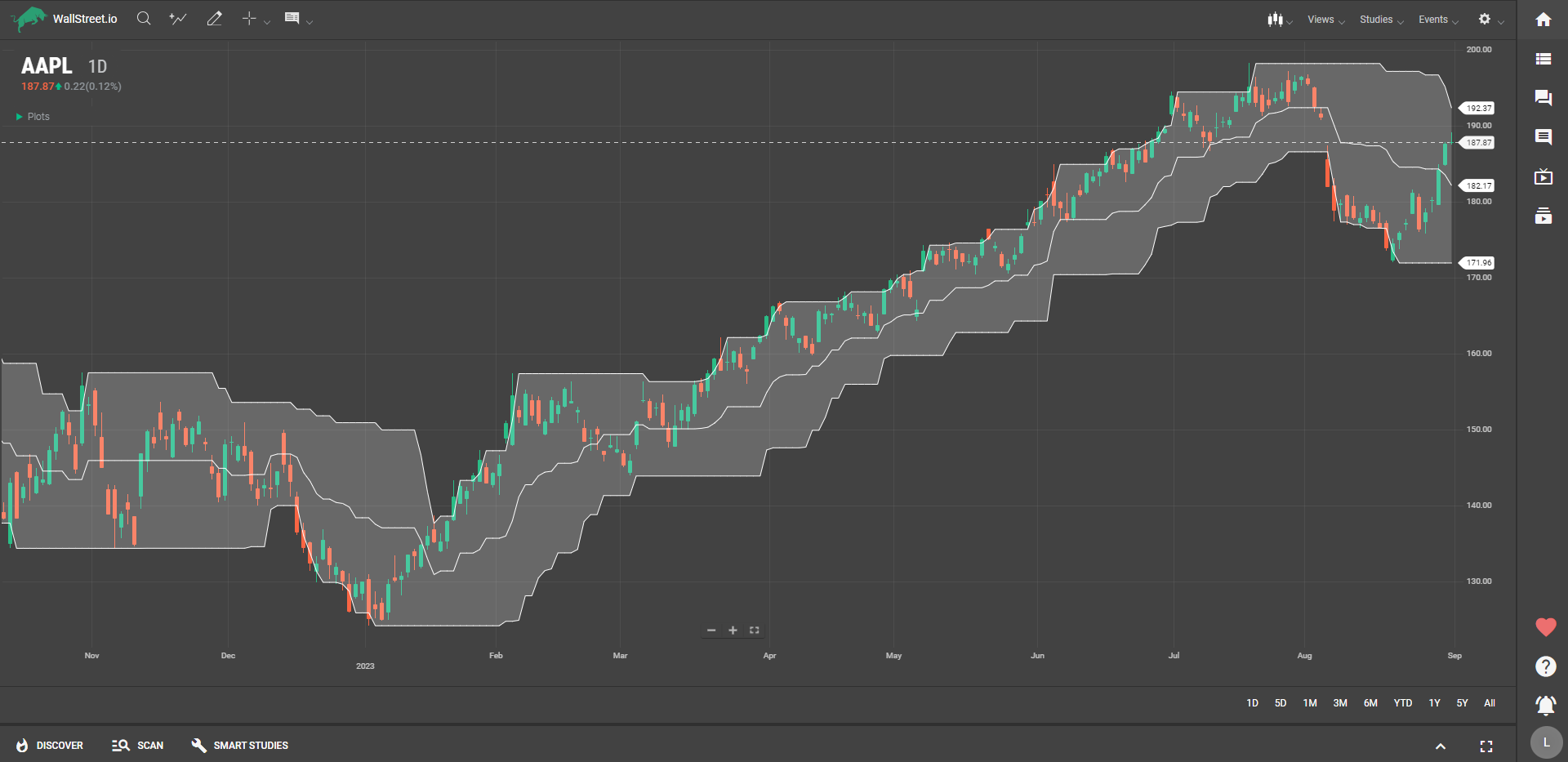

Donchian Channel

Definition

The Donchian Channel is a technical indicator often used to identify potential breakouts or breakdowns in price. It consists of three lines: the upper band, the lower band, and the median line. The upper band represents the highest high over a set number of periods, starting with the previous bar. The lower band is the lowest low over the same number of periods. The median line is the average of the upper and lower bands for each period.

Suggested Trading Use

The Donchian Channel is particularly useful for identifying potential breakout or breakdown points. When the price of an asset touches or moves above the Donchian High, it could indicate bullish momentum, possibly signaling a good entry point for a long position. Conversely, if the price touches or crosses below the Donchian Low, this could be a bearish signal, suggesting that it might be a good time to consider a short position.

The Median Line serves as a balancing point; prices hovering close to this line could indicate a range-bound or less volatile market. Traders often use this line as a reference for setting stop-loss or take-profit orders.

Discover Tab Reference Guide

Discover Tab Reference Guide Discover Tab How-To Guide

Discover Tab How-To Guide Smart Studies How-To Guide

Smart Studies How-To Guide Smart Studies Reference Guide

Smart Studies Reference Guide Scan Tab Reference Guide

Scan Tab Reference Guide Scan Tab How-To Guide

Scan Tab How-To Guide Watchlists How-To guide

Watchlists How-To guide Watchlists Reference Guide

Watchlists Reference Guide Chatrooms Reference Guide

Chatrooms Reference Guide Community Wall How-To Guide

Community Wall How-To Guide Community Wall Reference Guide

Community Wall Reference Guide Streams Reference Guide

Streams Reference Guide Streams How-To Guide

Streams How-To Guide