Hull MA as Smart Studies

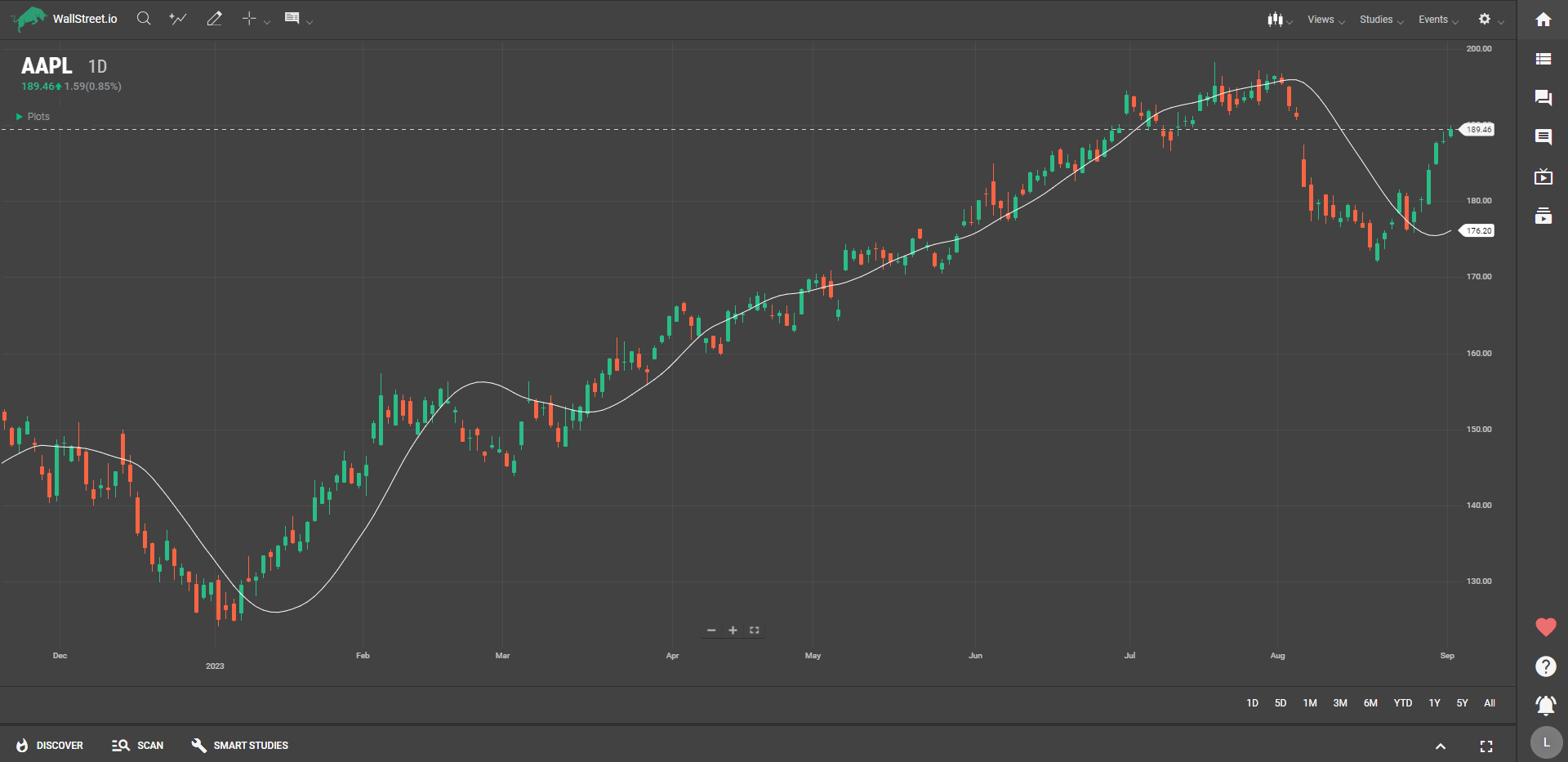

The Hull Moving Average (Hull MA or HMA) is a popular technical indicator developed by Alan Hull. It aims to provide a smoother and more responsive moving average than traditional ones. The HMA achieves this by utilizing a weighted moving average based on a specific period.

Customization Options for the Hull MA

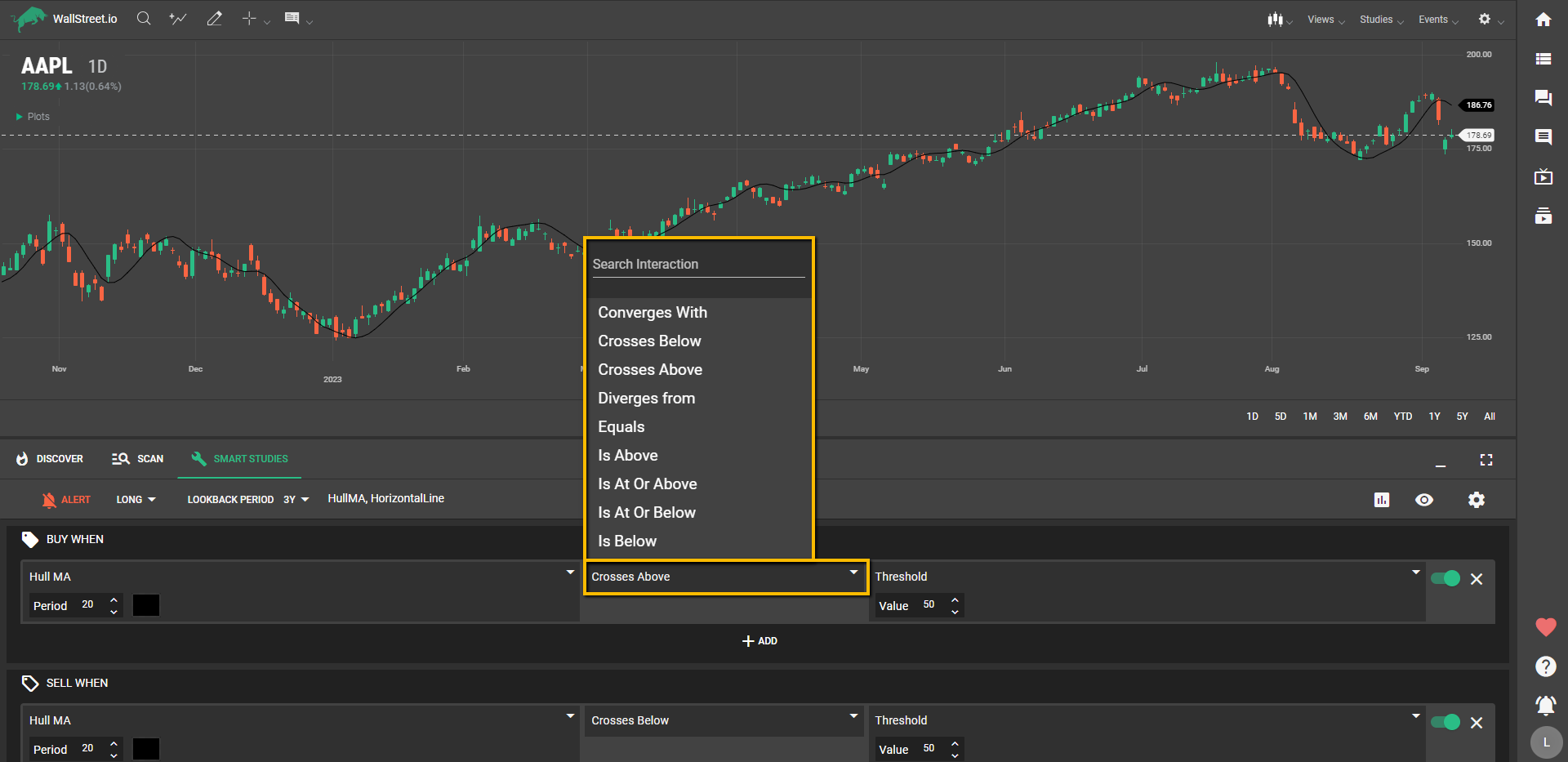

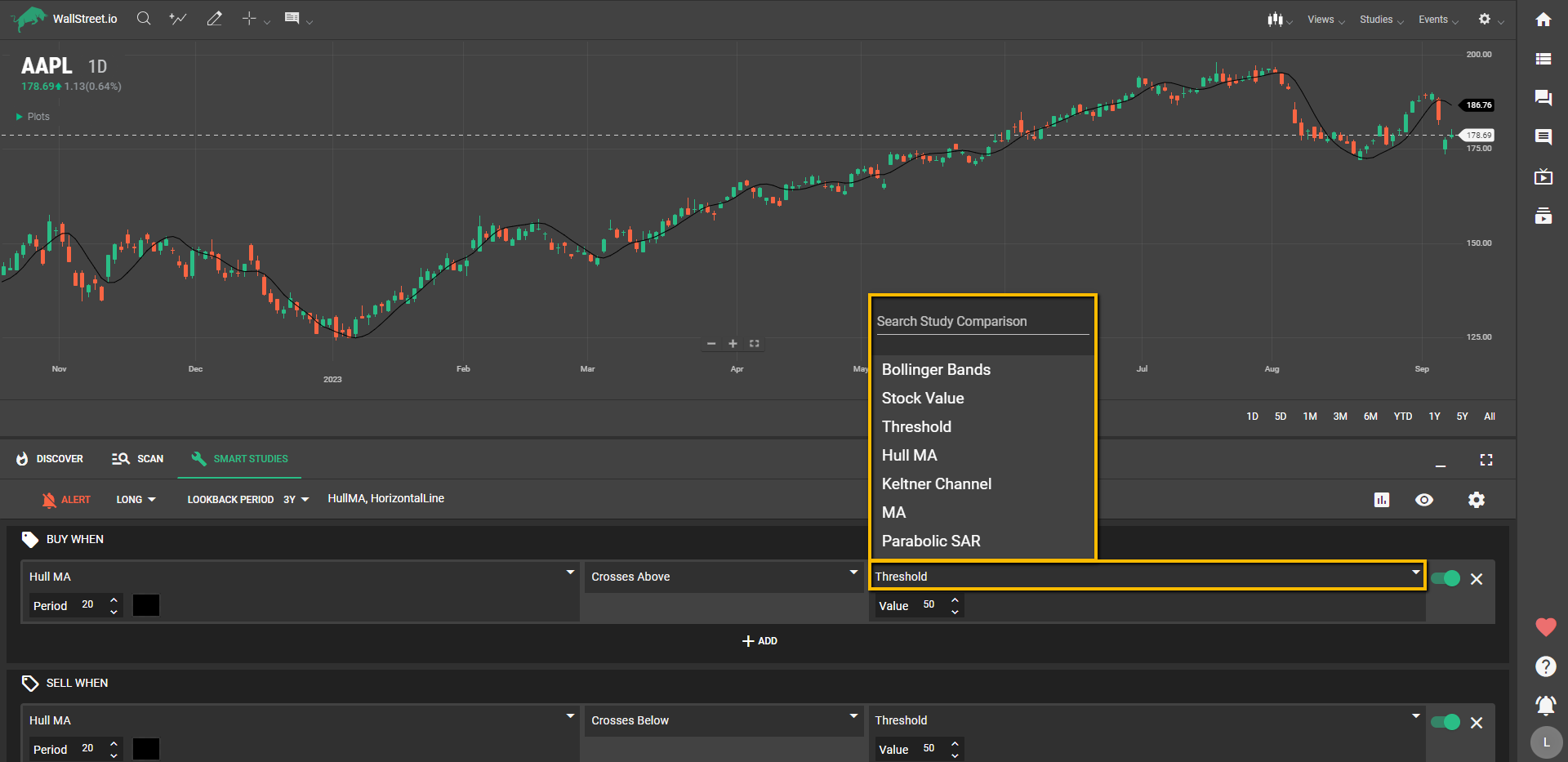

Click on the first dropdown menu under the "Buy When" or "Sell When" Signal sections, depending on if you want to create a Long (bullish) or Short (bearish) strategy.

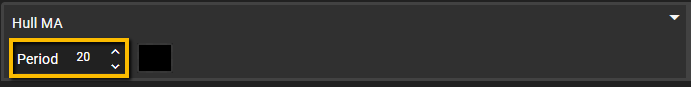

When you select the Hull MA from the first drop down menu under the Smart Studies tab, you'll find an additional sub-menu to adjust the Period for this Moving Average type.

Period

Shorter periods, such as 9 or 12, make the HMA more sensitive to recent price changes, resulting in a quicker response to price trends. Longer periods, such as 20 or 50, provide a smoother average and are better suited for identifying longer-term trends.

Selecting Interactions

Once you've configured the HMA, move to the second dropdown to pick the interaction. You have options like "Crosses above," "Is below," "Converges with," etc., to determine how the first criteria set will relate to the second criteria set.

Testing the Hull MA

In the third dropdown, you're presented with a list of Studies and values that can be combined with the HMA:

The Hull Moving Average (Hull MA) stands out as a versatile indicator that offers a smoother, faster way to identify market trends, making it a valuable component in a wide array of trading strategies. When combined with other studies, the Hull MA helps to filter out market noise and provide more reliable entry and exit points. The end result is a more effective strategy that allows you to navigate market conditions with increased confidence and reduced risk.

Discover Tab Reference Guide

Discover Tab Reference Guide Discover Tab How-To Guide

Discover Tab How-To Guide Smart Studies How-To Guide

Smart Studies How-To Guide Smart Studies Reference Guide

Smart Studies Reference Guide Scan Tab Reference Guide

Scan Tab Reference Guide Scan Tab How-To Guide

Scan Tab How-To Guide Watchlists How-To guide

Watchlists How-To guide Watchlists Reference Guide

Watchlists Reference Guide Chatrooms Reference Guide

Chatrooms Reference Guide Community Wall How-To Guide

Community Wall How-To Guide Community Wall Reference Guide

Community Wall Reference Guide Streams Reference Guide

Streams Reference Guide Streams How-To Guide

Streams How-To Guide