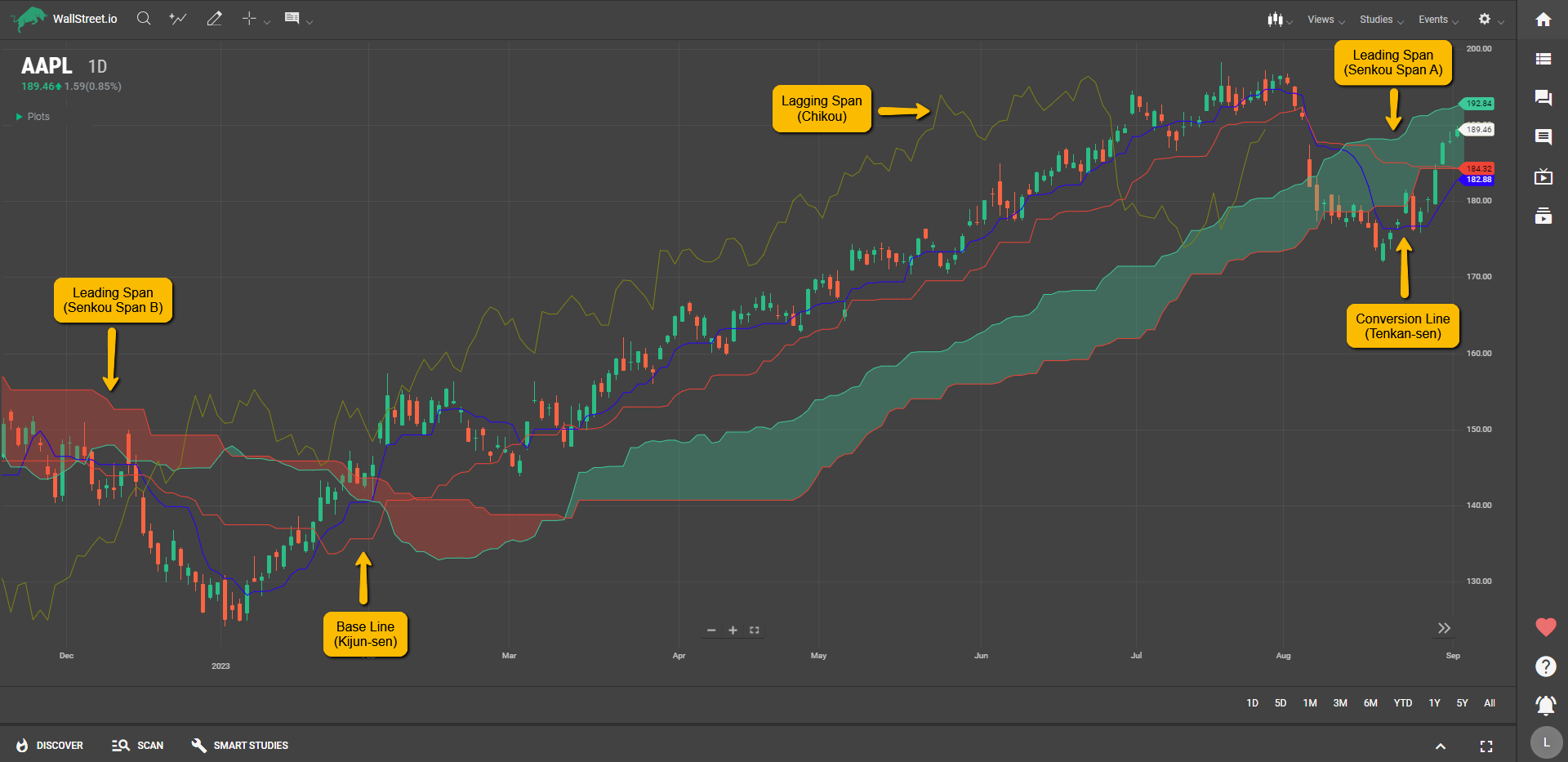

Ichimoku Cloud

Definition

The Ichimoku Cloud is a comprehensive study that gives you a "one-look" snapshot of an asset's support/resistance levels, momentum, and trend direction. It consists of five lines: Tenkan Sen, Kijun Sen, Senkou Span A, Senkou Span B, and Chikou.

These lines create various "clouds" that help you quickly identify key areas in the market.

Suggested Trading Use

When the price is above the cloud, that's a bullish signal, suggesting it might be a good time to consider a long position. Conversely, if the price is below the cloud, the market is bearish, and you might consider shorting the asset. The Tenkan Sen and Kijun Sen lines also serve as dynamic support and resistance levels: crossing above is generally bullish, while crossing below is bearish.

The cloud itself can act as a region of support or resistance. If you're in a trade, pay attention to how the price interacts with the cloud. A strong trend will often be confirmed by the price staying consistently on one side of the cloud.

Remember, the Ichimoku Cloud offers a lot at a single glance, but it's always wise to corroborate its readings with other aspects of your trading strategy.

Discover Tab Reference Guide

Discover Tab Reference Guide Discover Tab How-To Guide

Discover Tab How-To Guide Smart Studies How-To Guide

Smart Studies How-To Guide Smart Studies Reference Guide

Smart Studies Reference Guide Scan Tab Reference Guide

Scan Tab Reference Guide Scan Tab How-To Guide

Scan Tab How-To Guide Watchlists How-To guide

Watchlists How-To guide Watchlists Reference Guide

Watchlists Reference Guide Chatrooms Reference Guide

Chatrooms Reference Guide Community Wall How-To Guide

Community Wall How-To Guide Community Wall Reference Guide

Community Wall Reference Guide Streams Reference Guide

Streams Reference Guide Streams How-To Guide

Streams How-To Guide