide

Smart Studies How-To Guide Smart Studies Reference Guide

Smart Studies Reference Guide Scan Tab Reference Guide

Scan Tab Reference Guide Scan Tab How-To Guide

Scan Tab How-To Guide Watchlists How-To guide

Watchlists How-To guide Watchlists Reference Guide

Watchlists Reference Guide Chatrooms Reference Guide

Chatrooms Reference Guide Community Wall How-To Guide

Community Wall How-To Guide Community Wall Reference Guide

Community Wall Reference Guide Streams Reference Guide

Streams Reference Guide Streams How-To Guide

Streams How-To Guide