Donchian Width

Definition

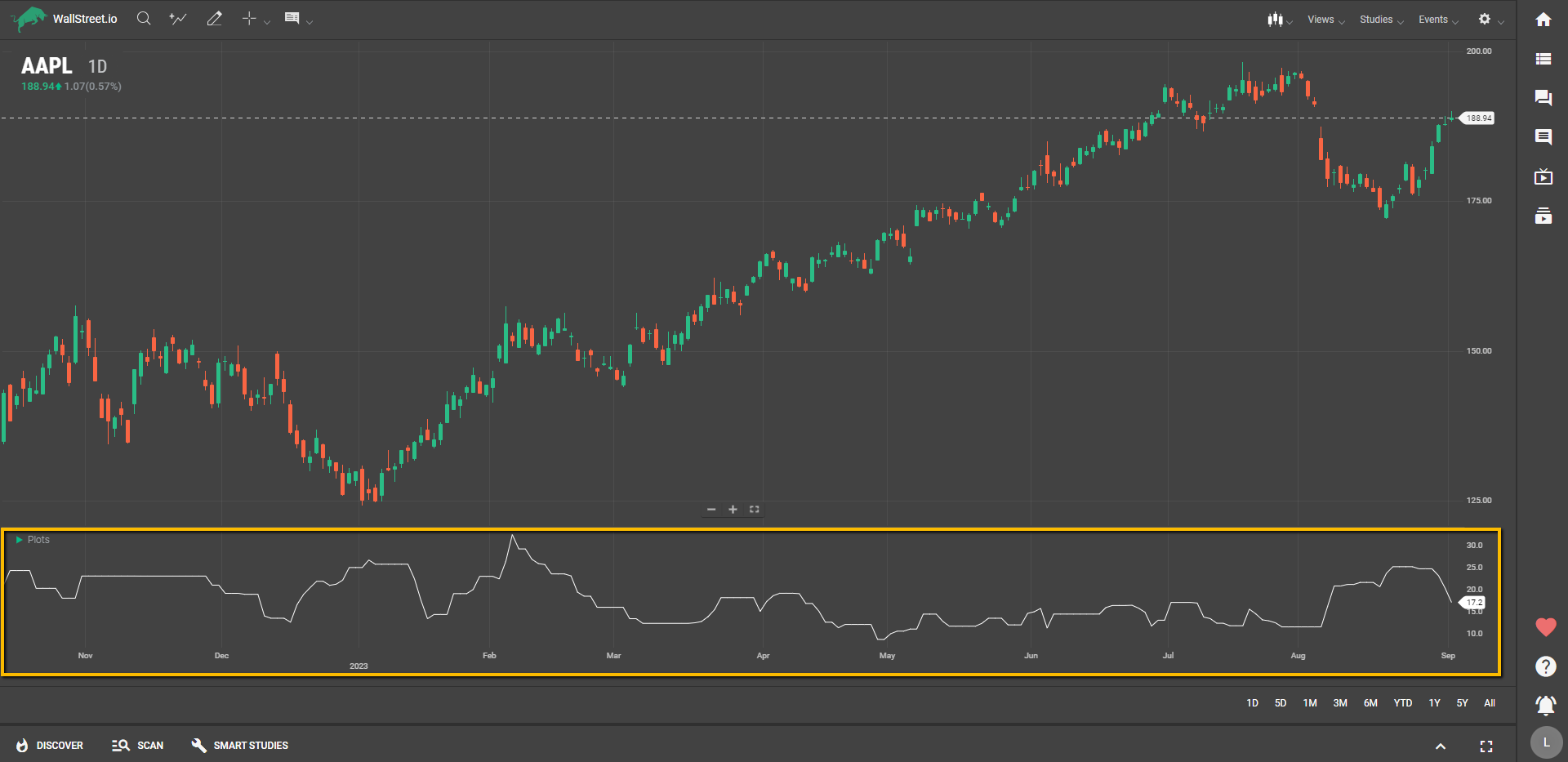

Donchian Width is a trading indicator that helps you gauge the market's volatility by measuring the distance between the Donchian High and Donchian Low bands. In simpler terms, it shows you how stretched or compressed the market range is at any given time.

Suggested Trading Use

If you notice the Donchian Width expanding, that's a sign the market is becoming more volatile. This could mean opportunity is knocking, but tread carefully. It might be a good time to tighten up those stop-loss orders to safeguard against sharp price reversals.

On the flip side, when you see the Donchian Width narrowing, the market is becoming less volatile. This can indicate a calmer market, but keep your eyes peeled. Low volatility often precedes a breakout in either direction, so be ready to act when the market starts showing its hand.

To get a fuller picture of market conditions, consider using Donchian Width in combination with related studies like Donchian Bands, Highest High Value, and Lowest Low Value. This multi-indicator approach helps you trade more confidently by providing different angles of insight into the market.

Discover Tab Reference Guide

Discover Tab Reference Guide Discover Tab How-To Guide

Discover Tab How-To Guide Smart Studies How-To Guide

Smart Studies How-To Guide Smart Studies Reference Guide

Smart Studies Reference Guide Scan Tab Reference Guide

Scan Tab Reference Guide Scan Tab How-To Guide

Scan Tab How-To Guide Watchlists How-To guide

Watchlists How-To guide Watchlists Reference Guide

Watchlists Reference Guide Chatrooms Reference Guide

Chatrooms Reference Guide Community Wall How-To Guide

Community Wall How-To Guide Community Wall Reference Guide

Community Wall Reference Guide Streams Reference Guide

Streams Reference Guide Streams How-To Guide

Streams How-To Guide