Keltner Channel as Smart Studies

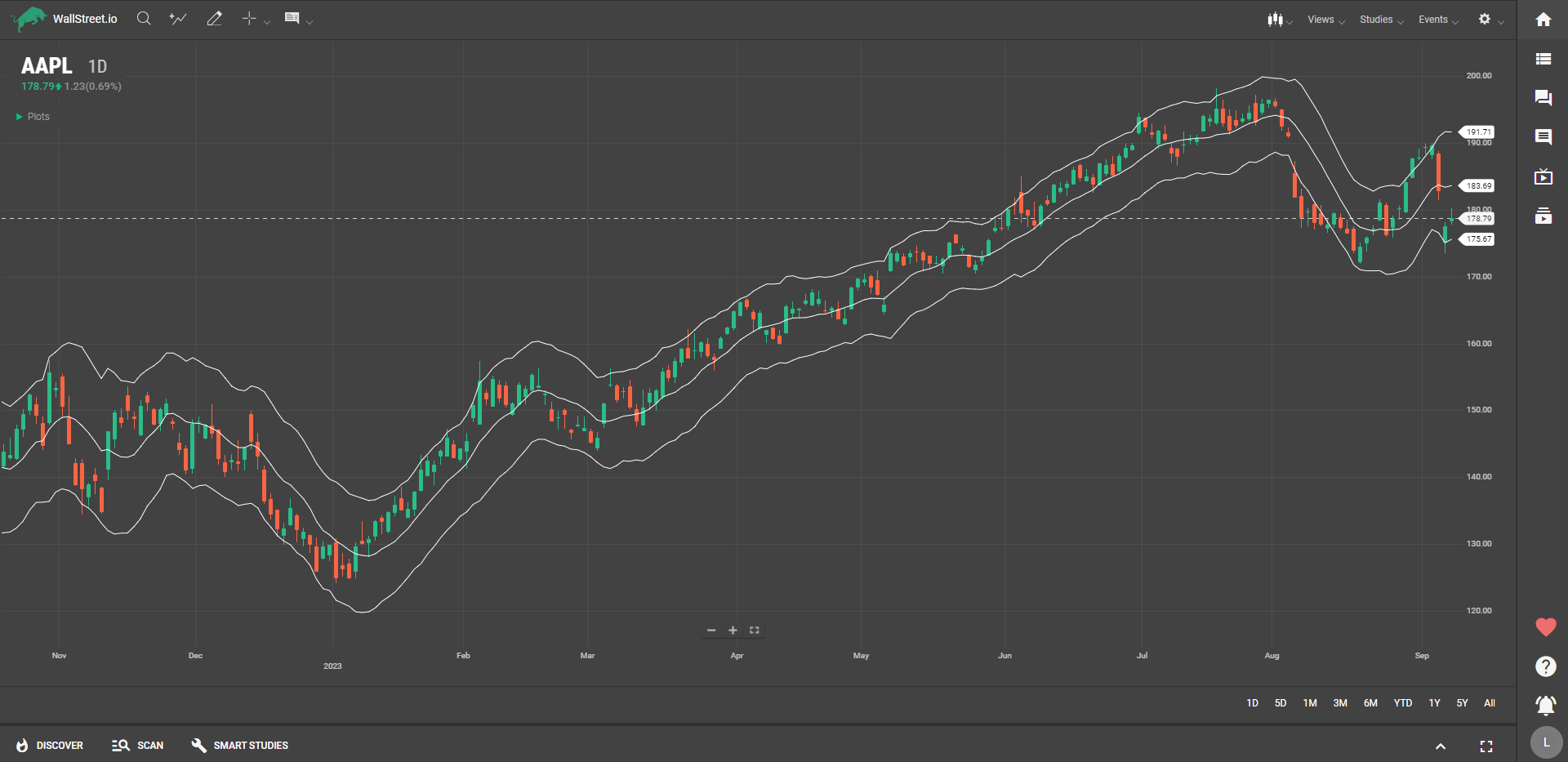

The Keltner Channel is a volatility-based technical indicator that forms a channel around an asset's price movements. The channel includes an upper and a lower line, which help traders assess the volatility and trend direction.

Customization Options for Keltner Channel

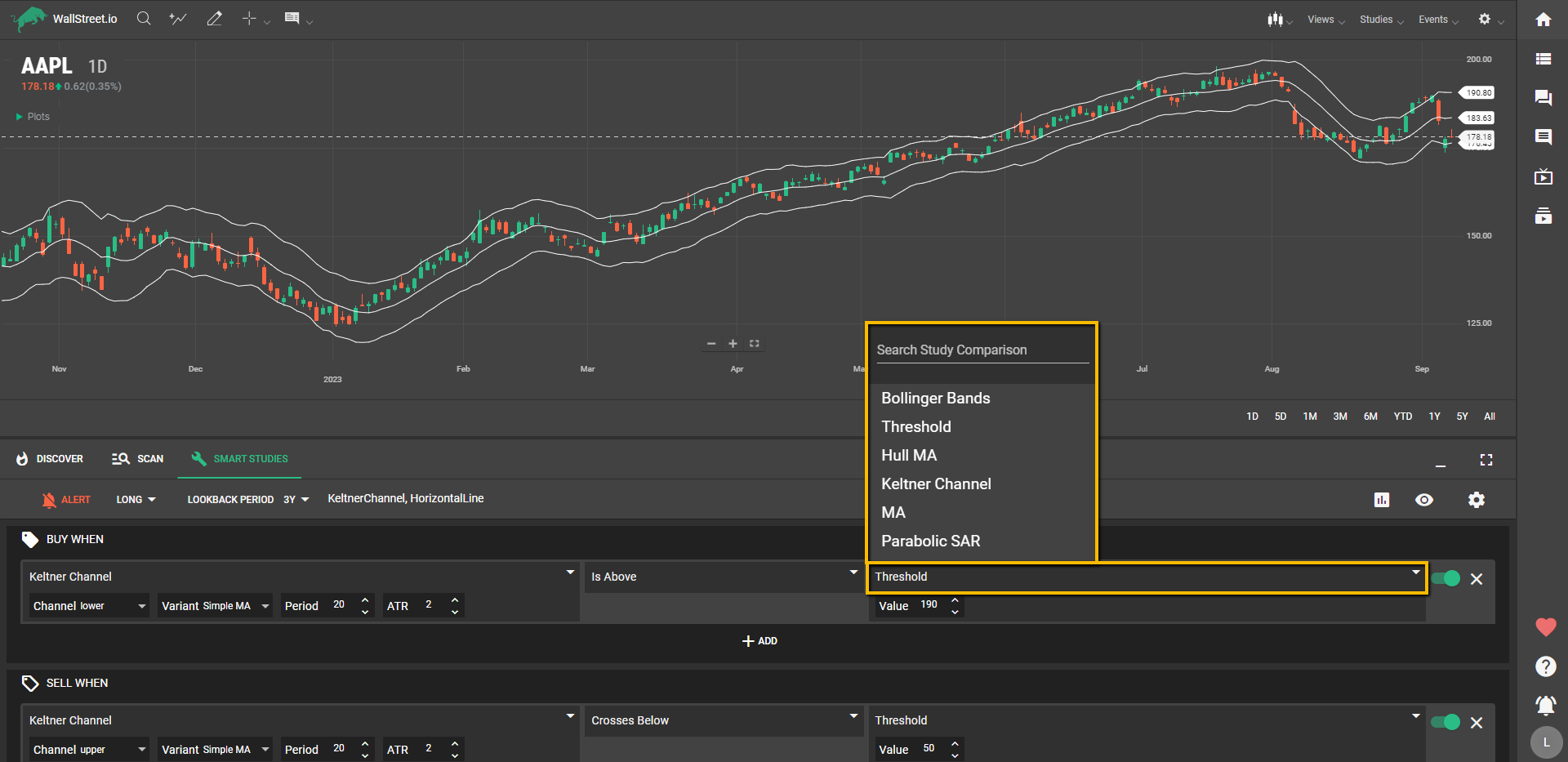

Click on the first dropdown menu under the "Buy When" or "Sell When" Signal sections, depending on if you want to create a Long (bullish) or Short (bearish) strategy.

When you select the Keltner Channel from the first dropdown menu under the Smart Studies tab, you'll find two additional sub-menus to tailor the study to your needs:

Let’s dive into what each of these concepts means:

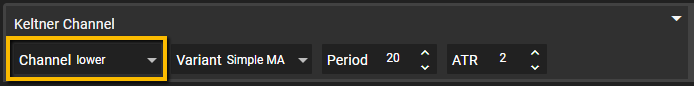

Channel

This dropdown lets you select which channel line—upper or lower—you wish to focus on for your Entry or Exit triggers. An "upper" channel often relates to overbought conditions, whereas a "lower" channel frequently signals oversold conditions.

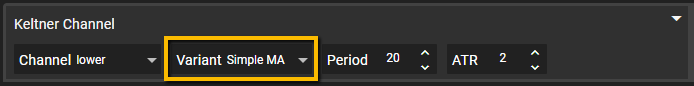

Variant

Here, you choose the type of Moving Average to use for your Keltner Channel. The choice affects how responsive the channel is to price changes. For instance, an Exponential Moving Average will be more reactive to recent price movements compared to a Simple Moving Average.

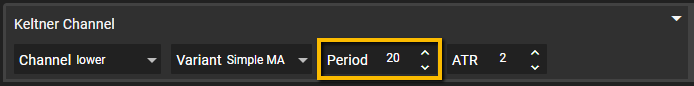

Period

The "Period" refers to the number of bars (or data points) used to calculate the Moving Average. Adjusting this number can make the Keltner Channel more or less sensitive to price changes.

ATR (Average True Range)

The ATR value determines the width of the Keltner Channel. A higher ATR value will result in a wider channel, capturing more price volatility, while a lower value will narrow the channel, making it less forgiving to price fluctuations.

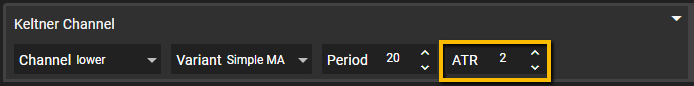

Possible Interactions

After you've customized the Keltner Channel, you move on to the second dropdown to select your desired interaction. Choices include actions like 'Crosses Above,' 'Is Below,' among others.

Testing the Keltner Channel

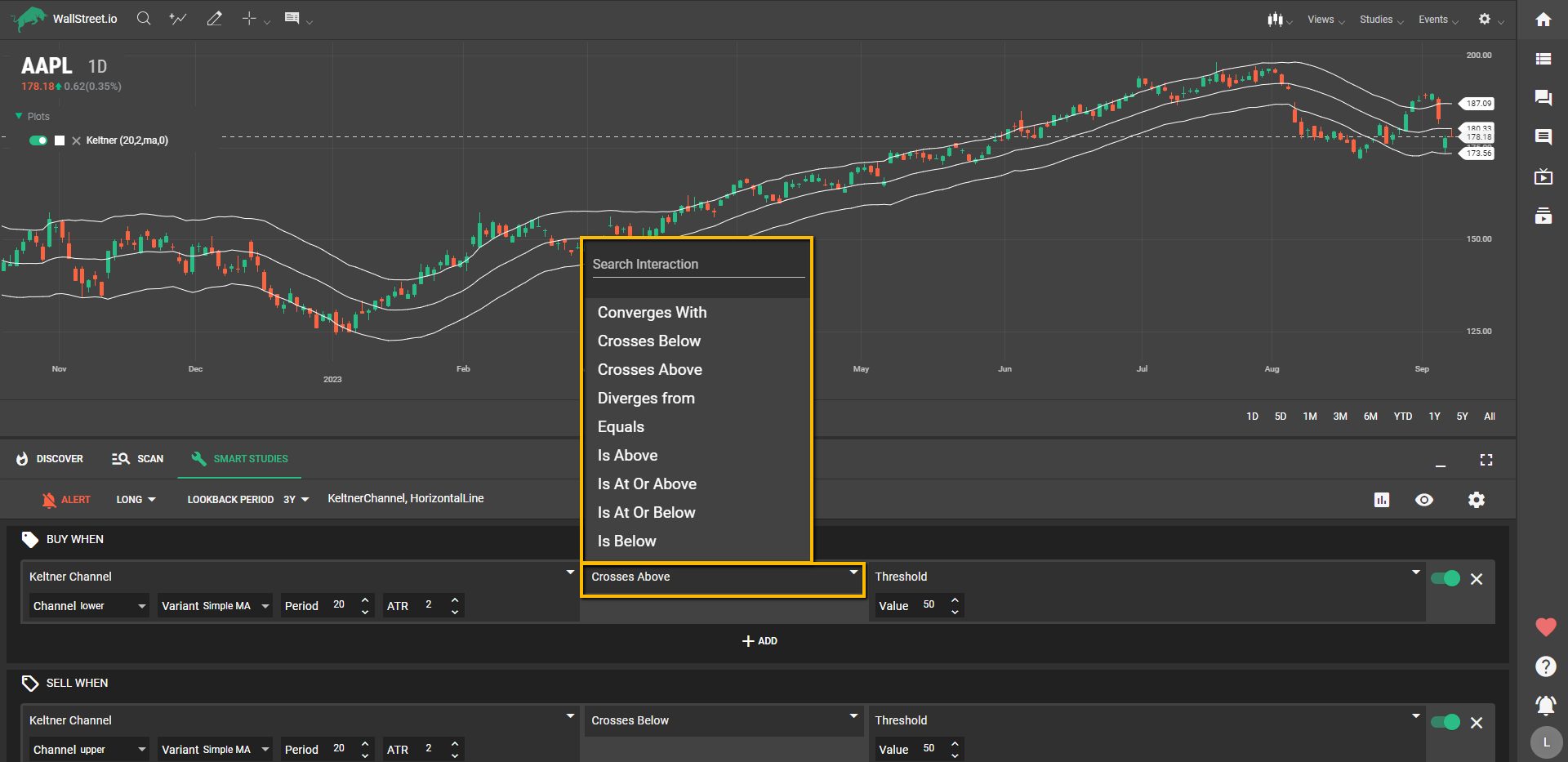

In the third dropdown, you're presented with a list of Studies and values that can be combined with the Keltner Channel:

Using the Keltner Channel within the Smart Studies framework offers a robust method for identifying overbought or oversold conditions, gauging volatility, and setting precise trading signals. The available customization options—ranging from channel selection and moving average type to specific periods and ATR settings—allow for nuanced backtesting that aligns closely with your trading objectives.

Discover Tab Reference Guide

Discover Tab Reference Guide Discover Tab How-To Guide

Discover Tab How-To Guide Smart Studies How-To Guide

Smart Studies How-To Guide Smart Studies Reference Guide

Smart Studies Reference Guide Scan Tab Reference Guide

Scan Tab Reference Guide Scan Tab How-To Guide

Scan Tab How-To Guide Watchlists How-To guide

Watchlists How-To guide Watchlists Reference Guide

Watchlists Reference Guide Chatrooms Reference Guide

Chatrooms Reference Guide Community Wall How-To Guide

Community Wall How-To Guide Community Wall Reference Guide

Community Wall Reference Guide Streams Reference Guide

Streams Reference Guide Streams How-To Guide

Streams How-To Guide