Heikin-Ashi as Smart Studies

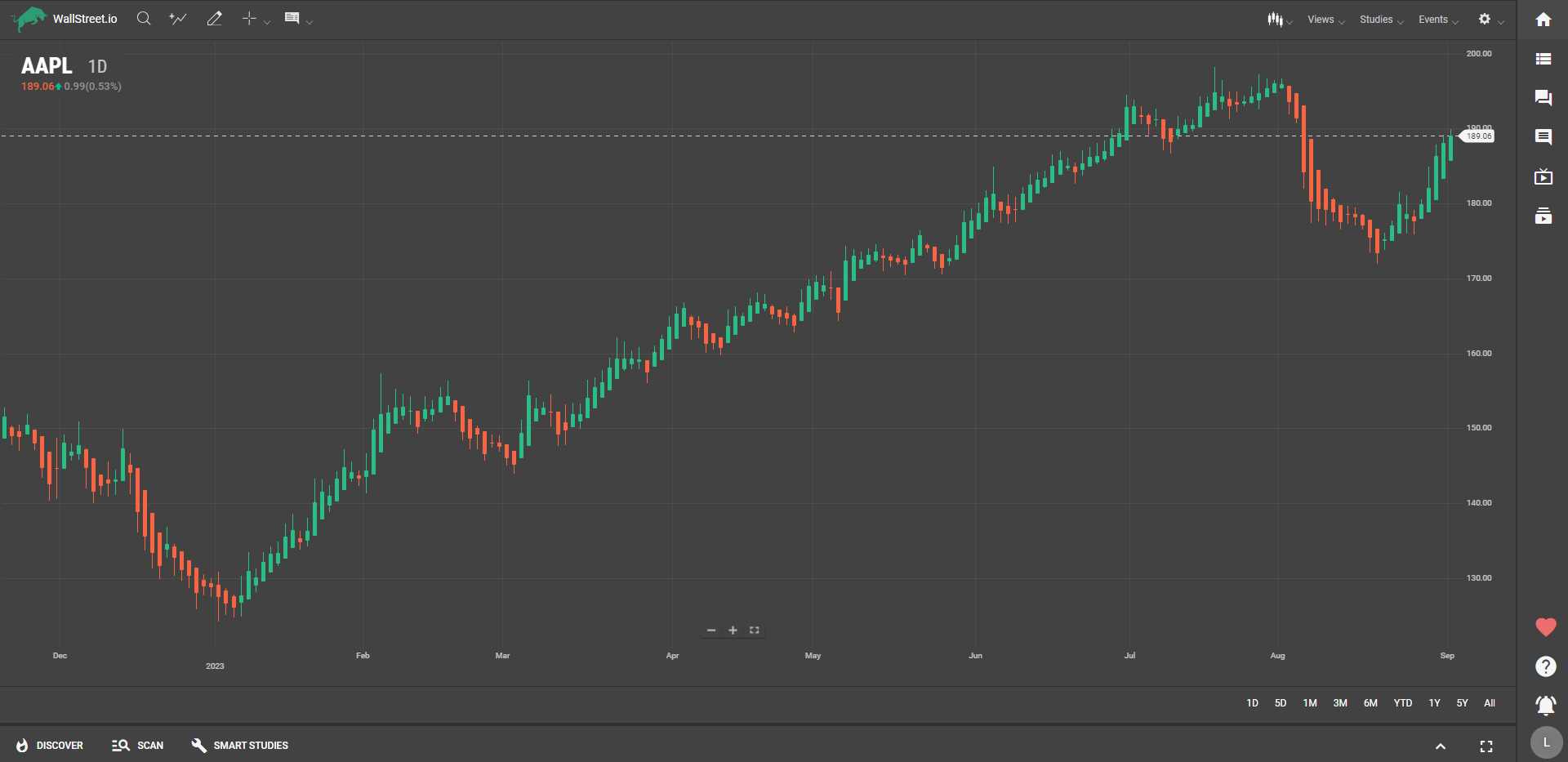

Heikin-Ashi is a type of candlestick chart that differs from traditional candlestick charts. While traditional candlesticks use open, close, high, and low values, Heikin-Ashi candlesticks are calculated in a way that smooths out volatility and gives you a clearer view of the market trend.

In Heikin-Ashi charts, each candlestick is calculated based on the average values of the previous candlestick, considering the open, high, low, and close prices. The calculation takes into account the current and prior candlestick's midpoint, which results in a modified representation of price action.

Customization Options for Heikin-Ashi

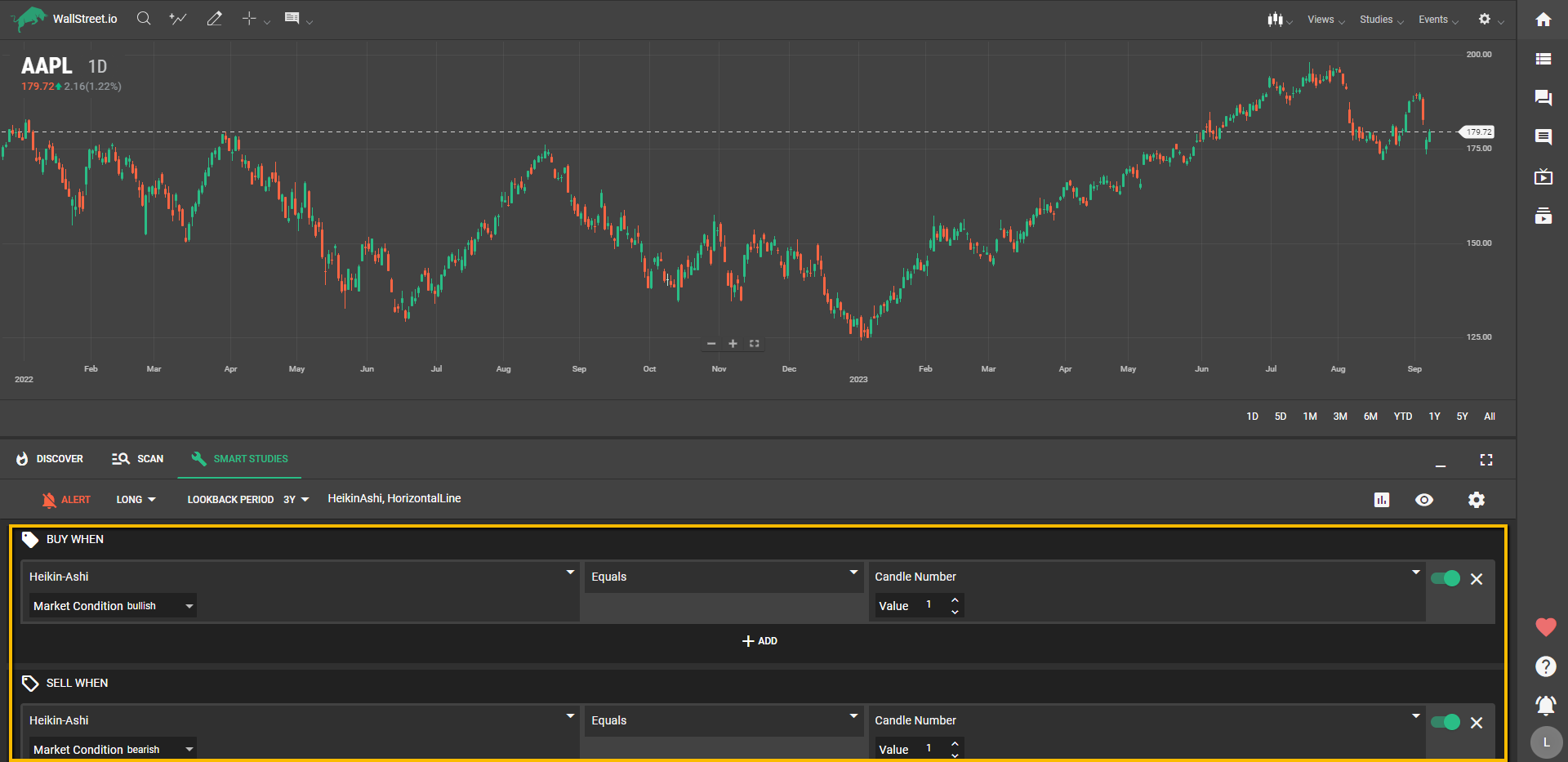

Click on the first dropdown menu under the "Buy When" or "Sell When" Signal sections, depending on if you want to create a Long (bullish) or Short (bearish) strategy.

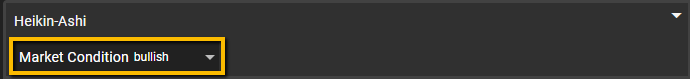

Now, when you select the Heikin-Ashi from the first dropdown menu under the Smart Studies tab, you'll find an additional sub-menu that allows you to choose the market condition for the Heikin-Ashi candles (i.e., bullish or bearish).

A bullish Heikin-Ashi candlestick has a lower open and a higher close compared to the previous candlestick, indicating positive price momentum. It appears as a green candlestick.

Conversely, a bearish Heikin-Ashi candlestick has a higher open and a lower close than the previous candlestick, suggesting negative price momentum. It’s represented as a red candlestick.

This might sound a little confusing at first, but let's clear up any possible confusion about the different layers of specifying bullish or bearish conditions when using Heikin-Ashi in Smart Studies.

Strategy Direction: The Overall Game Plan

Firstly, when you're setting up your strategy, you're given the option to make it a bullish (Long) or bearish (Short) strategy. This selection sets the overall tone for your trading approach.

This is your strategy's macro view. It guides whether you'll be looking for conditions to buy then sell (Long), or to sell then buy (Short).

Heikin-Ashi Candle Condition: The Specific Trigger

Once you've laid out your overall strategy, you'll dive into the specifics, which is where Heikin-Ashi comes into play. When you select Heikin-Ashi from the first dropdown menu, you're prompted to specify a market condition for that particular Study—either bullish or bearish.

This is the micro view, a specific condition or trigger that will tell you when to execute a buy or sell based on your overall strategy.

Why This Matters: Two Layers of Decision Making

Interactions and Further Customizations

After you've selected Heikin-Ashi and specified the market condition, you'll need to select the interaction “Equals” from the second dropdown menu.

By clicking on "Candle Number" from the third dropdown, another submenu appears that lets you specify which candle (first, second, etc.) should trigger the Signal. This works hand-in-hand with the market condition you chose earlier in the first submenu.

Incorporating Heikin-Ashi into your trading strategies via the Smart Studies Tab provides a nuanced way to gauge market trends. Its smoothing characteristics make it especially valuable for traders looking to filter out market noise. The customization options allow you to be as straightforward or intricate as you'd like, making Heikin-Ashi a versatile tool in your backtesting toolkit.

Discover Tab Reference Guide

Discover Tab Reference Guide Discover Tab How-To Guide

Discover Tab How-To Guide Smart Studies How-To Guide

Smart Studies How-To Guide Smart Studies Reference Guide

Smart Studies Reference Guide Scan Tab Reference Guide

Scan Tab Reference Guide Scan Tab How-To Guide

Scan Tab How-To Guide Watchlists How-To guide

Watchlists How-To guide Watchlists Reference Guide

Watchlists Reference Guide Chatrooms Reference Guide

Chatrooms Reference Guide Community Wall How-To Guide

Community Wall How-To Guide Community Wall Reference Guide

Community Wall Reference Guide Streams Reference Guide

Streams Reference Guide Streams How-To Guide

Streams How-To Guide