Fundamentals Tab Complete Guide

What this helps you do

This guide shows you how to read every panel inside the Fundamentals tab so you can quickly understand a stock’s profitability, earnings pattern, and basic company stats in one place.

This matters because when you know what each chart and metric is telling you, it becomes easier to decide whether a symbol deserves more of your attention in Strategy Builder or on your watchlists.

Layout overview

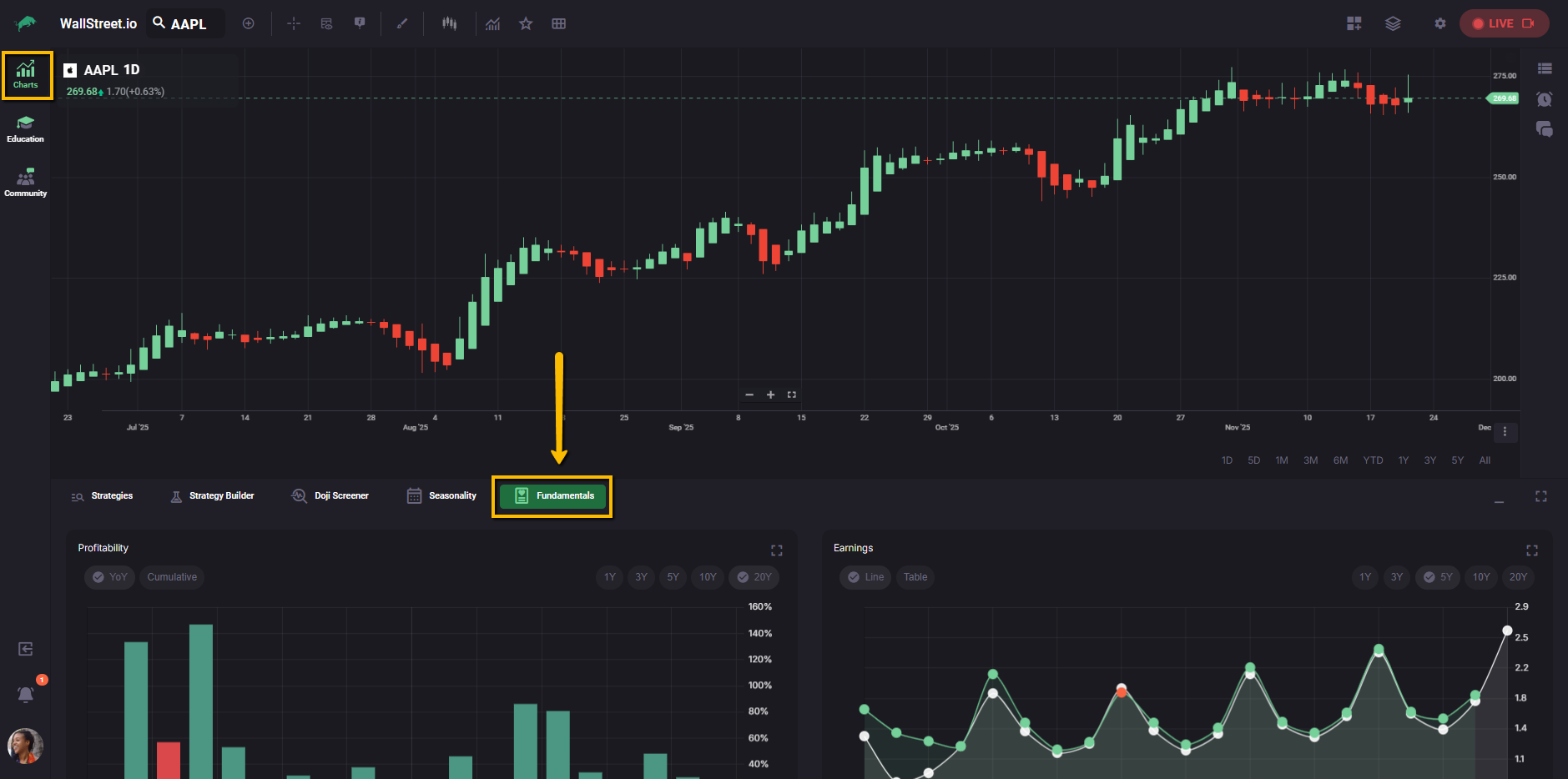

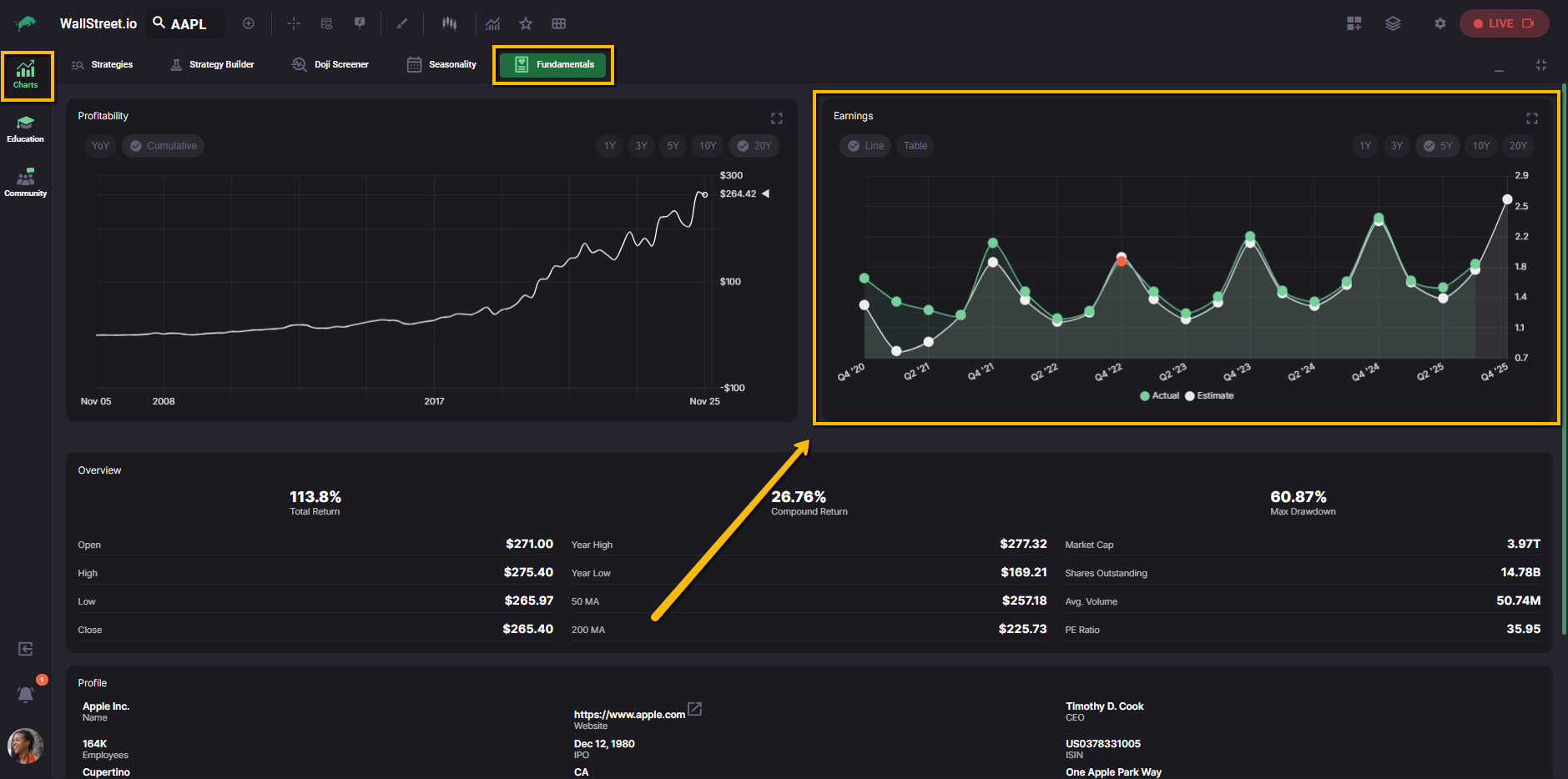

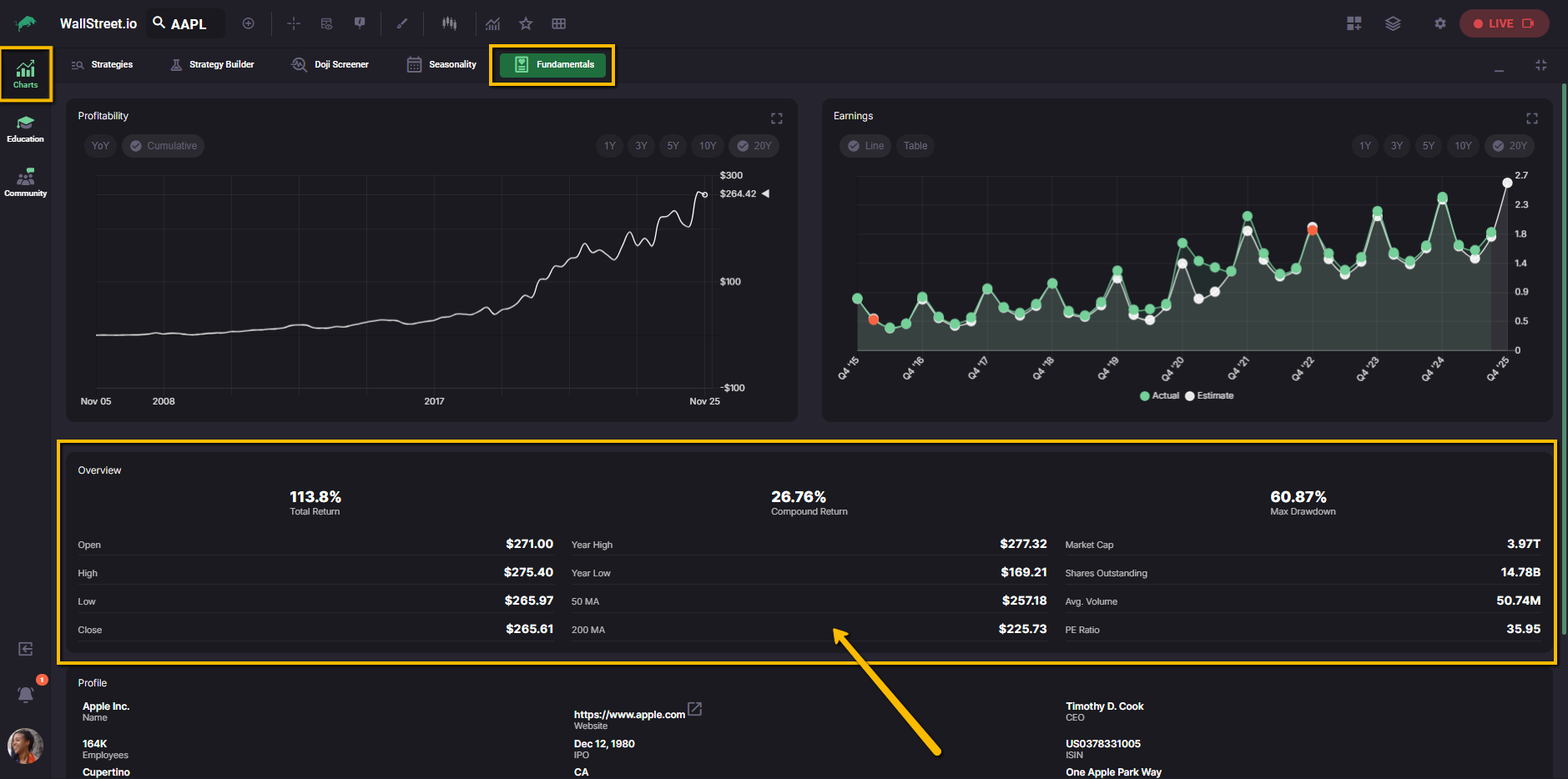

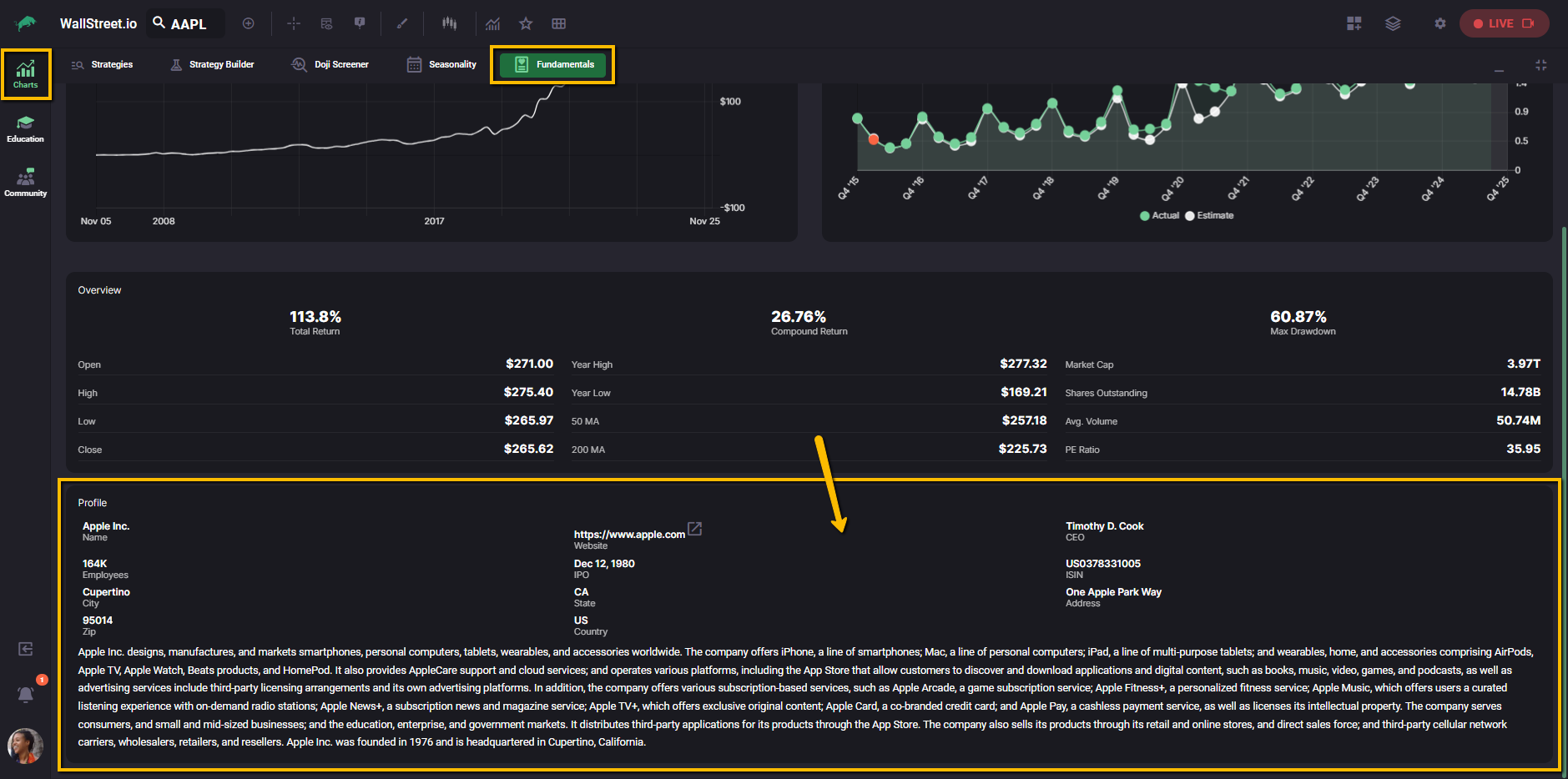

How the Fundamentals tab opens

When you click the Fundamentals tab, it first opens in a compact view so you can still see your candlestick chart above it. This lets you compare the chart and the fundamentals side-by-side without losing context.

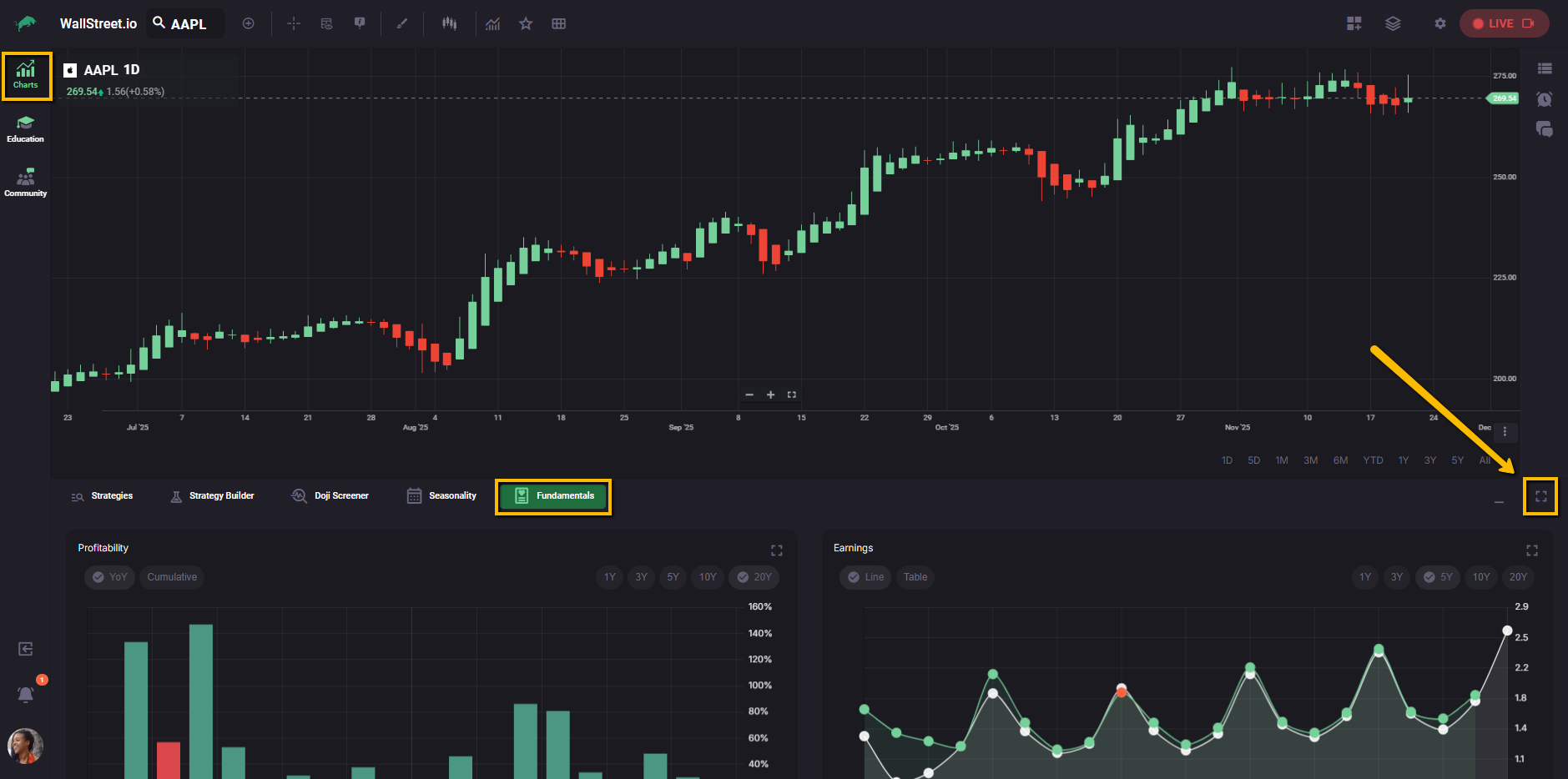

If you want a full workspace dedicated only to fundamentals, you can click the Maximize icon in the top-right corner of the tab.

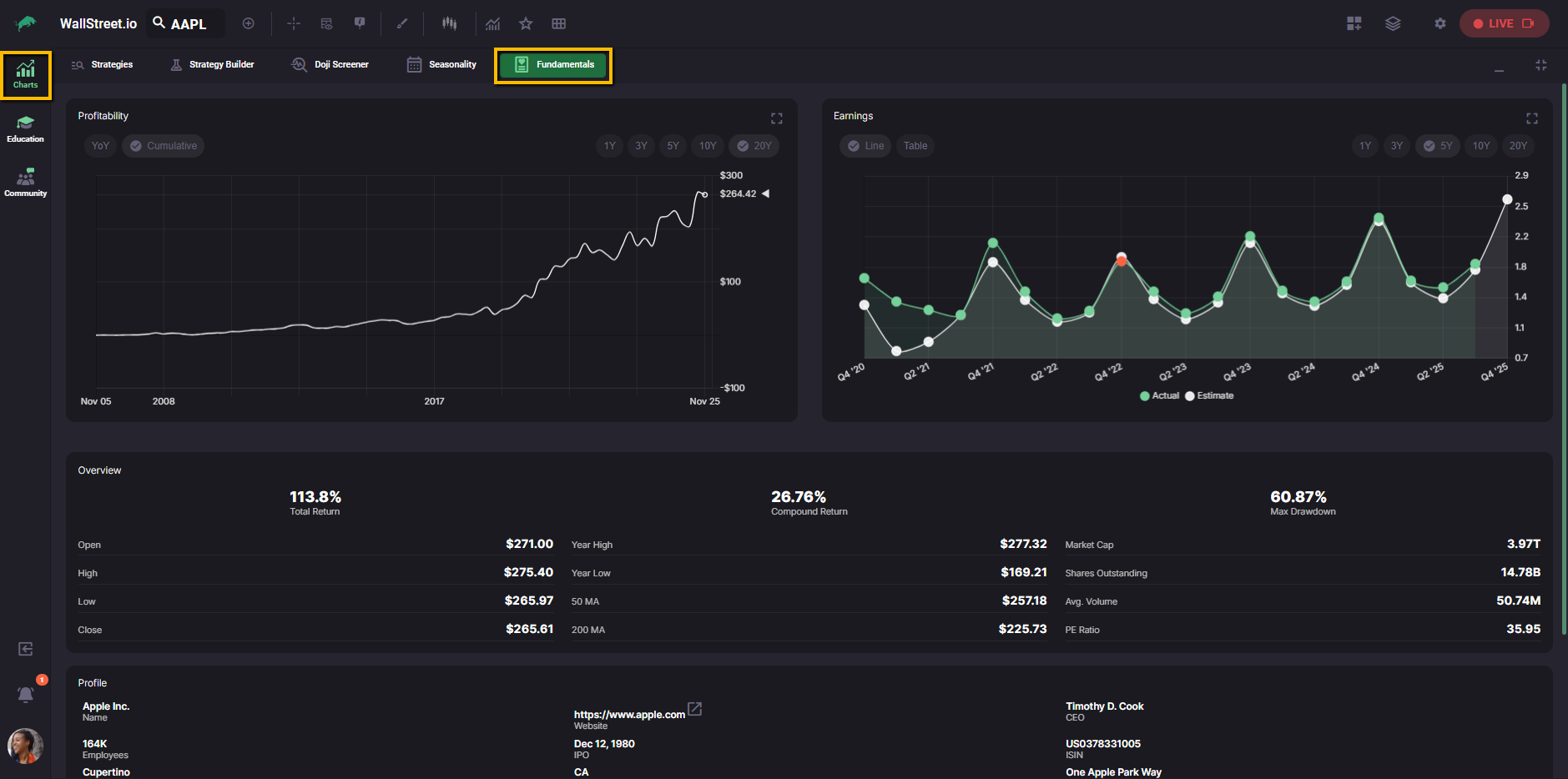

The panel will expand to fill the entire workspace, and you’ll see all four main sections at once: Profitability, Earnings, Overview, and Profile:

Each of the top charts has:

To help you zoom in on specific data, the Profitability and Earnings panels also have their own Maximize icons in the top-right corner of each chart. Clicking one of those expands only that panel so you can review the full history without scrolling.

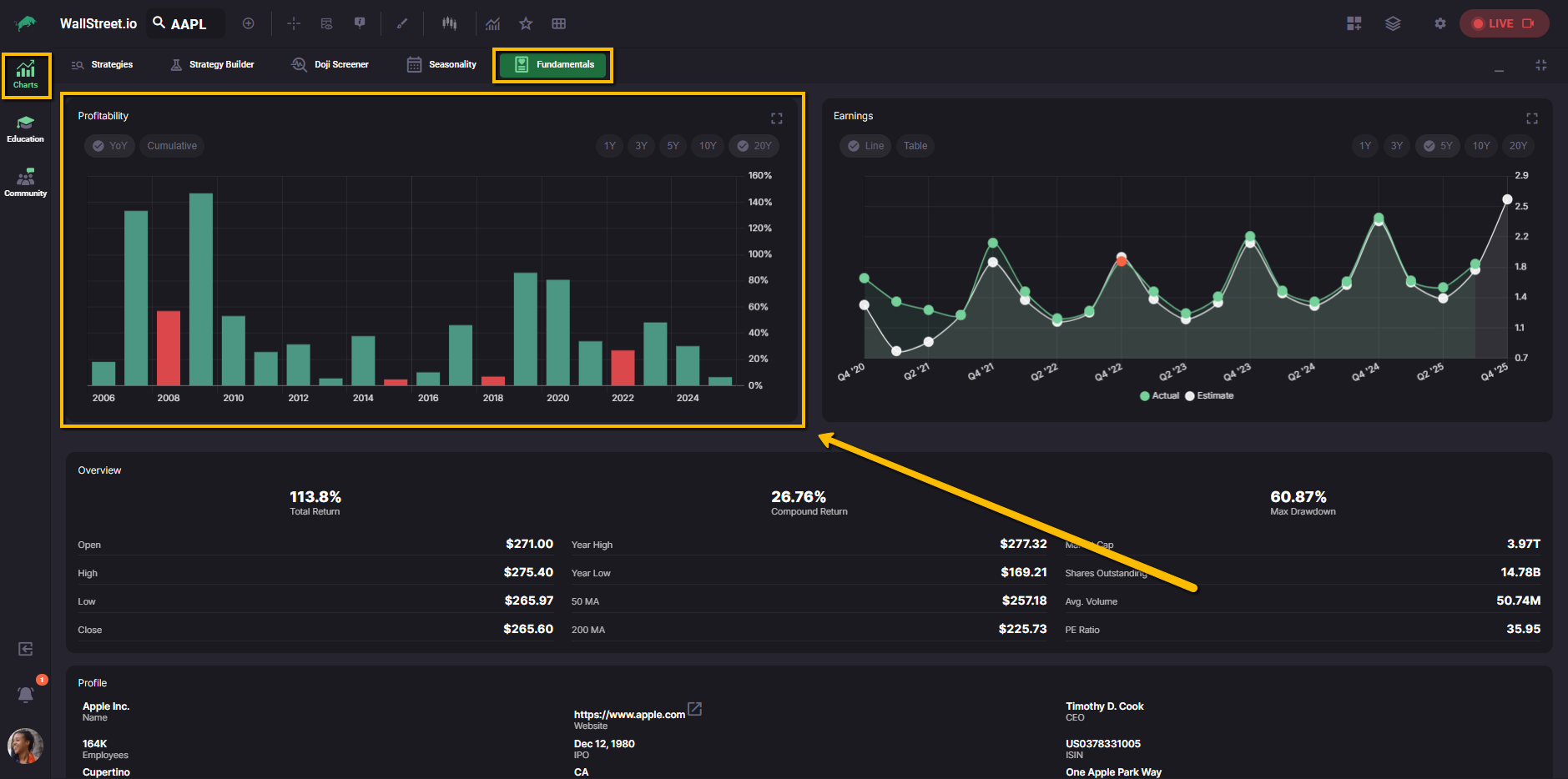

Profitability panel

The Profitability panel visualizes how the symbol has performed over different time ranges.

It has two display modes: YoY and Cumulative, each giving you a different way to understand long-term return behavior.

YoY mode

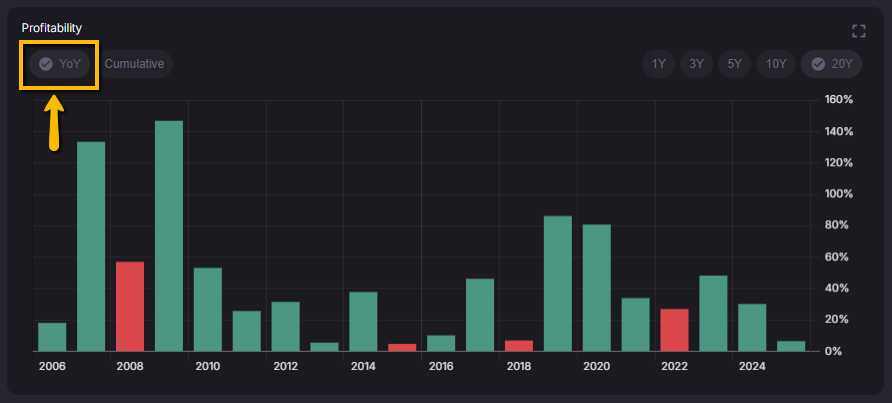

YoY shows a traditional year-over-year return bar chart.

Each bar represents the return for that specific calendar year inside your selected lookback window. Bars are color coded so you can see at a glance which years or periods were positive and which were negative.

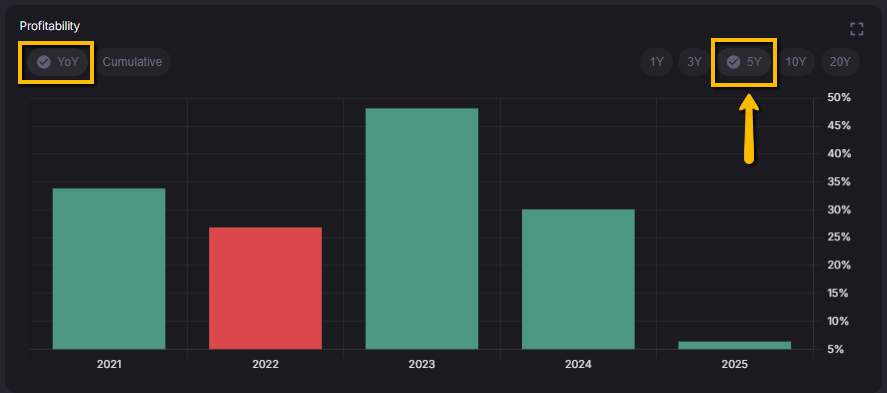

When you shorten the lookback (for example choosing 1Y), you’ll naturally see fewer bars, so each one becomes wider. Increasing the window (3Y, 5Y, 10Y, 20Y) increases the number of bars on the chart and they appear thinner.

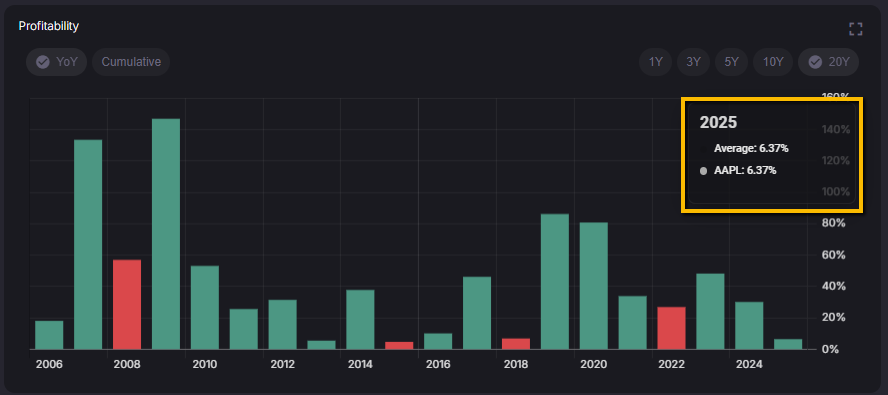

When you hover over a bar, you see a tooltip with the return for that specific year expressed as a percentage. These percentages are displayed as-is, based on historical price changes for the symbol.

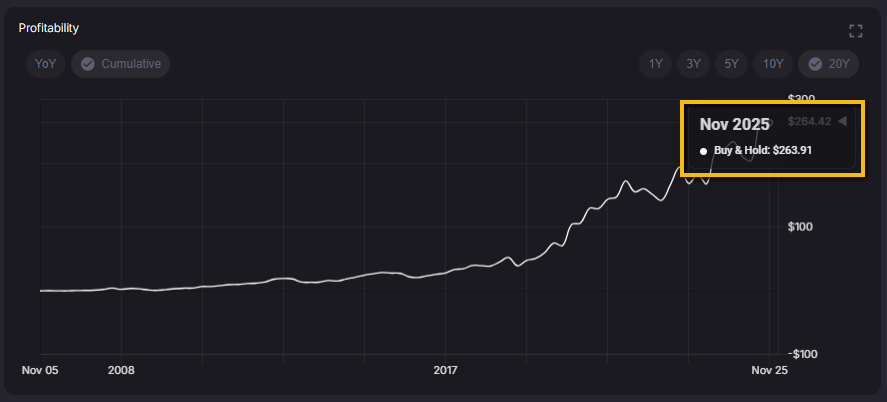

Cumulative mode

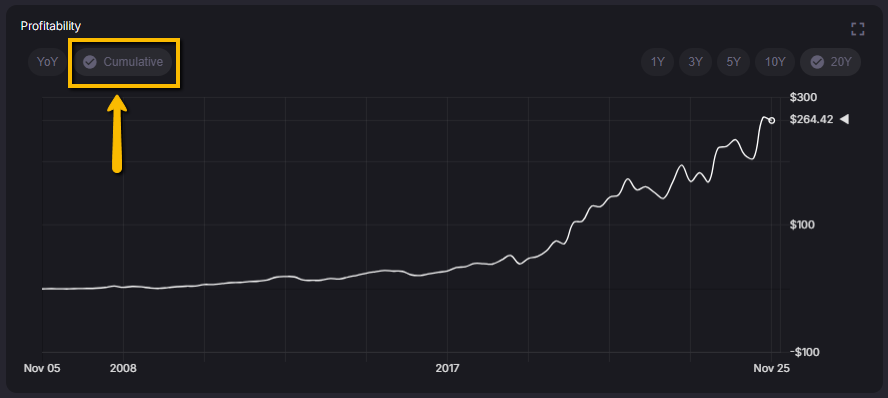

When you switch to Cumulative, the chart changes from bars to a line chart.

This line shows the Buy & Hold cumulative dollar return for the selected period, starting from zero. In other words, the line tracks how a hypothetical long-only position would have grown over that entire lookback range.

Because it starts at zero, you can compare different lookback periods without mental math.

Time range buttons

On the right side, you can switch between 1Y, 3Y, 5Y, 10Y, and 20Y. This changes the horizontal range shown in both YoY and Cumulative modes and updates the chart width, number of periods, and all underlying values.

Shorter ranges help you focus on recent performance, while longer ranges show how the symbol behaved across different market cycles.

Hover tooltip

When you move your cursor over a bar, you see a floating tooltip that shows the return for that period in dollar terms.

You can use this to:

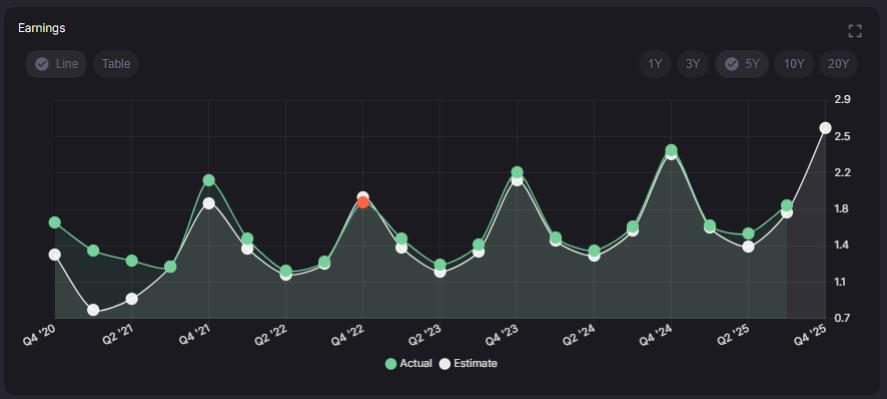

Earnings panel

What you see

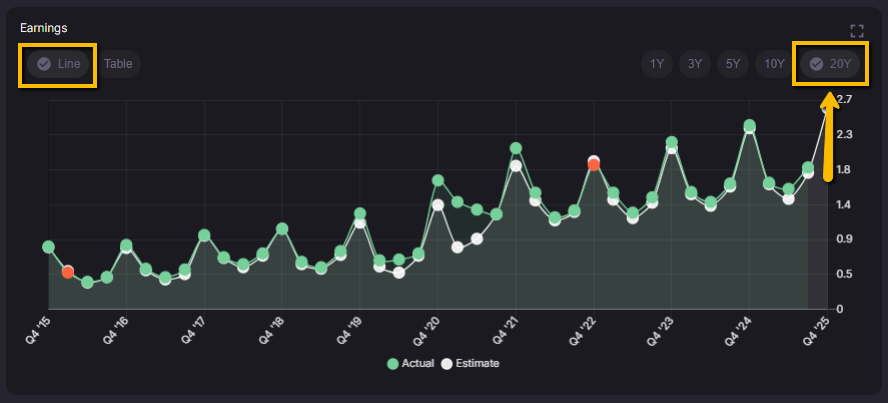

The Earnings panel shows the company’s earnings per share (EPS) over time, broken down by reporting period.

Along the bottom you see quarters (for example Q4 ’20, Q2 ’21, etc.), and along the right side you see EPS values.

There is a legend under the chart with separate markers for Actual and Estimate, so you can see how reported earnings compared to analyst expectations.

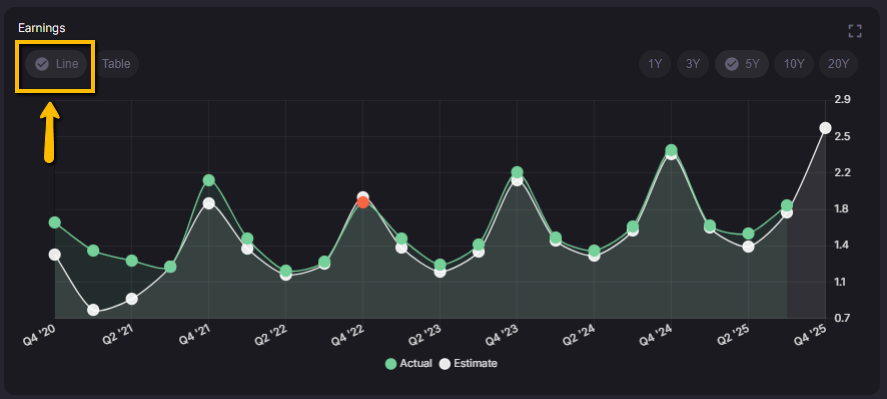

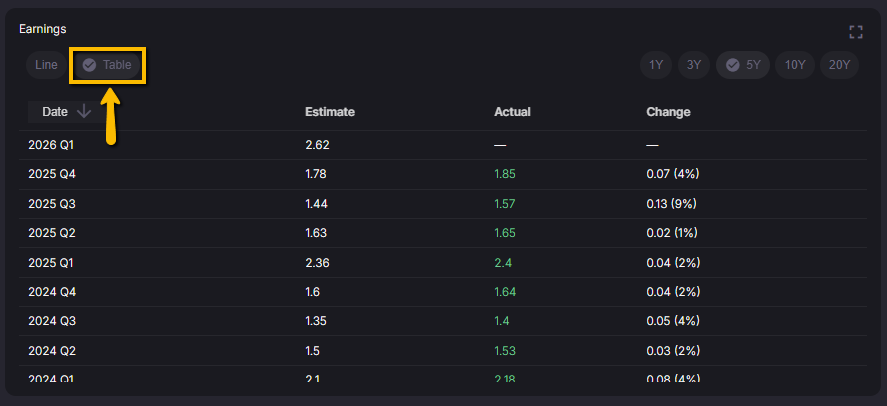

Line vs Table

On the top left of this panel you can switch between two views:

Time range buttons

Just like the Profitability chart, the right side of the toolbar lets you pick 1Y, 3Y, 5Y, 10Y, or 20Y of earnings history. Longer lookbacks show how consistent earnings have been across cycles, while shorter ones help you focus on the recent story.

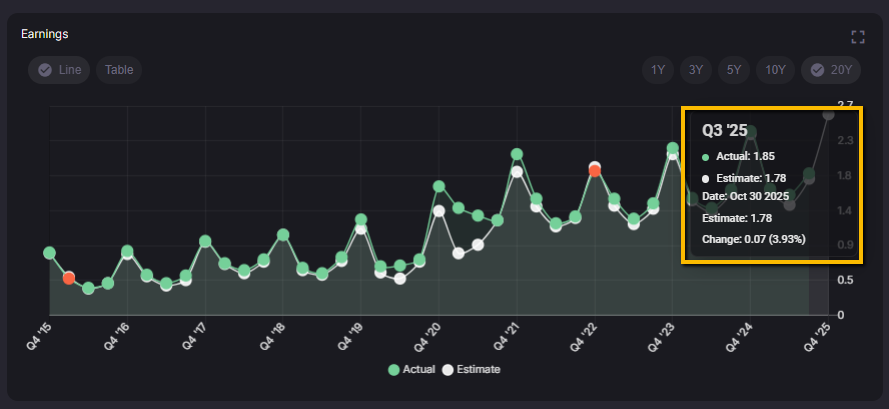

Hover tooltip

In Line view, when you hover over a point, you see a tooltip with:

This helps you quickly see earnings “surprises” without digging into external reports.

Overview panel

The Overview section summarizes performance, price levels, moving averages, and basic size/liquidity metrics for the same time range you selected above.

Performance metrics

At the top of the panel you see three headline numbers:

Price and trend levels

The left half of the table shows price and trend references:

Comparing current price to these moving averages helps you see whether the stock is trading above or below its recent trend.

Size and liquidity metrics

The right half of the table gives you quick context on the company’s size and trading activity:

These numbers help you avoid thinly traded symbols, compare valuation across peers, and understand whether a stock is a small, mid, or large cap within your watchlist.

Profile panel

The Profile section holds the identity and background of the company behind the ticker.

On the left, you see basic company details:

In the center, you have:

On the right, you see:

Below those fields is a company description that describes the main products, services, and segments the business operates in.

This section helps you quickly answer questions like “What does this company actually do?”, “Where is it based?”, and “How big is it in terms of headcount?” without leaving the platform.

Putting it together

When you scan a symbol in the Fundamentals tab, you can:

Once you are comfortable with the story here, you can move back into your strategy tools to backtest and track setups with more confidence.

Discover Tab Reference Guide

Discover Tab Reference Guide Discover Tab How-To Guide

Discover Tab How-To Guide Smart Studies How-To Guide

Smart Studies How-To Guide Smart Studies Reference Guide

Smart Studies Reference Guide Scan Tab Reference Guide

Scan Tab Reference Guide Scan Tab How-To Guide

Scan Tab How-To Guide Watchlists How-To guide

Watchlists How-To guide Watchlists Reference Guide

Watchlists Reference Guide Chatrooms Reference Guide

Chatrooms Reference Guide Community Wall How-To Guide

Community Wall How-To Guide Community Wall Reference Guide

Community Wall Reference Guide Streams Reference Guide

Streams Reference Guide Streams How-To Guide

Streams How-To Guide