Keltner Channel

Definition

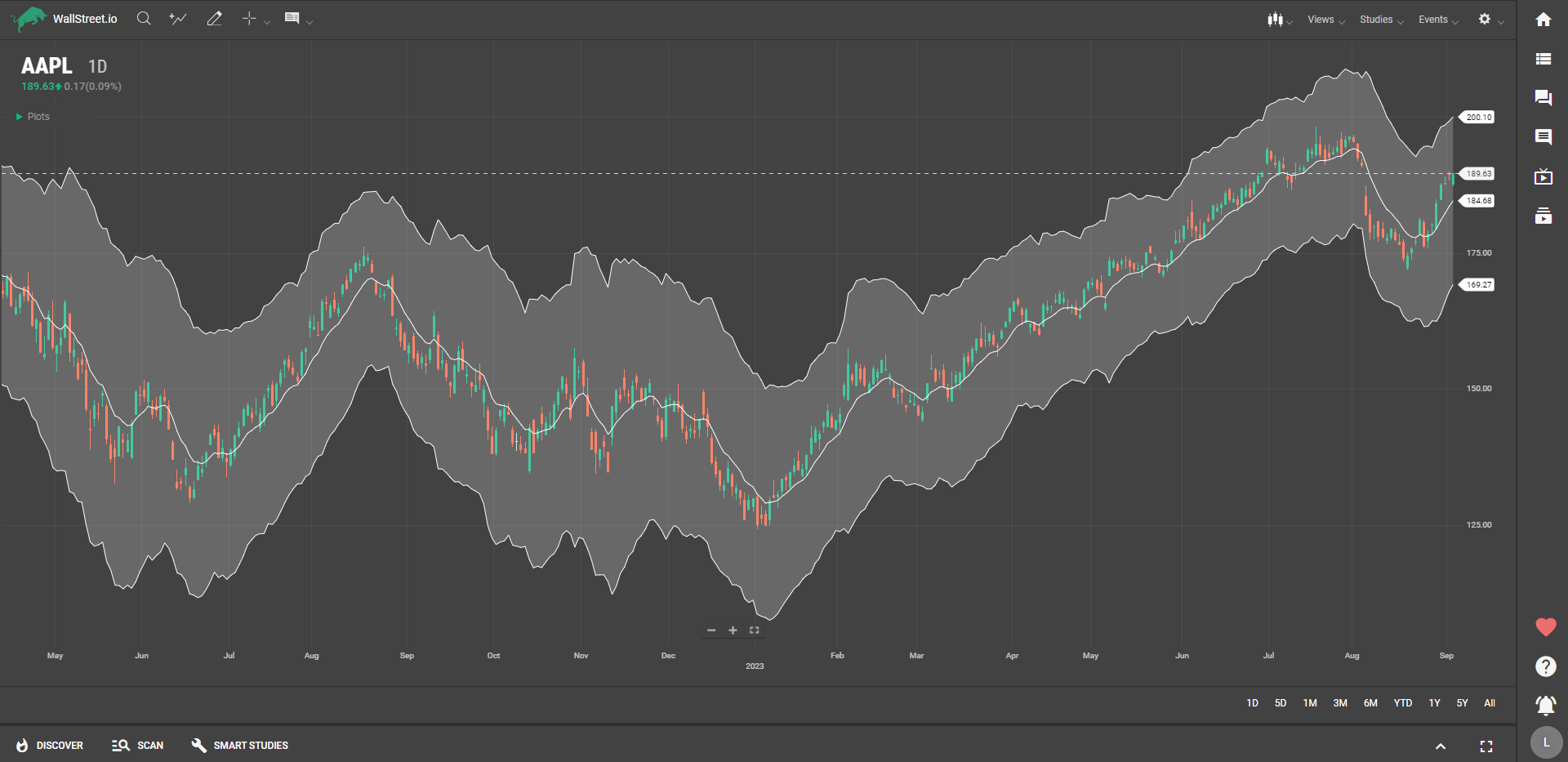

The Keltner Channel is an indicator that surrounds the price movements of an asset with an upper and lower "envelope." These lines are calculated by adding or subtracting a multiple of the Average True Range (ATR) to a central Moving Average. The channel expands and contracts, helping you gauge market volatility.

In the original formulation by Keltner, the central line is calculated as a 10-day simple moving average of the 'typical price,' which is the daily average of the high, low, and closing prices.

Subsequent authors have introduced variations to the Keltner Channel. These modifications include alternative averaging periods, employing exponential moving averages, and leveraging a multiple of Wilder's Average True Range (ATR) to set the channel bands.

Suggested Trading Use

The Keltner Channel is a versatile tool that can help you identify potential buy or sell signals. When the price breaks above the upper channel, it might indicate that the asset is gaining momentum, and you could consider entering a long position. Conversely, if the price falls below the lower channel, the asset could be losing strength, signaling a potential selling opportunity.

Additionally, the expansion and contraction of the channel can give you an idea of the volatility of the market. A widening channel often indicates increasing volatility, while a contracting channel suggests decreasing volatility.

Discover Tab Reference Guide

Discover Tab Reference Guide Discover Tab How-To Guide

Discover Tab How-To Guide Smart Studies How-To Guide

Smart Studies How-To Guide Smart Studies Reference Guide

Smart Studies Reference Guide Scan Tab Reference Guide

Scan Tab Reference Guide Scan Tab How-To Guide

Scan Tab How-To Guide Watchlists How-To guide

Watchlists How-To guide Watchlists Reference Guide

Watchlists Reference Guide Chatrooms Reference Guide

Chatrooms Reference Guide Community Wall How-To Guide

Community Wall How-To Guide Community Wall Reference Guide

Community Wall Reference Guide Streams Reference Guide

Streams Reference Guide Streams How-To Guide

Streams How-To Guide